Stock Market Outlook for February 21, 2025

Housing activity has been strained to start the year and this is taking a toll on the stocks with exposure.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

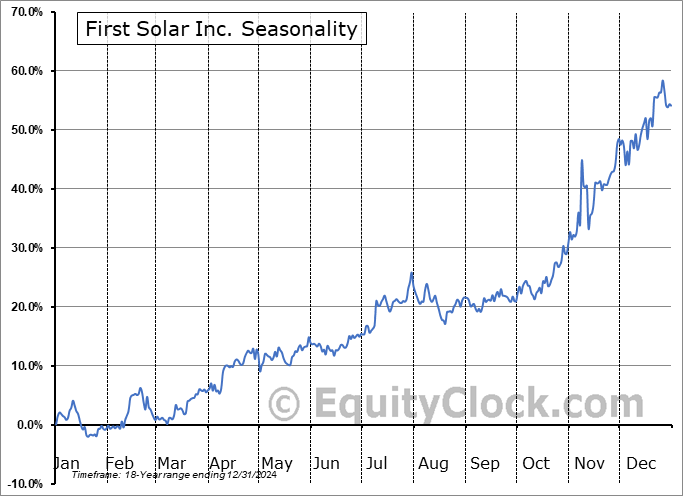

First Solar Inc. (NASD:FSLR) Seasonal Chart

Take-Two Interactive Software, Inc. (NASD:TTWO) Seasonal Chart

Avista Corp. (NYSE:AVA) Seasonal Chart

Nomad Foods Limited (NYSE:NOMD) Seasonal Chart

BMO Global Infrastructure Index ETF (TSE:ZGI.TO) Seasonal Chart

iShares U.S. Utilities ETF (NYSE:IDU) Seasonal Chart

Turning Point Brands, Inc. (NYSE:TPB) Seasonal Chart

Amazon.com, Inc. (NASD:AMZN) Seasonal Chart

Intel Corp. (NASD:INTC) Seasonal Chart

FormFactor Inc. (NASD:FORM) Seasonal Chart

Moderna Inc. (NASD:MRNA) Seasonal Chart

Descartes Systems Group Inc. (NASD:DSGX) Seasonal Chart

Trilogy Metals Inc. (AMEX:TMQ) Seasonal Chart

A-Mark Precious Metals, Inc. (NASD:AMRK) Seasonal Chart

The Markets

Stocks slipped on Thursday as a disappointing reaction to earnings from Walmart (WMT) and ongoing tariff concerns had traders on edge. The S&P 500 Index closed lower by just over four-tenths of one percent, still maintaining levels slightly above the 6100 hurdle that acted as a cap to upside momentum over the past couple of months. The benchmark is managing to remain resilient above the 20-day moving average (6073), despite the apparent loss of excitement to buy around present heights. Momentum indicators have negatively diverged from price since the middle of last year, highlighting the waning enthusiasm investors had been expressing towards tech-heavy (Mag-7) benchmarks, like this, amidst extreme valuations. We continue to monitor the potential impact of the apparent rotation in the market on our list of candidates in the market to Accumulate and to Avoid and we have adopted more of a neutral stance as segments that were previously noted as Accumulate candidates fall off (eg. Technology) and as areas to Avoid are added.

Today, in our Market Outlook to subscribers, we discuss the following:

- The unwind of the Yen carry trade and how it is posing a burden on domestic equities, while benefiting other stocks around the globe (eg. China)

- US Housing Starts and homebuilding stocks

- Home improvement retailers carving out a topping pattern

- Consumer Loan activity and the ongoing elevation of home equity lines of credit

- Delinquency rate on consumer loans as of the end of 2024

- Weekly jobless claims and the health of the labor market

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for February 21

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.78.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|