Stock Market Outlook for December 30, 2025

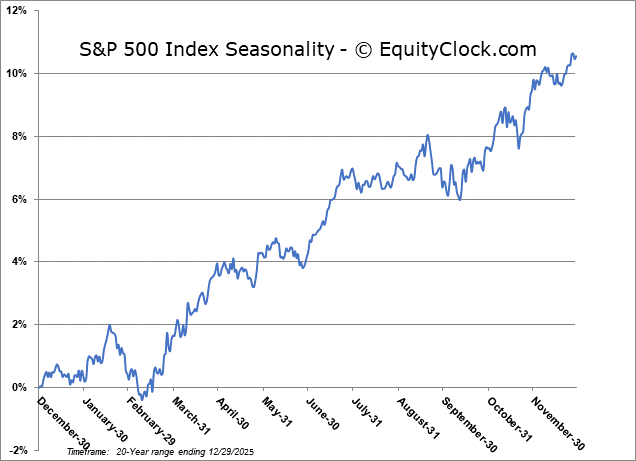

Looking at defensive and diversifying plays for the start of the new year as seasonal influences shift.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Royal Road Minerals Limited (TSXV:RYR.V) Seasonal Chart

West Vault Mining Inc. (TSXV:WVM.V) Seasonal Chart

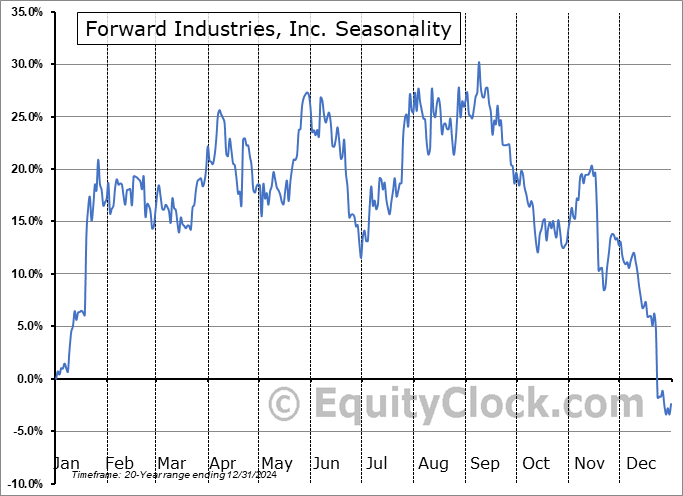

Forward Industries, Inc. (NASD:FWDI) Seasonal Chart

Star Bulk Carriers Corp. (NASD:SBLK) Seasonal Chart

ANI Pharmaceuticals, Inc. (NASD:ANIP) Seasonal Chart

China Gold International Resources Corp. Ltd. (TSE:CGG.TO) Seasonal Chart

Disclaimer: Comments and opinions offered in this report are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered is believed to be accurate, but is not guaranteed.

