Stock Market Outlook for July 23, 2025

Add credit spreads to the list of things to scrutinize to determine when the risk-off phase for stocks begins.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

The Travelers Cos., Inc. (NYSE:TRV) Seasonal Chart

iShares Core U.S. Aggregate Bond ETF (NYSE:AGG) Seasonal Chart

Caseys General Stores, Inc. (NASD:CASY) Seasonal Chart

W. R. Berkley Corp. (NYSE:WRB) Seasonal Chart

Axis Capital Holdings Ltd. (NYSE:AXS) Seasonal Chart

South State Corp. (NYSE:SSB) Seasonal Chart

Mastech Digital, Inc. (AMEX:MHH) Seasonal Chart

Vanguard Intermediate-Term Bond ETF (NYSE:BIV) Seasonal Chart

Invesco Senior Loan ETF (NYSE:BKLN) Seasonal Chart

Vanguard Total Bond Market ETF (NASD:BND) Seasonal Chart

Invesco CurrencyShares Japanese Yen Trust (NYSE:FXY) Seasonal Chart

Invesco KBW Property & Casualty Insurance ETF (NASD:KBWP) Seasonal Chart

abrdn Physical Gold Shares ETF (NYSE:SGOL) Seasonal Chart

iShares TIPS Bond ETF (NYSE:TIP) Seasonal Chart

Invesco DB US Dollar Index Bullish Fund (NYSE:UUP) Seasonal Chart

JPMorgan Ultra-Short Income ETF (AMEX:JPST) Seasonal Chart

The Markets

Stocks edged higher on Tuesday in a rather defensive session as traders rotated into low beta sectors (health care, staples, utilities, REITs), bonds, and precious metals (gold, silver). The S&P 500 Index closed higher by just less than a tenth of one percent, remaining at the upper limit of the tight short-term consolidation span between 6200 and 6300; a break of the 100-point range would project a move of the same magnitude (eg. higher to 6400 or lower to 6100). The technical and seasonal backdrops provide an upside bias. Support at the cloud of major moving averages remains well defined, including the 20-day moving average (6232), a variable hurdle that has been unviolated throughout the bull-market rally from the April lows. Until some of the implied levels of support start to crack, this market still has the appearance of having an easier ability to excel above levels of resistance than to fail below levels of support. While overbought signals have triggered according to various metrics in recent days, this should be viewed as a sign of strength given that market participants continue to desire putting funds to work around these heights. Our list of candidates in the market that are worthy to Accumulate or Avoid continues to be appropriately positioned, keeping investors tuned into those segments of the market that are working in such areas as in the Technology, Communication Services, Financials, and Utilities sectors.

Today, in our Market Outlook to subscribers, we discuss the following:

- REITs breaking above horizontal resistance, following the strength of Utilities

- Staples charting a bullish engulfing candlestick

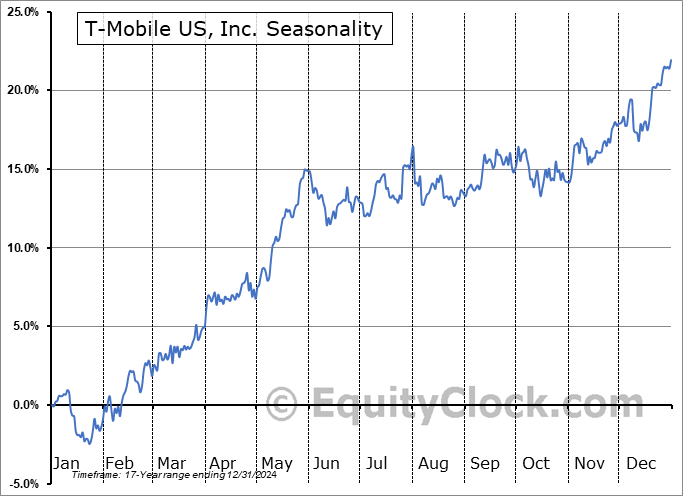

- Start of the optimal holding period for Aggregate Bond funds

- Credit spreads

- Ratio of Junk bonds over US Treasuries

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for July 23

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.88.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|