Stock Market Outlook for May 16, 2023

Manufacturer sentiment and shipping activity continue to attest to a manufacturing economy that is in recession.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Clearway Energy, Inc. (NYSE:CWEN) Seasonal Chart

Global X Founder-Run Companies ETF (AMEX:BOSS) Seasonal Chart

Global X Millennials Thematic ETF (NASD:MILN) Seasonal Chart

ETFMG Prime Mobile Payments ETF (AMEX:IPAY) Seasonal Chart

EcoSynthetix Inc. (TSE:ECO.TO) Seasonal Chart

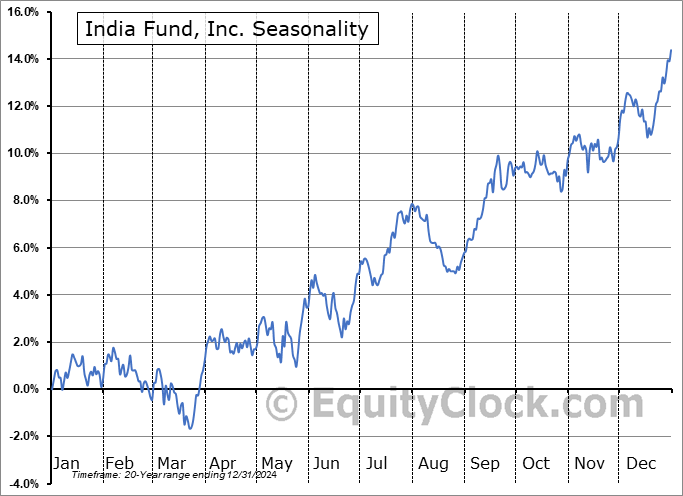

India Fund, Inc. (NYSE:IFN) Seasonal Chart

Alamos Gold Inc. (TSE:AGI.TO) Seasonal Chart

MagnaChip Semiconductor Corp. (NYSE:MX) Seasonal Chart

Vicor Corp. (NASD:VICR) Seasonal Chart

Inseego Corp. (NASD:INSG) Seasonal Chart

TTEC Holdings, Inc. (NASD:TTEC) Seasonal Chart

Forward Air Corp. (NASD:FWRD) Seasonal Chart

The Markets

Stocks drifted higher to start the week as investors continue to monitor the developments pertaining to the debt ceiling negotiations as the clock ticks closer towards a possible default. The S&P 500 Index closed with a gain of three-tenths of one percent, remaining in this band of resistance between 4100 and 4200. Support remains persistent at the congestion of major moving averages between 3950 to 4050. Momentum indicators are still pointed lower, but they have not made much progress on the downside since a MACD sell signal was recorded on April 24th. This market remains in need of a catalyst to trigger a direction, one way or the other.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

- Currencies

- Cryptocurrencies

- Commodities

- Major Benchmarks

- Sub-sectors / Industries

- ETFs: Bonds | Commodities | Equity Markets | Industries | Sectors

Subscribe now.

Today, in our Market Outlook to subscribers, we discuss the following:

- Our weekly chart books updates, along with our list of all of the segments of the market that you should either Accumulate or Avoid

- Empire State Manufacturing Index

- CASS Freight Index and the technicals of Dow Jones Transportation Average

- Scrutinizing the technicals of Silver

- Investor sentiment and active investment manager exposure to stocks

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for May 16

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Monday, as gauged by the put-call ratio, ended neutral at 0.96.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|