Stock Market Outlook for July 27, 2022

In our work, we look for dislocations compared to seasonal norms and the abnormal decline in new home sales through the first half of the year certainly stands out. Prior to the pandemic, sales of new homes have never fallen through the spring, even during past recessions.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

iShares Morningstar Large-Cap ETF (NYSE:ILCB) Seasonal Chart

ProShares Hedge Replication ETF (NYSE:HDG) Seasonal Chart

Global X China Industrials ETF (NYSE:CHII) Seasonal Chart

United States 12 Month Natural Gas Fund (NYSE:UNL) Seasonal Chart

Invesco CurrencyShares Japanese Yen Trust (NYSE:FXY) Seasonal Chart

Global X China Consumer ETF (NYSE:CHIQ) Seasonal Chart

C.H. Robinson Worldwide, Inc. (NASD:CHRW) Seasonal Chart

Invesco Canadian Dividend Index ETF (TSE:PDC.TO) Seasonal Chart

The Markets

Stocks closed lower on Tuesday as investors braced for an onslaught of earnings in the technology sector after the closing bell. The S&P 500 Index shed 1.15%, trading back to and testing the recently broken 50-day moving average at 3919 as a level of support. This is often a hurdle that investors will tend to revert to ahead of an uncertain event, such as what scheduled earnings presented. The uncertainty ahead of the FOMC announcement on Wednesday is another consideration. Previous declining trendline resistance can be pegged at 3800. Both MACD and RSI are holding above their middle lines as they attempt to relinquish the characteristics of a bearish trend that has proliferated since the year began. Despite the pullback in recent days, this is still a market that is trying to firm a base, albeit one that still has a lot of question marks tied to it given the intermediate path of lower-lows and lower-highs that remains unviolated.

Today, in our Market Outlook to subscribers, we discuss the following:

- Monitoring how this short-term wave lower in the market evolves and the levels of importance

- The resumption of the rising trend of the US Dollar Index

- The change that we are enacting in the Super Simple Seasonal Portfolio

- US New Home Sales

- US Home Prices

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for July 27

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Tuesday, as gauged by the put-call ratio, ended neutral at 1.00.

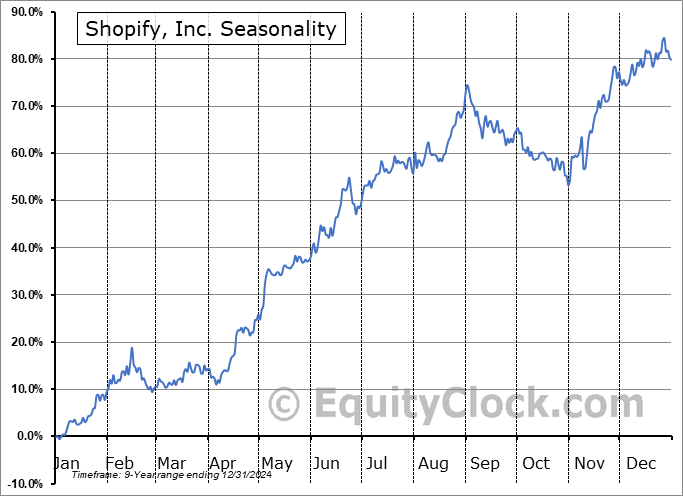

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|