Stock Market Outlook for July 18, 2023

The below average trend of manufacturer sentiment readings continues into July, suggesting weaker than normal activity at this time of year that typically sees factories shutdown/re-tool.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Washington Federal, Inc. (NASD:WAFD) Seasonal Chart

Banco Latinoamericano de Comercio Exterior, SA (NYSE:BLX) Seasonal Chart

Xylem Inc. (NYSE:XYL) Seasonal Chart

Trio-Tech Intl (AMEX:TRT) Seasonal Chart

Keysight Technologies Inc. (NYSE:KEYS) Seasonal Chart

Green Plains Partners LP (NASD:GPP) Seasonal Chart

The Markets

Stocks closed with gains on the day that traditionally marks the average peak to the summer rally timeframe that began in the last week of June. The S&P 500 Index closed higher by just less than four-tenths of one percent, charting a fresh 52-week high. The Relative Strength Index (RSI) has moved back into overbought territory following this mid-year gyration, threatening to exhaust buying demand in the short-term, particularly now that the strongest period of July has concluded. Momentum indicators continue to show characteristics of a bullish trend above their middle lines and moving averages continue to fan out in a bullish manner.

Today, in our Market Outlook to subscribers, we discuss the following:

- Gauging the level of complacency in the market ahead of the period of seasonal volatility

- Our weekly chart books update: Find out what joins our list of Accumulate candidates this week and what falls off of our list of segments to Avoid

- Low Volatility funds continue to show some of the weakest charts in the market

- Manufacturer Sentiment

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for July 18

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

- Currencies

- Cryptocurrencies

- Commodities

- Major Benchmarks

- Sub-sectors / Industries

- ETFs: Bonds | Commodities | Equity Markets | Industries | Sectors

Subscribe now.

Sentiment on Monday, as gauged by the put-call ratio, ended bullish at 0.85.

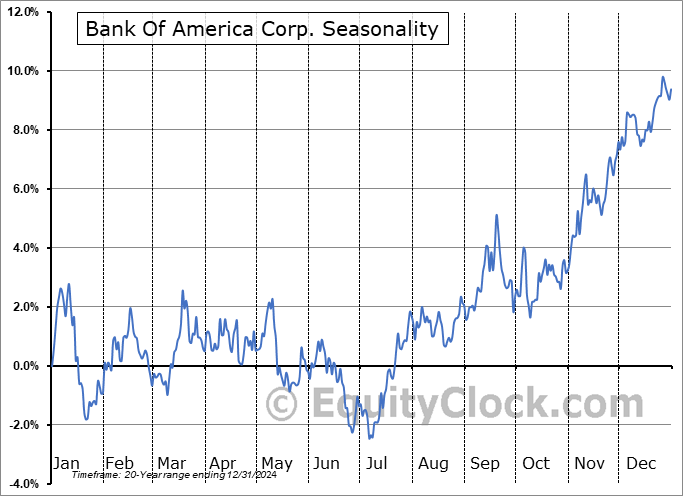

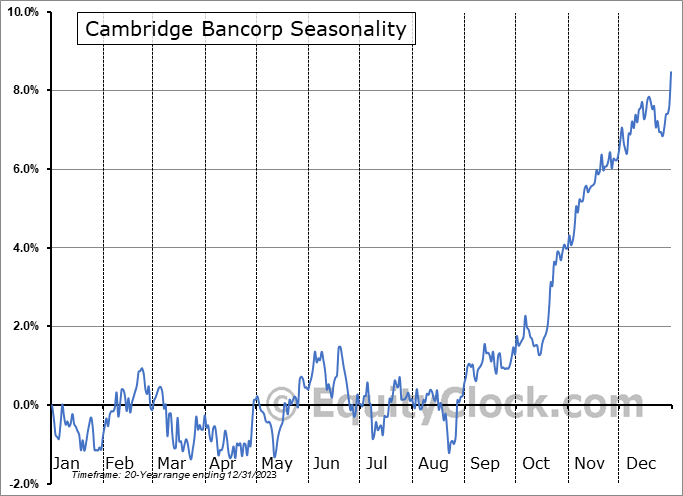

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|