Stock Market Outlook for December 23, 2025

Waning interest in consumer discretionary stocks combined with an ongoing rotation towards materials counterparts increasingly influential in equity market performance and how to position into 2026.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

iShares Silver Trust (NYSE:SLV) Seasonal Chart

Invesco DB Precious Metals Fund (NYSE:DBP) Seasonal Chart

SPDR Gold Shares (NYSE:GLD) Seasonal Chart

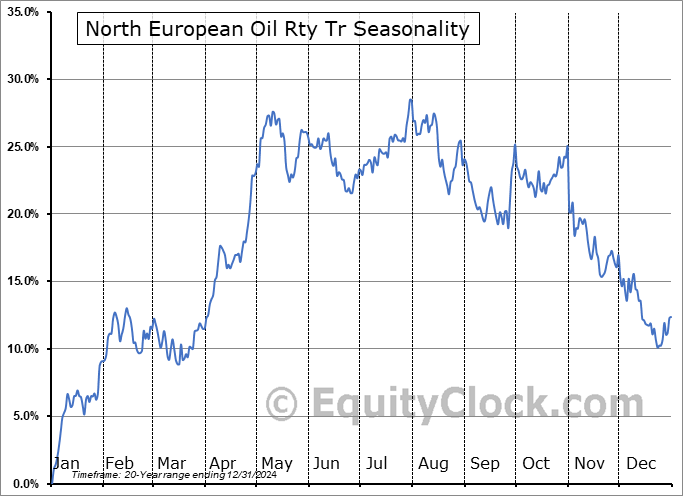

North European Oil Rty Tr (NYSE:NRT) Seasonal Chart

Sprott Inc. (NYSE:SII) Seasonal Chart

BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ) Seasonal Chart

ZTO Express (Cayman) Inc. (NYSE:ZTO) Seasonal Chart

Ascent Industries Co. (NASD:ACNT) Seasonal Chart

Lundin Mining Corp. (TSE:LUN.TO) Seasonal Chart

Imax Corp. (NYSE:IMAX) Seasonal Chart

CCL Industries Inc. – Class B (TSE:CCL/B.TO) Seasonal Chart

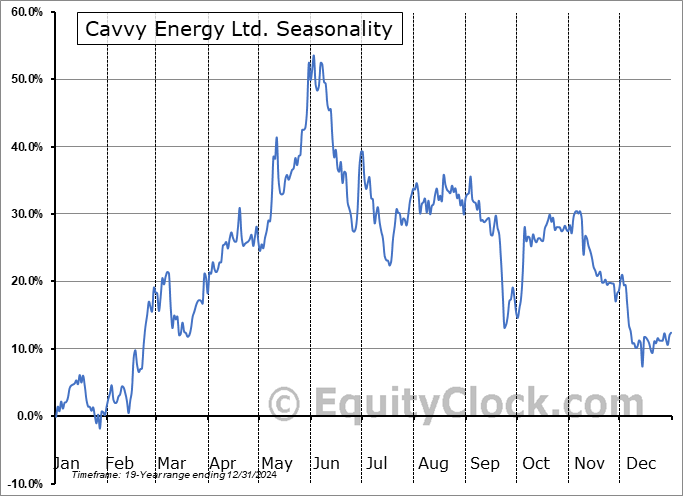

Cavvy Energy Ltd. (TSE:CVVY.TO) Seasonal Chart

Travel + Leisure Co. (NYSE:TNL) Seasonal Chart

iShares U.S. Preferred Stock ETF (NASD:PFF) Seasonal Chart

Chicago Rivet & Machine Co. (AMEX:CVR) Seasonal Chart

Paramount Resources Ltd. (TSE:POU.TO) Seasonal Chart

Pulse Seismic Inc. (TSE:PSD.TO) Seasonal Chart

Disclaimer: Comments and opinions offered in this report are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered is believed to be accurate, but is not guaranteed.

Note pertaining to our holiday schedule ahead: The holidays are upon us and we will be stepping back from our regular schedule over the next few days surrounding Christmas. Our next report will be released on Monday, December 29th when we will provide our weekly chart books update. We will continue to update the seasonal charts of economic data following the various releases through the days ahead and note anything of significance through our social media channels at StockTwits, X, or Reddit. In the meantime, we are busy at work preparing for our annual database refresh and our monthly report for January is slated to be released next week, providing you with the playbook of what to expect heading through the months/year ahead.

