Stock Market Outlook for September 12, 2025

While investors are embracing the increased probability of Fed rate cuts ahead, cutting cycles coinciding with rising unemployment have traditionally been equity market negative.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Pacer Trendpilot US Mid Cap ETF (AMEX:PTMC) Seasonal Chart

iShares Focused Value Factor ETF (AMEX:FOVL) Seasonal Chart

Fidelity International High Quality Index ETF (TSE:FCIQ.TO) Seasonal Chart

Vanguard S&P Small-Cap 600 ETF (NYSE:VIOO) Seasonal Chart

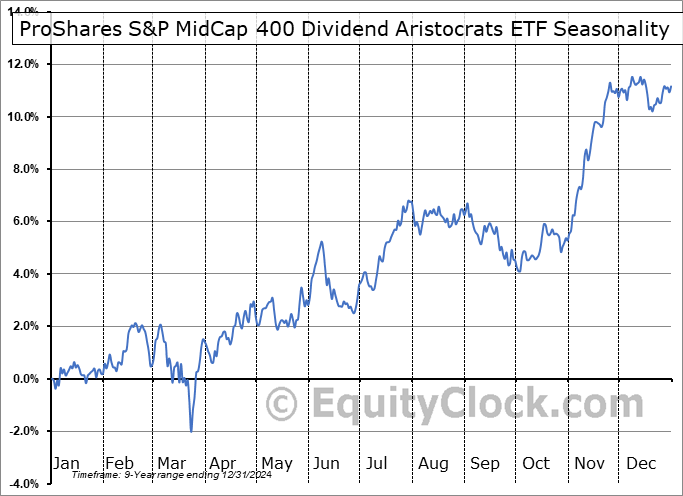

ProShares S&P MidCap 400 Dividend Aristocrats ETF (NYSE:REGL) Seasonal Chart

Illinois Tool Works, Inc. (NYSE:ITW) Seasonal Chart

Luna Innovations Inc. (NASD:LUNA) Seasonal Chart

Columbus McKinnon Corp. (NASD:CMCO) Seasonal Chart

Steelcase, Inc. (NYSE:SCS) Seasonal Chart

Farmer Brothers Co. (NASD:FARM) Seasonal Chart

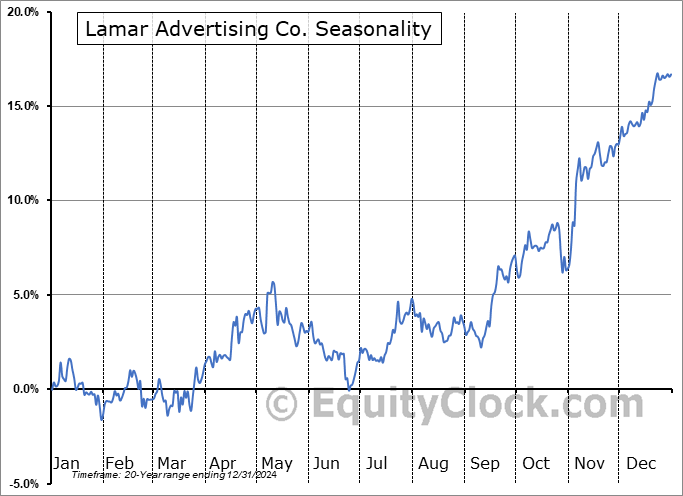

Lamar Advertising Co. (NASD:LAMR) Seasonal Chart

Automatic Data Processing, Inc. (NASD:ADP) Seasonal Chart

HP Inc. (NYSE:HPQ) Seasonal Chart

Delta Air Lines Inc. (NYSE:DAL) Seasonal Chart

Industrial-Alliance Life Insurance Co. (TSE:IAG.TO) Seasonal Chart

Fidelity MSCI Financials Index ETF (AMEX:FNCL) Seasonal Chart

The Markets

An increase in the probability that the Fed will cut rates next week after a surge in the level of initial jobless claims had stocks in rally mode on Thursday. The S&P 500 Index ended up by over eight-tenths of one percent, moving beyond the 6500 level that had presented struggle in recent weeks. After weeks of holding close to short-term support at the 20-week moving average (6466), an elevation above the norm can be seen materializing, certainly pushing back on the contention for the weakness that the month of September is known for. As has been emphasized, this is the time to be on your toes given the well known volatile period that this time of year is notorious for and the weakest, most volatile, period within this timeframe is still ahead, running through the last couple of weeks of the month (the first half of September is normally positive). The strategy remains to avoid being aggressive in risk (stocks) in the near-term, but take advantage of any volatility shocks (should they materialize) to increase the risk profile of portfolios ahead of the best six months of the year for stocks that gets underway in October. We have picked our spots in the market to which we want to be exposed in our list of candidates in the market that are worthy to Accumulate or Avoid and the performance continues to be exceptional. Those themes that are enduring according to our three-pronged approach incorporating seasonal, technical, and fundamental analysis keeps us focused and we are not concerned, at all, if the broad market weakness that is normal of September fails to materialize.

Today, in our Market Outlook to subscribers, we discuss the following:

- US Consumer Price Index (CPI) and the investment implications within

- The crack of trendline support for long-term treasury bond yields

- Weekly jobless claims and the health of the labor market

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for September 12

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.84.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|