Stock Market Outlook for November 26, 2021

REITs starting to perk up now that their period of seasonal weakness has come to an end.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Stryker Corp. (NYSE:SYK) Seasonal Chart

Winpak Ltd. (TSE:WPK.TO) Seasonal Chart

Ametek, Inc. (NYSE:AME) Seasonal Chart

Hersha Hospitality Trust (NYSE:HT) Seasonal Chart

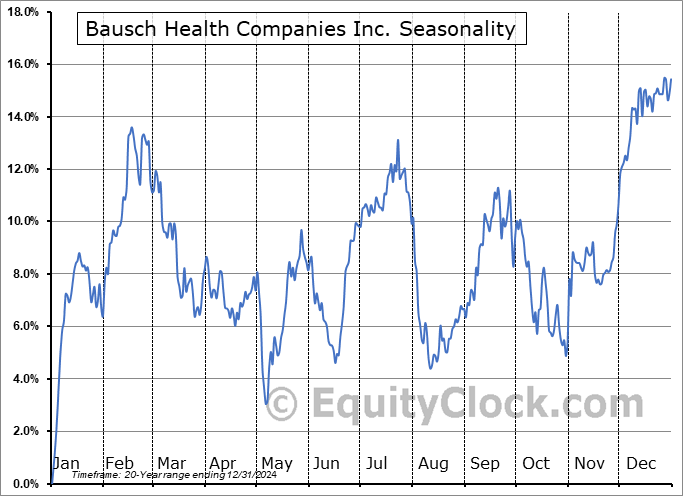

Bausch Health Companies Inc. (TSE:BHC.TO) Seasonal Chart

Covanta Holding Corp. (NYSE:CVA) Seasonal Chart

iShares MSCI Mexico Capped ETF (NYSE:EWW) Seasonal Chart

Â

Note: No report will be released on Thursday due to the Thanksgiving holiday in the US. Happy Thanksgiving to our US audience!

Â

The Markets

Stocks closed higher in the Thanksgiving-eve session as the positive sentiment that is typical of the day materialized into the closing bell. The S&P 500 Index added nearly a quarter of one percent, remaining supported in the short-term at the rising 20-day moving average. Intermediate support can continue to be pegged at the rising 50-day moving average, now at 4525. Momentum indicators continue to show characteristics of a bullish trend and this is still a market that is showing positive trends on short, intermediate, and long-term timeframes, warranting a bullish bias, particularly during this seasonally strong time of year.

Today, in our Market Outlook to subscribers, we discuss the following:

- The skewed look that the media provided of the state of initial jobless claims

- Continued claims and what the monthly payroll report may show next week

- REITs perking up and how to play it

- US New Home Sales

- US Durable Goods Orders and the health of the manufacturing economy

Subscribe now and we’ll send this outlook to you.

Sentiment on Wednesday, as gauged by the put-call ratio, ended bullish at 0.91.

Â

Â

Â

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|