Stock Market Outlook for January 7, 2026

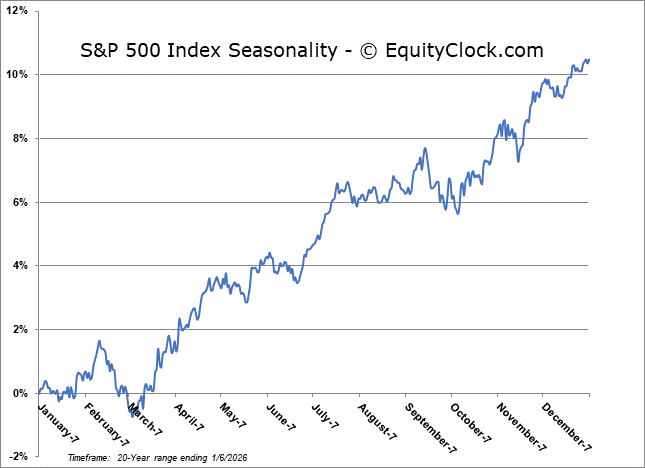

The Santa Claus Rally Period in stocks ended with the strongest gain since 2020. We’ll tell you what history suggests comes next.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

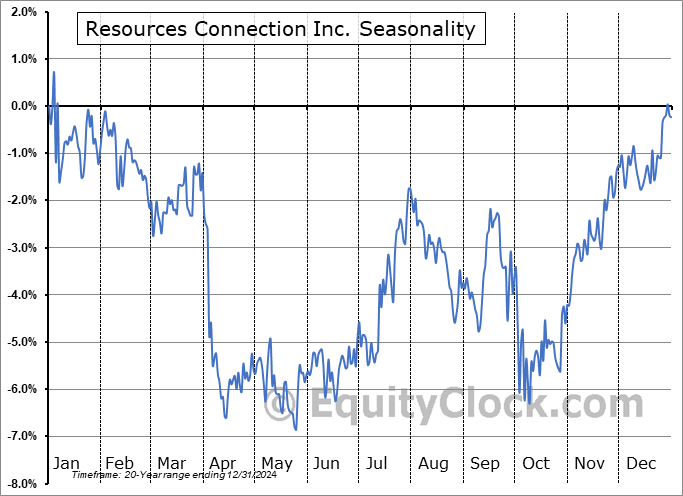

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Tractor Supply Co. (NASD:TSCO) Seasonal Chart

Teck Resources Ltd. (NYSE:TECK) Seasonal Chart

Advanced Drainage Systems, Inc. (NYSE:WMS) Seasonal Chart

Disclaimer: Comments and opinions offered in this report are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered is believed to be accurate, but is not guaranteed.

The Markets

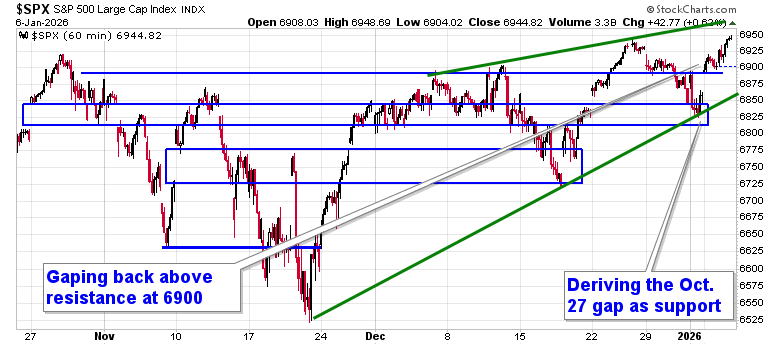

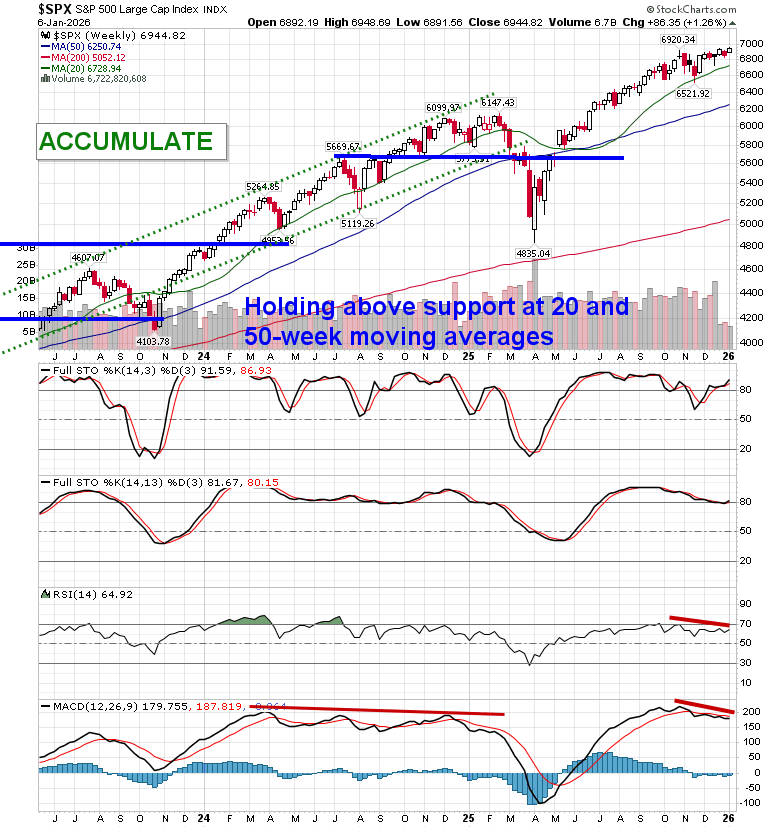

A record setting day for stocks saw the S&P 500 Index and Dow Jones Industrial average chart all-time highs. The large-cap benchmark posted a gain of around six-tenths of one percent, continuing to move above horizontal resistance presented by the prior 52-week closing highs around 6900. End of October gap resistance has turned into support around 6830 and, until it is broken, playing on the long-side of this market remains appropriate. Applying trendlines to the short-term chart shows a narrowing range that points to a culmination around the 7000 level, a psychologically important level that is presently acting as a draw. In the Seasonal Advantage Portfolio that we oversee at Castlemoore, we remain fully invested in the equity market and the themes in our chart books to either Accumulate or Avoid have been capturing the strength that has leached into the market from the November 20th lows.

