Stock Market Outlook for October 28, 2021

Core-cyclical bets pulling back from levels of resistance into the end of the month, but there is little fundamentally, technically, nor seasonally to suggest that these segments are at risk for declines in the months ahead.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Caterpillar, Inc. (NYSE:CAT) Seasonal Chart

Masco Corp. (NYSE:MAS) Seasonal Chart

Hecla Mining Co. (NYSE:HL) Seasonal Chart

Boston Properties, Inc. (NYSE:BXP) Seasonal Chart

J.B. Hunt Transport Services, Inc. (NASD:JBHT) Seasonal Chart

MGM Resorts International (NYSE:MGM) Seasonal Chart

Brinker Intl, Inc. (NYSE:EAT) Seasonal Chart

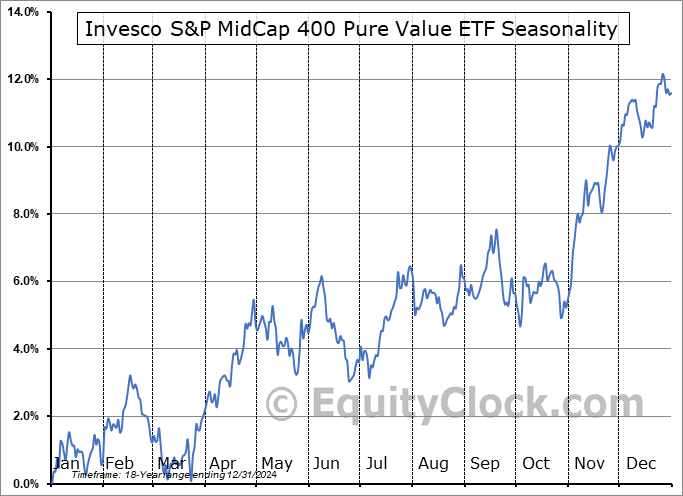

Invesco S&P MidCap 400 Pure Value ETF (NYSE:RFV) Seasonal Chart

Cedar Fair L P (NYSE:FUN) Seasonal Chart

Invesco Dynamic Leisure and Entertainment ETF (NYSE:PEJ) Seasonal Chart

Marvell Technology Group, Ltd. (NASD:MRVL) Seasonal Chart

iShares Morningstar Small-Cap Value ETF (NYSE:JKL) Seasonal Chart

Nutrien Ltd. (NYSE:NTR) Seasonal Chart

iShares Core S&P Mid-Cap ETF (NYSE:IJH) Seasonal Chart

iShares Russell 2000 ETF (NYSE:IWM) Seasonal Chart

Invesco Dynamic Networking ETF (NYSE:PXQ) Seasonal Chart

Invesco S&P 500 Equal Weight Consumer Discretionary ETF (NYSE:RCD) Seasonal Chart

Vanguard Large-Cap ETF (NYSE:VV) Seasonal Chart

Â

Â

The Markets

Stocks pulled back on Wednesday as signs of mean reversion finally materialize ahead of the end of the month. The S&P 500 Index shed around half of one percent, led by core-cyclical bets, which have realized stellar performance over the past month. The benchmark is pulling back from previous rising trendline support, now resistance, hovering around 4575, a target that we had highlighted for the benchmark earlier in the month. Levels of support below this market remain plentiful, the most notable of which being the 50-day moving average at 4450. The intermediate hurdle continues to point higher, providing a level for traders to peg their bets. As long as the hurdle remains in a position of support, reason to be constructive in favourable seasonal bets exists. Momentum indicators are showing early signs of rolling over as the benchmark seeks to consolidate some of the strength realized through the past month as the best six months for stocks between November and April gets set to begin. Thus far, there is nothing to suggest deviating from the path we’ve laid out for subscribers as we head into this period of strength ahead.

Today, in our Market Outlook to subscribers, we discuss the following:

- The rollover of core-cyclical bets from around levels of resistance into the end of the month

- US petroleum inventories and the technical analysis for the price of oil

- US Durable Goods Orders and the standout in September’s report

Subscribe now and we’ll send this outlook to you.

Sentiment on Wednesday, as gauged by the put-call ratio, ended bullish at 0.86.

Â

Â

Â

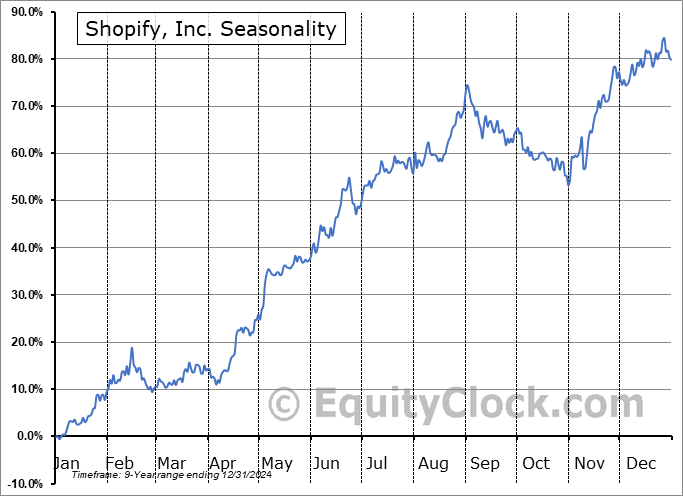

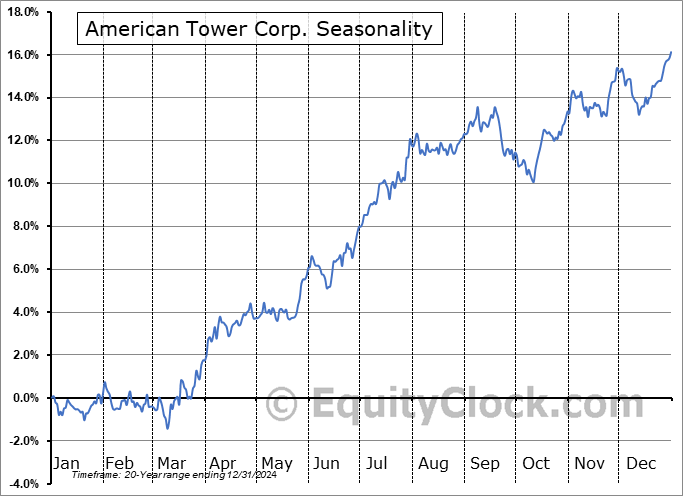

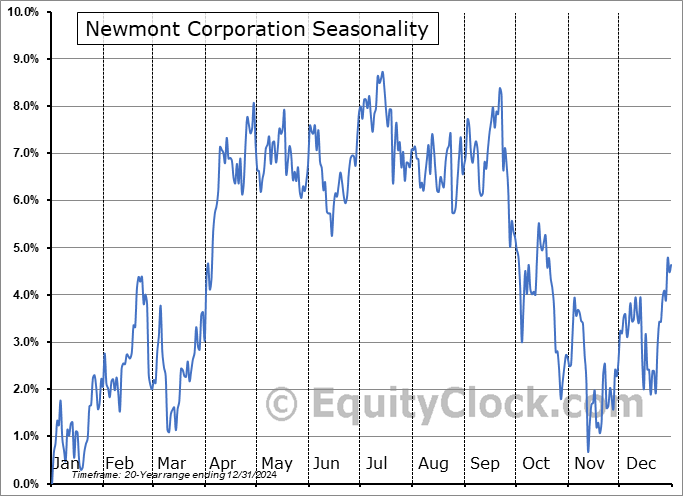

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|