Stock Market Outlook for February 20, 2025

Magnificent 7 not looking too hot as NVIDIA reaches the upper limit of its “Deepseek selloff” gap.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Campbell Soup Co. (NASD:CPB) Seasonal Chart

Ecolab, Inc. (NYSE:ECL) Seasonal Chart

Ritchie Bros Auctioneers (NYSE:RBA) Seasonal Chart

FTI Consulting, Inc. (NYSE:FCN) Seasonal Chart

CONSOL Energy Inc. (NYSE:CEIX) Seasonal Chart

The Markets

Stocks edged higher on Wednesday as traders shook off minutes from the US Fed that expressed concern over the impact of tariffs on the economy. The S&P 500 Index was up by nearly a quarter of one percent, closing at yet another fresh record high and maintaining levels slightly above the 6100 hurdle that acted as a cap to upside momentum in the past couple of months. The benchmark is managing to remain resilient above 20 and 50-day moving averages, despite the apparent loss of excitement to buy around present heights. Momentum indicators have negatively diverged from price since the middle of last year, highlighting the waning enthusiasm investors had been expressing towards tech-heavy (MAG-7) benchmarks, like this, amidst extreme valuations. We continue to monitor the potential impact of the apparent rotation in the market on our list of candidates in the market to Accumulate and to Avoid and we have adopted more of a neutral stance as segments that were previously noted as Accumulate candidates fall off (eg. Technology) and as areas to Avoid are added.

Today, in our Market Outlook to subscribers, we discuss the following:

- Shares of NVIDIA reaching the upper limit of its “Deepseek selloff” gap

- Fading breadth in Magnificent 7

- US Industrial Production and the investment implications within

- Manufacturer sentiment

- The Industrial sector

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for February 20

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Wednesday, as gauged by the put-call ratio, ended bullish at 0.89.

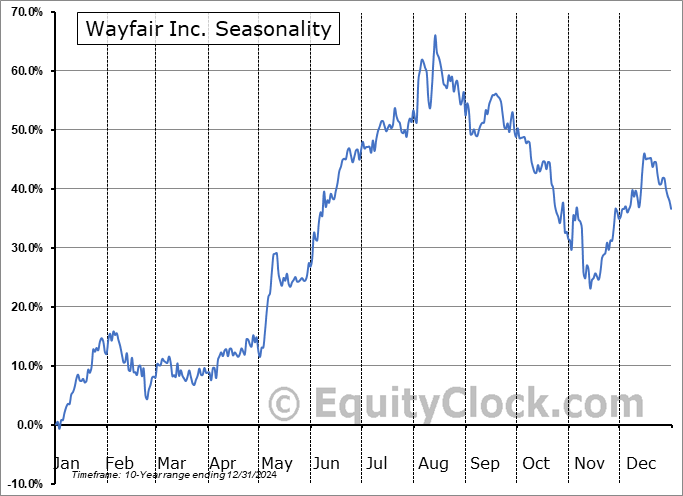

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|