Stock Market Outlook June 6, 2025

International trade in Canada became completely derailed in April, but the areas where exports are staying afloat are indicative of where to allocate portfolios in this uncertain market/economy.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Southern Co. (NYSE:SO) Seasonal Chart

EastGroup Properties, Inc. (NYSE:EGP) Seasonal Chart

iShares Cybersecurity and Tech ETF (AMEX:IHAK) Seasonal Chart

Personalis Inc. (NASD:PSNL) Seasonal Chart

FlexShares US Quality Low Volatility Index Fund (AMEX:QLV) Seasonal Chart

Centrais Eletricas Brasileiras SA (NYSE:EBR) Seasonal Chart

Murphy USA Inc. (NYSE:MUSA) Seasonal Chart

Vanguard Extended Duration Treasury ETF (NYSE:EDV) Seasonal Chart

Global X Cybersecurity ETF (NASD:BUG) Seasonal Chart

The Markets

Stocks stumbled slightly on Thursday as an escalating spat between Elon Musk and Donald Trump had investors pushing the sell button is shares of Tesla, one of the largest constituents in the S&P 500 Index and Nasdaq 100. The S&P 500 Index closed down by just over half of one percent, continuing to show sluggish performance in the band of resistance between 5900 and 6100. Hint remains that the short-term rising trend stemming from the April lows is coming to an end with the 50-hour moving average no longer enticing the type of buying demand that has been observed over the past month and a half; a digestive period heading into the end of the second quarter is is still foreseeable before the summer rally period in July gets underway at the end of this month. Upside gap support around 5700 remains the critical level to watch over the short-term timeframe given a violation of the implied level of support would lead to a resumption of the strains that the intermediate-term trend has been portraying since the start of the year. Our list of candidates in the market that are worthy to Accumulate continues to perform well and, this week, only a few ratings changes were required.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly jobless claims and the health of the labor market

- A look ahead at what to expect from the monthly Nonfarm Payroll report

- Natural gas and the seasonal trade in the commodity

- Canada International Trade and the investment implications within

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for June 6

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.84.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

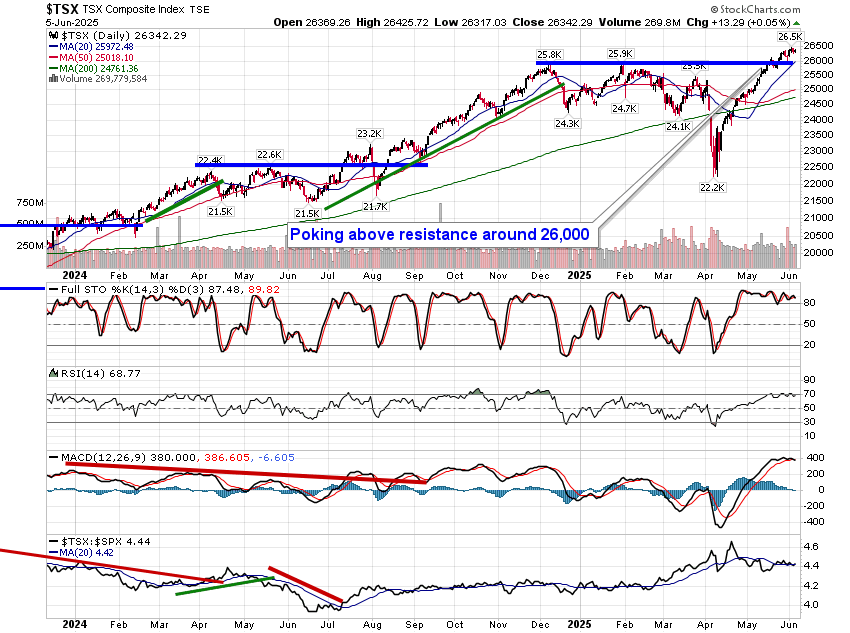

TSE Composite

| Sponsored By... |

|