The Markets

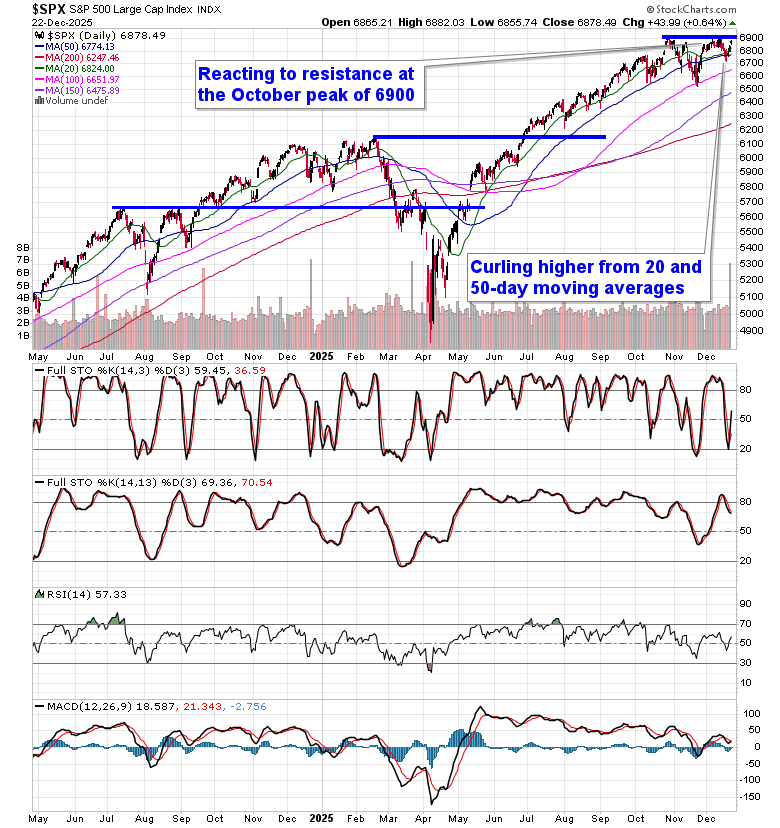

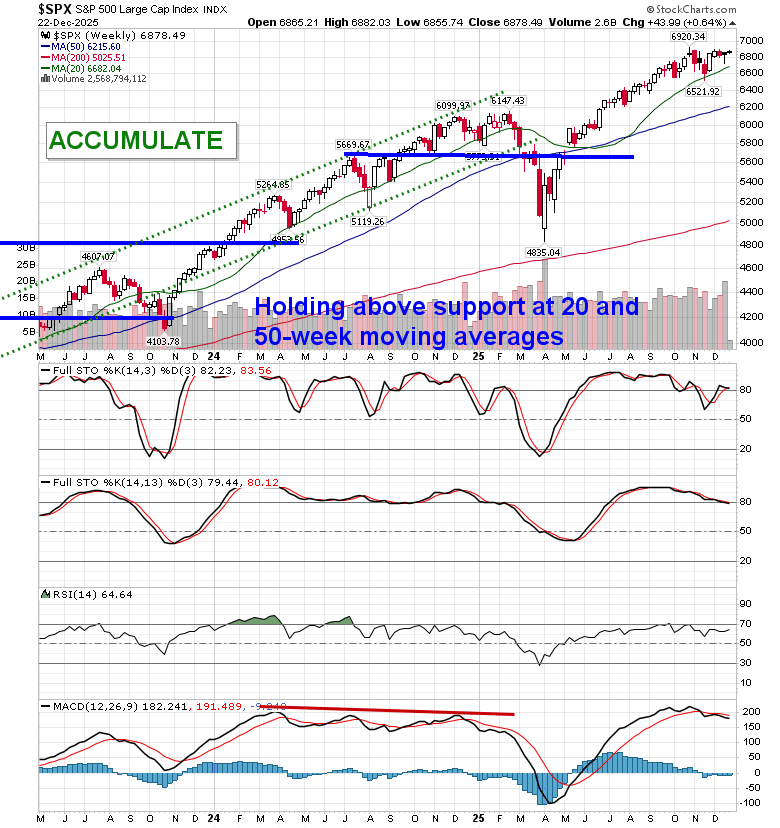

Stocks edged higher on Monday as the quiet positivty surrounding the Christmas holiday week sets in. The S&P 500 Index gained nearly two-thirds of one percent, continuing to move higher from the zone of support presented by the November 10th upside gap between 6729 and 6785. The October 27th gap around 6830 has now been taken out. The race to make an attack on double-top resistance around the 6900 during this end of year positivity is underway. While the broader negative setup, if held, presents an overhanging threat against the trajectory of the market that could result in a move back towards the February of 2025 high around 6150, the underlying support at major moving average and positive year-end tendencies suggest a more likely scenario in the near-term that the barrier ahead will be cracked. The psychologically important 7000 level is now just 1.8% overhead and traders love to pin markets and stocks into these important levels during these significant seasonal timeframes. In the Seasonal Advantage Portfolio that we oversee at Castlemoore, we have been fully invested in the equity market since last Thursday and the themes in our chart books to either Accumulate or Avoid have been capturing the strength that has leached into the market from the November 20th lows.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

- Currencies

- Cryptocurrencies

- Commodities

- Major Benchmarks

- Sub-sectors / Industries

- ETFs: Bonds | Commodities | Equity Markets | Industries | Sectors

Subscribe now.

