Stock Market Outlook for April 1, 2025

After the fourth weakest March performance for stocks in the past five decades, history suggests a strong recovery through April is likely.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

SL Green Realty Corp. (NYSE:SLG) Seasonal Chart

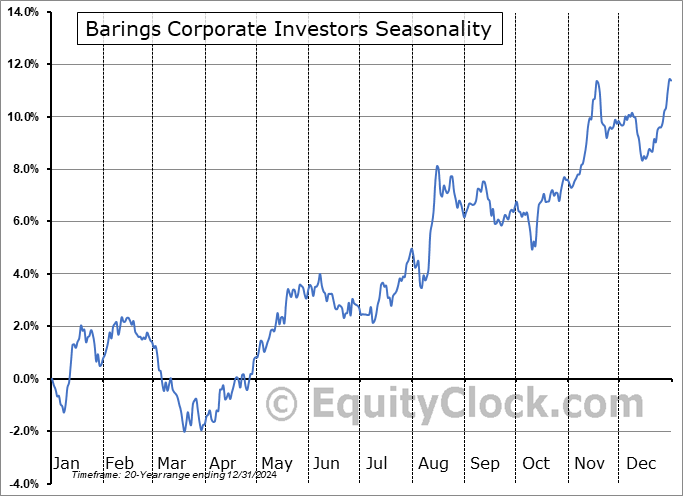

Barings Corporate Investors (NYSE:MCI) Seasonal Chart

Falcon Gold Corp. (TSXV:FG.V) Seasonal Chart

Byrna Technologies Inc (NASD:BYRN) Seasonal Chart

Rentokil Initial plc (NYSE:RTO) Seasonal Chart

The Markets

Stocks reversed early declines to end higher on Monday following a retest of the mid-March lows on the S&P 500 Index at 5500. The S&P 500 Index closed higher by just over half of one percent, charting a hammer candlestick around the the significant horizontal hurdle and starting to lend to the belief of a short-term double-bottom in the works. The benchmark remains in a precarious state heading into the second quarter, holding levels below the 200-day moving average, a variable hurdle that traditionally provides a reasonable dividing line between long-term bullish and bearish trends. A check-back of the now declining resistance at the 50-day moving average (~5900) has been our base case, but headline risks have to be contended with in the very near-term. We are still in this period of seasonal strength that runs into the month of April, therefore there is a bias to give this favourable timeframe the benefit of the doubt; the more likely time to see a resumption of the declining intermediate-term path for stocks is through the off-season that starts in May. We have not made any changes to our Super Simper Seasonal Portfolio, yet, following our tactical positioning to take advantage of the positivity that surrounds the end of the quarter, but we are cognizant that the intermediate-term trajectory (most importance to us in our work) is becoming increasingly threatened. We continue to monitor the potential impact of the apparent rotation in the market on our list of candidates in the market to Accumulate and to Avoid and we have adopted more of a neutral stance as segments that were previously noted as Accumulate candidates fall off (eg. Technology) and as areas to Avoid are added.

Today, in our Market Outlook to subscribers, we discuss the following:

- Large March drops in stocks have historically resulted in similarly large April pops

- Monthly look at the large-cap benchmark

- Sectors that mitigated the March slump and their prospects for the month(s) ahead

- Our weekly chart books update, along with our list of all segments of the market to either Accumulate or Avoid

- Other Notes

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for April 1

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

- Currencies

- Cryptocurrencies

- Commodities

- Major Benchmarks

- Sub-sectors / Industries

- ETFs: Bonds | Commodities | Equity Markets | Industries | Sectors

Subscribe now.

Sentiment on Monday, as gauged by the put-call ratio, ended close to neutral at 0.94.

Just Released…

Our monthly report for April is out, providing you with everything that you need to know to navigate the market through the month(s) ahead.

Highlights in this report include:

- Equity market tendencies in the month of April

- Individual Investors the most bearish since 2022

- Asset manager exposure to S&P 500 still around the highs of the past decade

- Watching the trajectory of earnings expectations heading towards the off-season for stocks

- How “on point” are analysts with their expectations at the present time

- Watch credit spreads for signs of economic struggle

- Investors looking for certainty outside of the US

- Spring is the time for real estate

- Medical devices

- Time to overweight bonds?

- April’s currency tailwind

- Second weakest February change in Retail Sales on record

- Consumer Loan activity still struggling

- Consumer momentum the lowest since the pandemic

- Industrial Production

- Consumer goods producers racing to front run the imposition of tariffs

- Utilities not so hot in February, but still a desired investment

- Manufacturer sentiment has become dampened amidst the tariff uncertainty

- Commodities remain well supported at this seasonally strong time of year

- New high engine has been turned off

- Our list of all segments of the market to either Accumulate or Avoid, along with relevant ETFs

- Positioning for the months ahead

- Sector Reviews and Ratings

- Stocks that have Frequently Gained in the Month of April

- Notable Stocks and ETFs Entering their Period of Strength in April

Subscribers can look for this 113-page report in their inbox and in the report archive.

Not subscribed yet? Signup now to receive access to this report and all of the research that we publish.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|