Stock Market Outlook for February 27, 2024

Growing evidence of investor indecision with benchmarks showing some of the most overbought readings in years increases the likelihood of near-term buying exhaustion.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Crew Energy Inc. (TSE:CR.TO) Seasonal Chart

B&G Foods Inc. (NYSE:BGS) Seasonal Chart

Sintana Energy Inc. (TSXV:SEI.V) Seasonal Chart

iShares MSCI World ETF (AMEX:URTH) Seasonal Chart

The Markets

Stocks closed generally lower on Monday as traders sought to re-balance their portfolios ahead of the end of the month. The S&P 500 Index ended lower by just under four-tenths of one percent, peeling back slightly from the record highs charted into the end of last week. An upside open gap derived by the “NVIDIA surge” between 4983 and 5038 creates an initial zone to shoot off of as support upon a near-term digestion of gains, a range that now aligns with the rising 20-day moving average. Should a full-blown correction in the market take hold, levels down to the zone between 4600 and 4800 are fair game in order to keep the rising intermediate-term trajectory of the benchmark intact. Negative momentum divergences with respect to MACD and RSI attest to the waning of buying demand around these heights, but the benchmark is still far from showing characteristics of a bearish trend that would foretell a decline over a sustained timeframe.

Today, in our Market Outlook to subscribers, we discuss the following:

- Indecision candlesticks on the chart of the US Dollar Index

- Our weekly chart books update, along with our list of all of the segments of the market to either Accumulate or Avoid

- US New Home Sales

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for February 27

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

- Currencies

- Cryptocurrencies

- Commodities

- Major Benchmarks

- Sub-sectors / Industries

- ETFs: Bonds | Commodities | Equity Markets | Industries | Sectors

Subscribe now.

Sentiment on Monday, as gauged by the put-call ratio, ended neutral at 1.00.

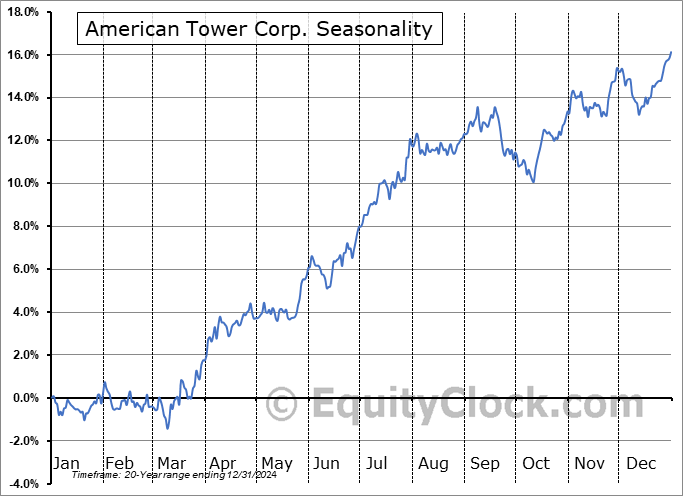

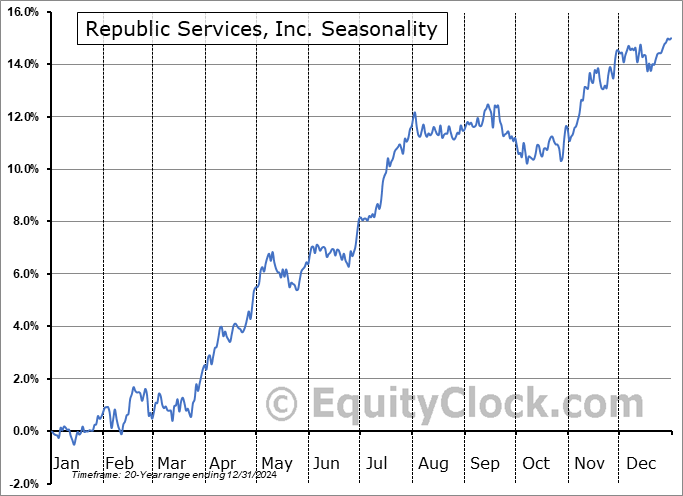

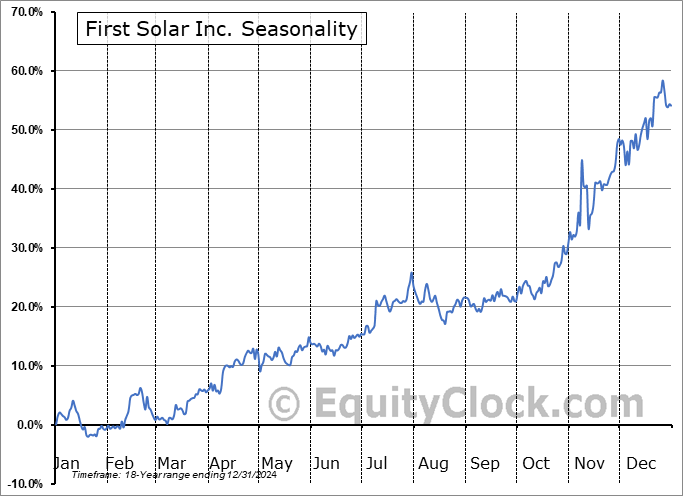

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|