Stock Market Outlook for September 3, 2025

Energy stocks perking up as energy commodities show bottoming setups.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

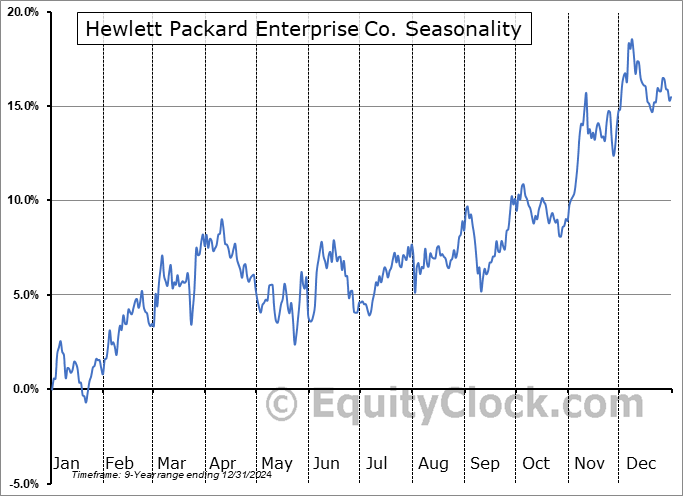

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Trustmark Corp. (NASD:TRMK) Seasonal Chart

Enterprise Financial Services Corp. (NASD:EFSC) Seasonal Chart

Schwab Fundamental U.S. Large Company Index ETF (AMEX:FNDX) Seasonal Chart

The Markets

An uptick in the cost of borrowing amidst concerns that the government would have to pay back collected tariff revenue following an unfavourable ruling against the import tax had investors selling stocks on Tuesday. The large-cap benchmark ended down by just less than seven-tenths of one percent, intersecting and violating, yet again, the 20-day moving average (6421). Momentum indicators are still showing negative divergences versus price where lower-highs below July’s overbought extremes have been charted for RSI and MACD. The result gives strong evidence of buying exhaustion, once again lending itself to the onset of a digestion of prices aligning with the period of volatility for the equity market. As has been emphasized, this is the time to be on your toes given the well known volatile period that this time of year is notorious for. As equity markets destabilize from their summer strength, looking for opportunities to peel back risk in portfolios has become appropriate in order to mitigate the erratic moves that impacts stocks in the final months of the third quarter (August/September). The strategy remains to avoid being aggressive in risk (stocks) in the near-term, but take advantage of any volatility shocks (should they materialize) to increase the risk profile of portfolios ahead of the best six months of the year for stocks that gets underway in October. Our list of candidates in the market that are worthy to Accumulate or Avoid continues to be dialed in appropriately, keeping investors tuned into those segments of the market that are working according to our three-pronged approach incorporating seasonal, technical, and fundamental analysis.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

- Currencies

- Cryptocurrencies

- Commodities

- Major Benchmarks

- Sub-sectors / Industries

- ETFs: Bonds | Commodities | Equity Markets | Industries | Sectors

Subscribe now.

Today, in our Market Outlook to subscribers, we discuss the following:

- Our weekly chart books update, along with our list of all segments of the market to either Accumulate or Avoid

- Other Notes

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for September 3

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish

Sentiment on Tuesday, as gauged by the put-call ratio, ended close to neutral at 0.92.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|