Stock Market Outlook for April 20, 2022

Commentators are highlighting the extreme bearish sentiment of investors as reason the market should rally, but looking at how investors are positioning rather than what they are saying provides an alternate viewpoint of the state of the market.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Unifi, Inc. (NYSE:UFI) Seasonal Chart

Norwood Financial Corp. (NASD:NWFL) Seasonal Chart

Brightcove, Inc (NASD:BCOV) Seasonal Chart

Invesco DWA SmallCap Momentum ETF (NASD:DWAS) Seasonal Chart

The Markets

Stocks jumped on Tuesday as investors buckle up for the onslaught of earnings reports expected in the coming days. The S&P 500 Index rallied by 1.61%, moving back above its 50-day moving average, which has been the scene of massive daily swings higher and lower in recent days. Resistance at the open gap in the range of 4465 and 4480 was tested at the highs of the session. Moving averages continue to converge around 4500, threatening to provide a cap to the benchmark in the near-term. Short to intermediate-term moving averages, including everything from the 20-day to the 100-day, are pointed lower, which is a distinct shift from the rising trajectories that have been apparent since the summer of 2020. This is clearly no longer the market of the past couple of years and a trading environment (as opposed to a buy and hold framework) continues to be implied.

Today, in our Market Outlook to subscribers, we discuss the following:

- A break of the trend of lower-lows and lower-highs on the hourly chart of the S&P 500 Index

- An extensive look at sentiment and positioning in this market

- US Housing Starts and the stocks of the home builders

Subscribe now and we’ll send this outlook to you.

Sentiment on Tuesday, as gauged by the put-call ratio, ended neutral at 0.96.

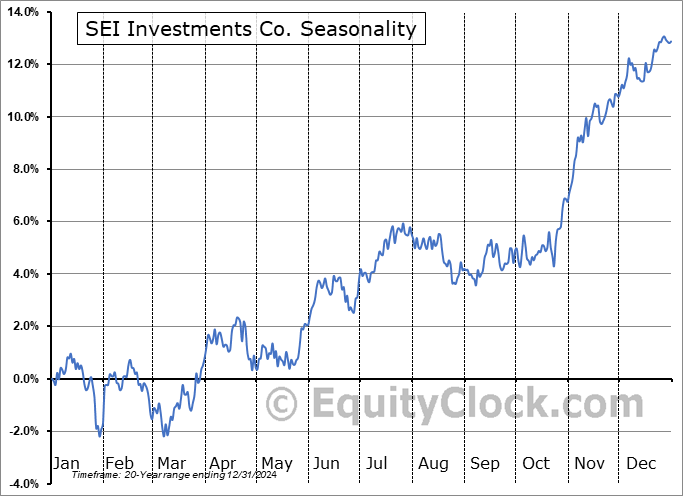

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|