Stock Market Outlook for May 20, 2025

Industrial production upbeat early into the year, but manufacturer sentiment is not.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

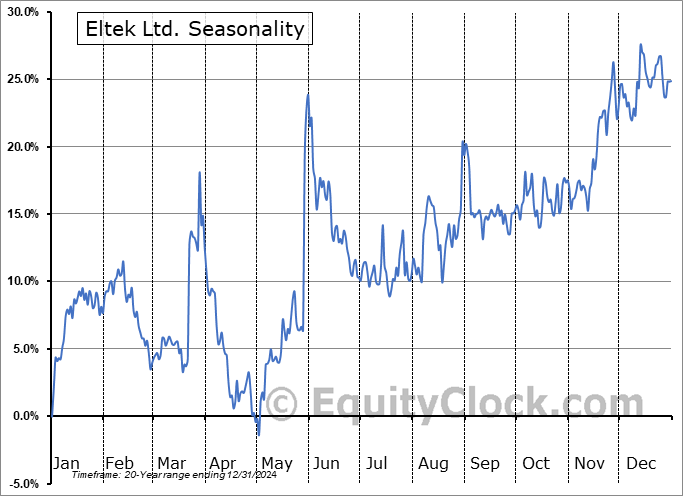

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Seabridge Gold, Inc. (NYSE:SA) Seasonal Chart

Vanguard Growth ETF (NYSE:VUG) Seasonal Chart

Harvest Global REIT Leaders Income ETF (TSE:HGR.TO) Seasonal Chart

Upwork Inc. (NASD:UPWK) Seasonal Chart

Goldman Sachs Group, Inc. (NYSE:GS) Seasonal Chart

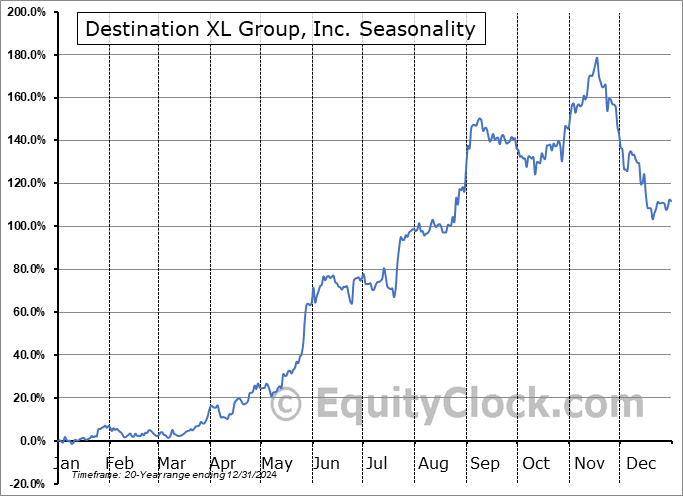

Destination XL Group, Inc. (NASD:DXLG) Seasonal Chart

Otter Tail Power Co. (NASD:OTTR) Seasonal Chart

Nathans Famous, Inc. (NASD:NATH) Seasonal Chart

VanEck Vectors Brazil Small-Cap ETF (NYSE:BRF) Seasonal Chart

iShares Russell 1000 Growth ETF (NYSE:IWF) Seasonal Chart

Loop Industries, Inc. (NASD:LOOP) Seasonal Chart

Tesla Inc. (NASD:TSLA) Seasonal Chart

Citizens, Inc. (NYSE:CIA) Seasonal Chart

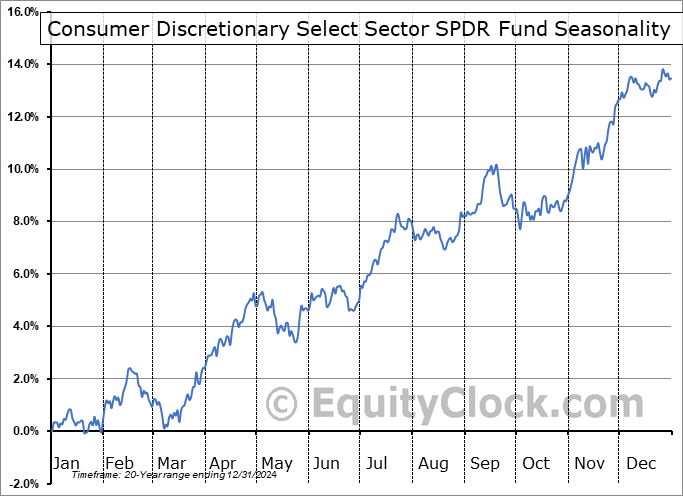

Consumer Discretionary Select Sector SPDR Fund (NYSE:XLY) Seasonal Chart

Note: Monday is a holiday in Canada (Victoria Day) and, as a result, our next report to subscribers will be released on Tuesday. Our weekly chart books will be updated, as per usual, on Sunday and will be available for download in the archive, but the commentary regarding the updates will be released on Tuesday. Have a great weekend everyone!