The Markets

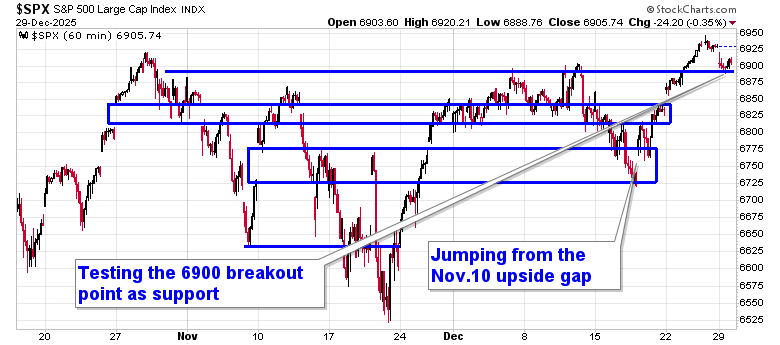

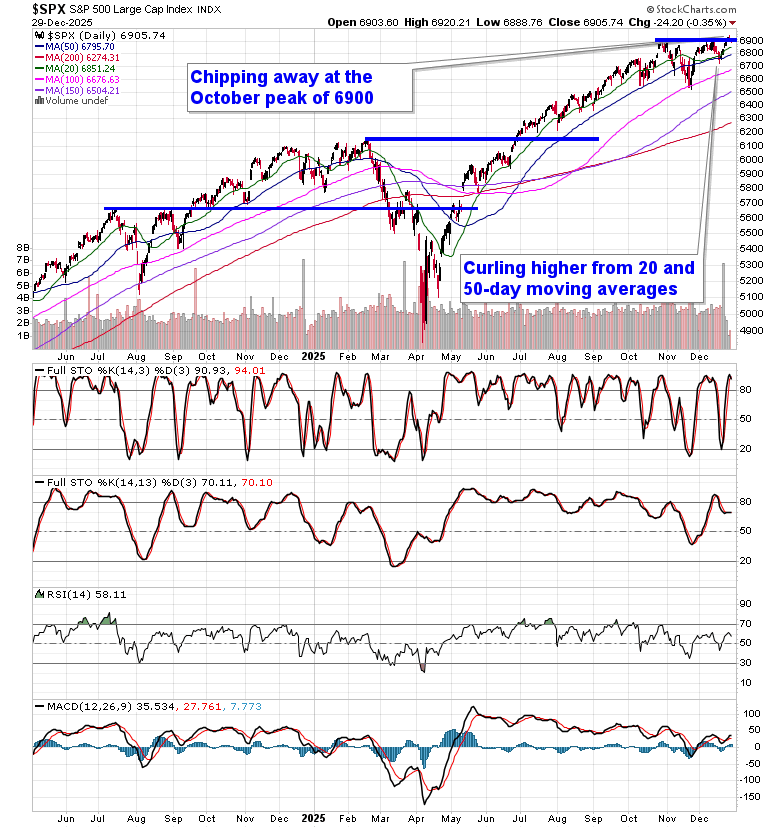

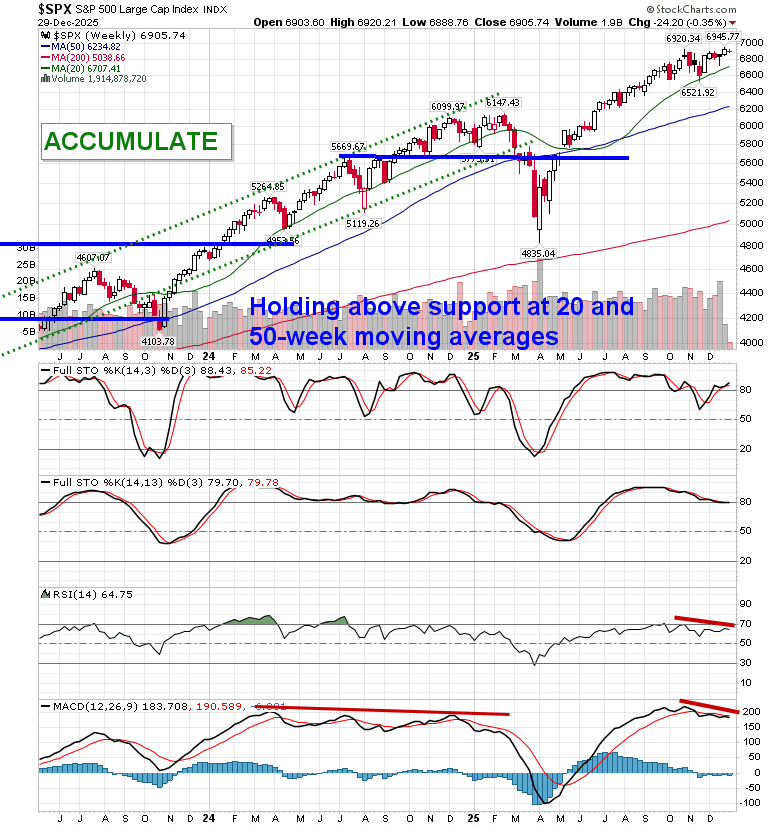

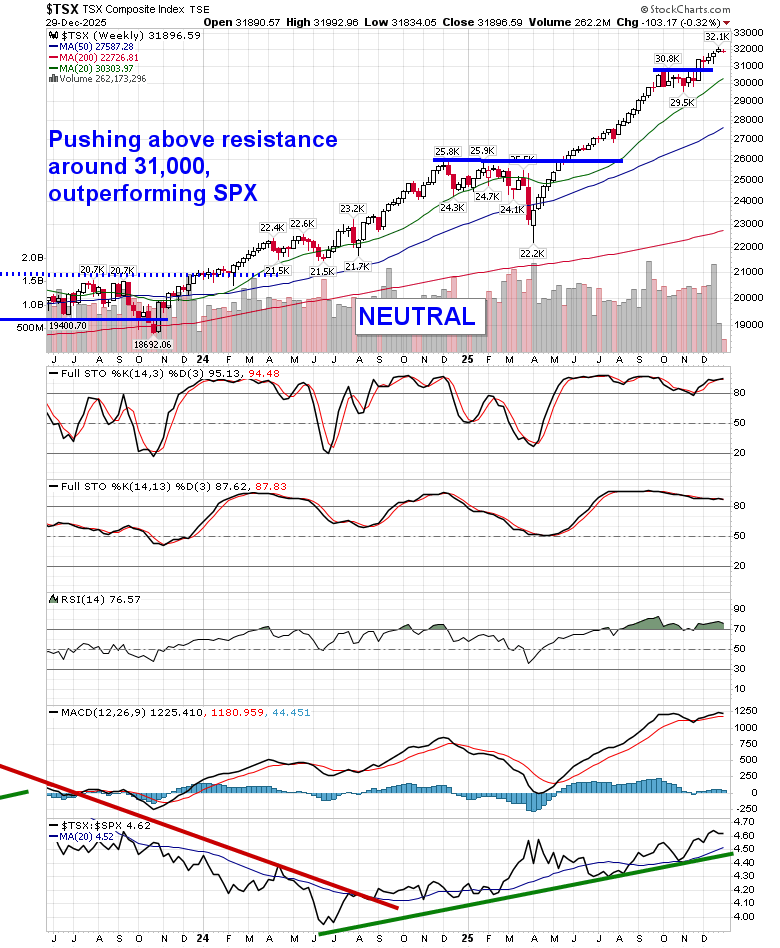

Stocks slipped slightly in the final Monday session of 2025 as technology and metal stocks underwent profit-taking pressures. The S&P 500 Index declined by around a third of one percent, testing the recently broken level of horizontal resistance presented by the prior 52-week closing highs around 6900. The benchmark remains firmly elevated above prior zones of gap resistance around 6750 and 6830, presenting plenty of leeway before a more threatening technical setup would be presented. Underlying support at major moving averages and positive year-end tendencies suggest a move towards the psychologically important 7000 level that is now around 1.4% overhead; traders love to pin markets and stocks into these important levels during these significant seasonal timeframes. In the Seasonal Advantage Portfolio that we oversee at Castlemoore, we have been fully invested in the equity market since December 18th and the themes in our chart books to either Accumulate or Avoid have been capturing the strength that has leached into the market from the November 20th lows.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