Today, in our Market Outlook to subscribers, we discuss the following:

- Our weekly chart books update, along with the list of all segments of the market to either Accumulate or Avoid

- Other Notes

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for December 23

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish

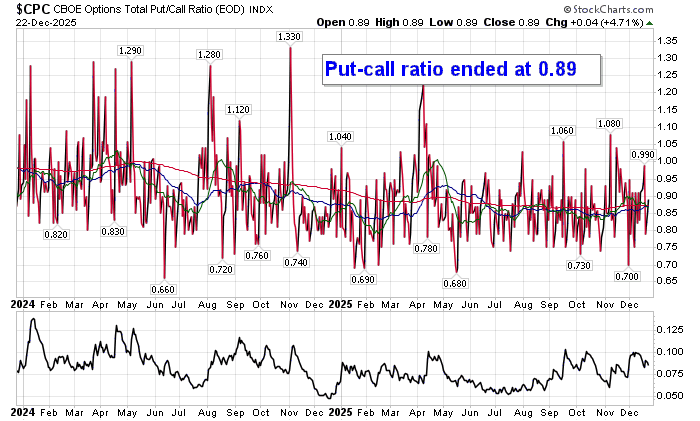

Sentiment on Monday, as gauged by the put-call ratio, ended bullish at 0.89.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

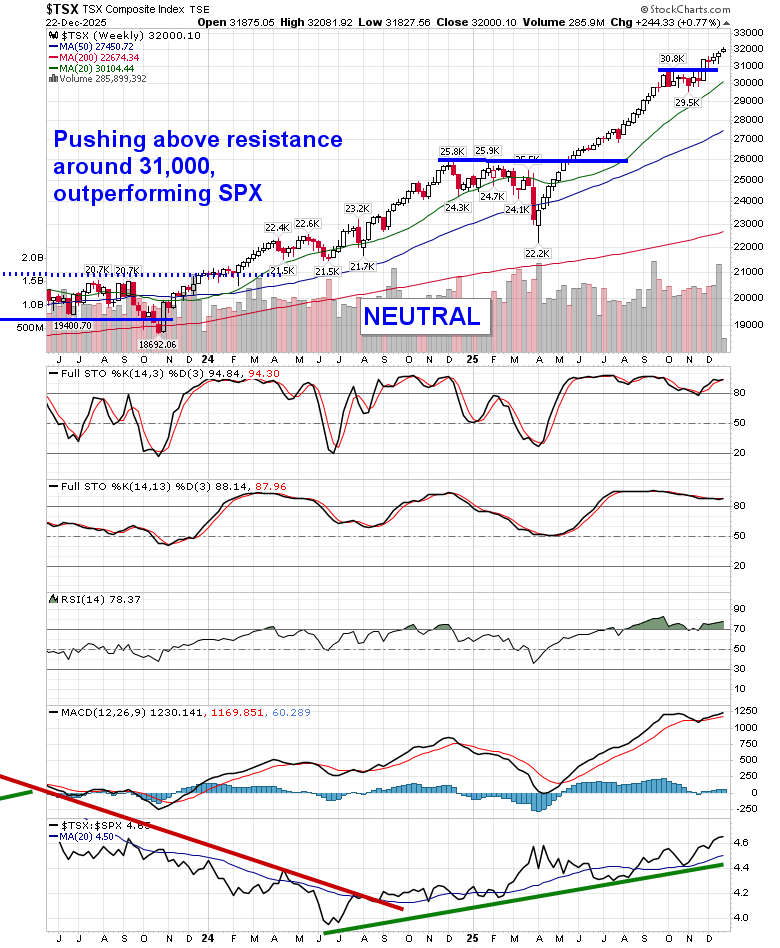

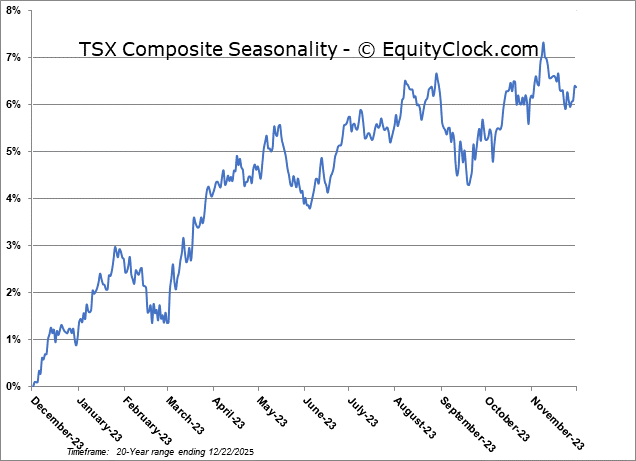

TSE Composite

| Sponsored By... |

|