The Markets

Stocks continued to tack onto gains as traders that were shaken out of positions by April’s tariff turmoil found the need to rebuild bullish bets. The S&P 500 Index closed higher by seven-tenths of one percent, reaching into a band of resistance between 5900 and 6100, effectively the all-time highs. The implied cap over this market in the range between 5500 and 5800 (corresponding with the span of the cloud of major moving averages) has been broken and it will now be looked to as a zone of support on a subsequent pullback. The short-term trend stemming from the April low is positive, but the intermediate-term path (which is of most importance to us in our seasonal approach) remains under threat, particularly with nothing that burdened the equity market previous adequately solved. We continue to like the way our list of candidates in the market to Accumulate or to Avoid is positioned and we remain on the lookout for new opportunities, either on the long or short side, heading through this off-season for stocks. On the seasonal timeline, the foreseeable threat to stocks is the mean reversion move lower that is common through the middle of June as quarter-end portfolio rebalancing is enacted. We can consider strategy around that event closer to the timeframe.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the the large-cap benchmark

- US Industrial Production and the investment implications within

- Manufacturer Sentiment

- Investor Sentiment

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for May 20

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Friday, as gauged by the put-call ratio, ended overly bullish at 0.69.

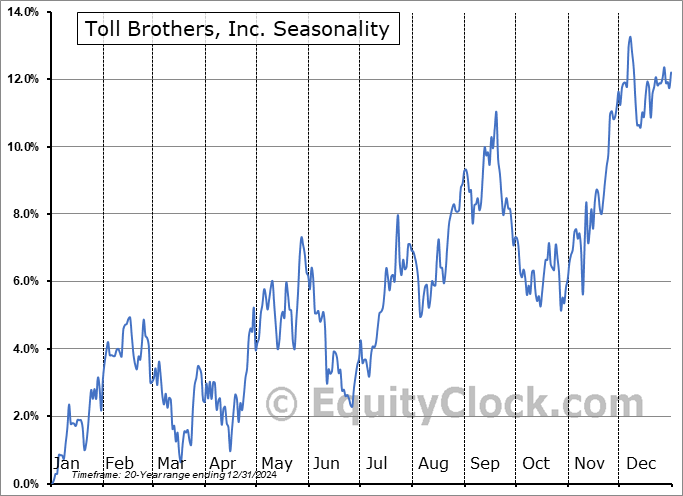

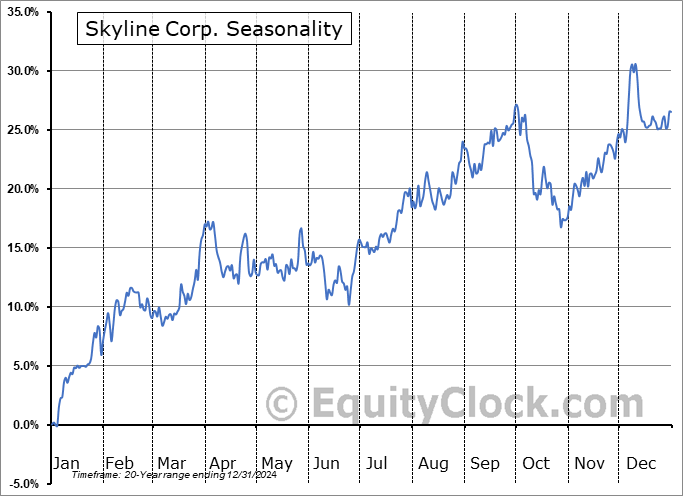

Seasonal charts of companies reporting earnings today:

S&P 500 Index

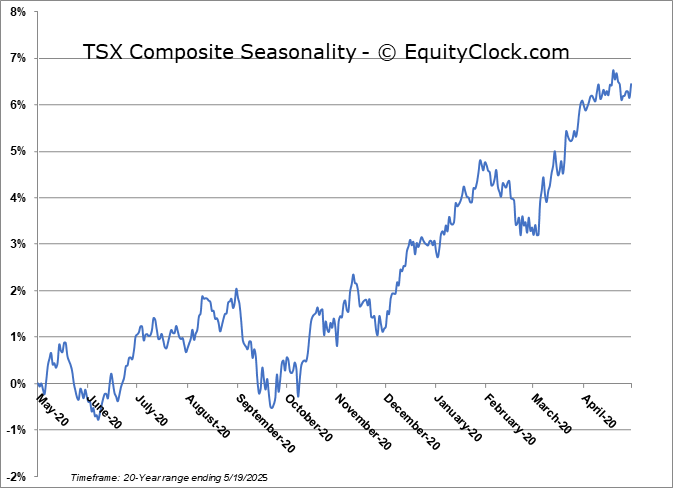

TSE Composite

| Sponsored By... |

|