Stock Market Outlook for August 4, 2021

Following an abrupt uptick in strength of core cyclical sectors to end the month of July, we see hints of risk-taking re-emerging.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Starbucks Corp. (NASD:SBUX) Seasonal Chart

Allegiant Travel Co. (NASD:ALGT) Seasonal Chart

PriceSmart, Inc. (NASD:PSMT) Seasonal Chart

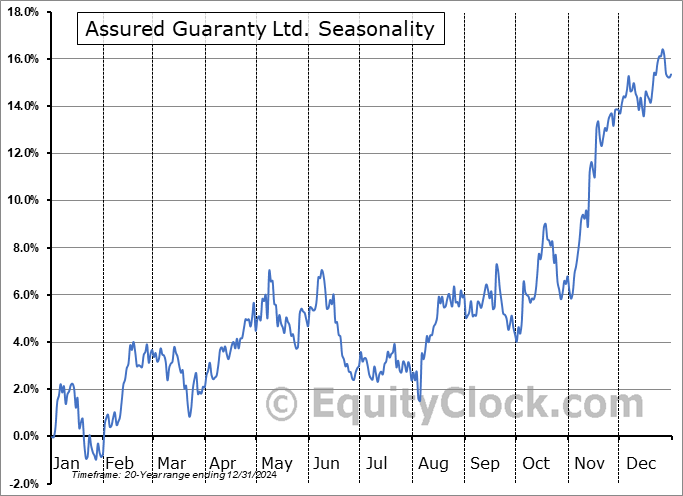

Assured Guaranty Ltd. (NYSE:AGO) Seasonal Chart

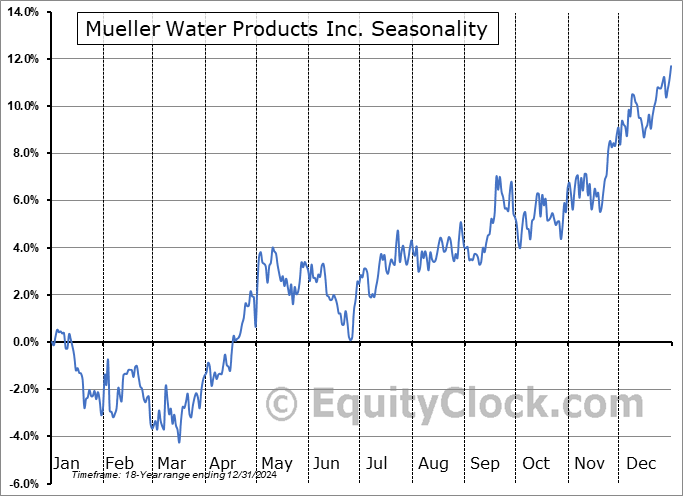

Mueller Water Products Inc. (NYSE:MWA) Seasonal Chart

Superior Group of Companies, Inc. (NASD:SGC) Seasonal Chart

Cass Commercial Corp. (NASD:CASS) Seasonal Chart

Chefs’ Warehouse, Inc. (NASD:CHEF) Seasonal Chart

Capri Holdings Ltd. (NYSE:CPRI) Seasonal Chart

Â

Â

The Markets

Stocks closed firmly higher on Tuesday as continued rotation into core-cyclical sectors carries the baton from the high-flying technology-oriented sectors. The S&P 500 Index gained just over eight-tenths of one percent, continuing to find short-term support at its rising 20-day moving average. Intermediate support remains at the rising 50-day moving average at 4293. But while the trends across the short, intermediate, and long-term timeframes continue to register as being positive, negative momentum divergences with respect to MACD and RSI have hinted of waning buying demand as investor enthusiasm around these record peaks fades.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

Subscribe now.

Today, in our Market Outlook to subscribers, we discuss the following:

- The short-term trading range of the S&P 500 Index

- Notable changes in this week’s chart books: Find out which industries have been upgraded to Accumulate and which industry has been downgraded

- US Factory Orders and what the results say about which areas of the market to favor longer-term

- US Construction Spending and stocks exposed to the industry

Subscribe now and we’ll send this outlook to you.

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.76.

Â

Â

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|