- Currencies

- Cryptocurrencies

- Commodities

- Major Benchmarks

- Sub-sectors / Industries

- ETFs: Bonds | Commodities | Equity Markets | Industries | Sectors

Subscribe now.

Today, in our Market Outlook to subscribers, we discuss the following:

- Market Action and Technical Picture

- Seasonality and Risk Bias

- Early Warning signals for 2026

- Bonds, Dollar, and Cross-Asset Signals

- New Accumulate Candidates: Defensive and Diversifying Plays

- Emerging Markets

- Our list of all segments of the market to either Accumulate or Avoid

- Other Important Notes and Insights

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for December 30

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish

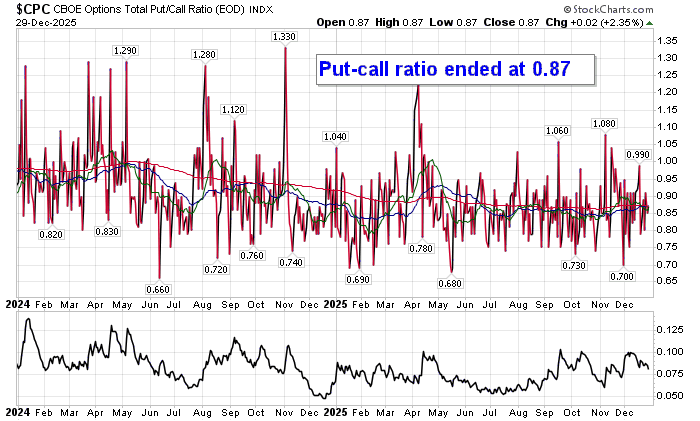

Sentiment on Monday, as gauged by the put-call ratio, ended slightly bullish at 0.87.

Seasonal charts of companies reporting earnings today:

- No Significant earnings scheduled for today.

S&P 500 Index

TSE Composite

| Sponsored By... |

|