Today, in our Market Outlook to subscribers, we discuss the following:

- Market Action & Technical Picture

- Santa Claus Rally Results & Seasonal Implications

- Mid-Term Election Year Caution

- Risk-On Leadership providing early-year wins to our portfolios

- US Vehicle Sales: Consumer & Business Strain and Strategy Implications

- Auto stocks: A Conditional Bright Spot

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for January 7

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish

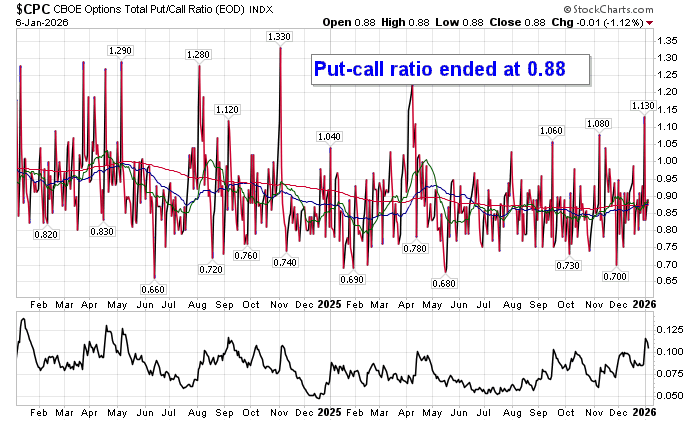

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.88.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

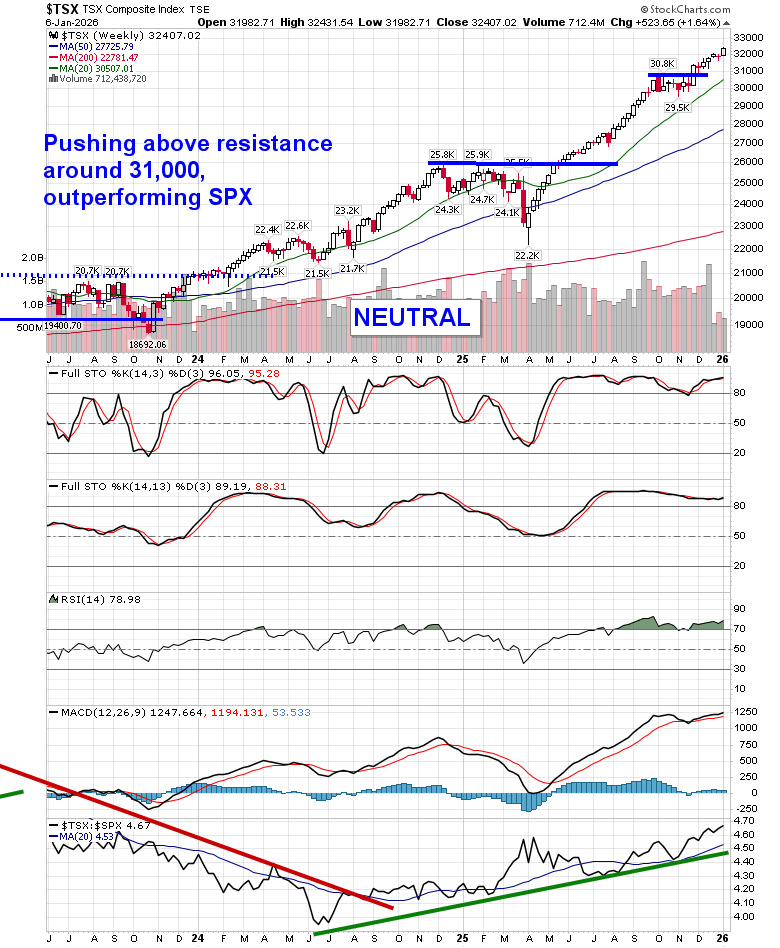

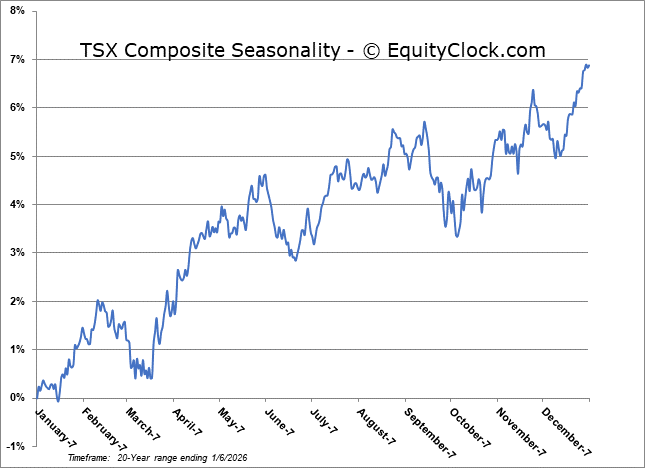

TSE Composite

| Sponsored By... |

|