Stock Market Outlook for May 23, 2024

Core-cyclical sectors starting to roll over below their March peaks, emphasizing the risk-aversion that is propagating through the market.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Realty Income Corp. (NYSE:O) Seasonal Chart

Quidel Corp. (NASD:QDEL) Seasonal Chart

Five Below, Inc. (NASD:FIVE) Seasonal Chart

RH (NYSE:RH) Seasonal Chart

Brixmor Property Group Inc. (NYSE:BRX) Seasonal Chart

Invesco DWA Momentum ETF (NASD:PDP) Seasonal Chart

Patriot Battery Metals Inc. (TSXV:PMET.V) Seasonal Chart

The Markets

Stocks wobbled on Wednesday as traders reacted to the latest minutes from the FOMC. The S&P 500 Index closed down by just over a quarter of one percent, giving up the prior session’s gain and showing signs of stall around the 5300 level. A short-term consolidation range around this hurdle has become apparent in recent days between 5285 and 5325, the break of which will be closely scrutinized. Momentum indicators (MACD and RSI) are showing early hints of rolling over below the peaks charted in March, starting to re-affirm a diverging path versus price that once again renews concerns pertaining to waning buying demand. While the price action is insignificant at present, the recent short-term setup suggests that it could become something more, threatening to cascade down to our desired intermediate-term timeframe that we target in our seasonal approach. Significant support is presented at the 100-day moving average (5053), but other minor points of support have been re-adopted at 20 and 50-week moving averages at 5190 and 5167, respectively. As has been highlighted in recent reports, stocks are typically supported around the Memorial day holiday and into the start of June before a mean reversion phase takes hold through the last few weeks of June There is nothing to act on negatively from a technical or seasonal perspective, yet, but Wednesday’s price action has certainly provided things/levels to watch.

Today, in our Market Outlook to subscribers, we discuss the following:

- Core-cyclical sectors at risk of rolling over below their March highs

- The ongoing trend of underperformance in the Consumer Discretionary sector

- Mid-caps hinting of a double-top

- US Existing Home Sales

- Canada Consumer Price Index (CPI)

- Canadian Dollar

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for May 23

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Wednesday, as gauged by the put-call ratio, ended bullish at 0.76.

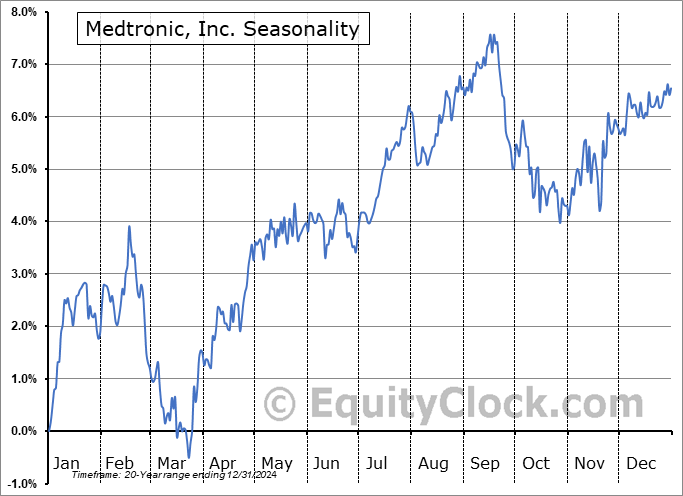

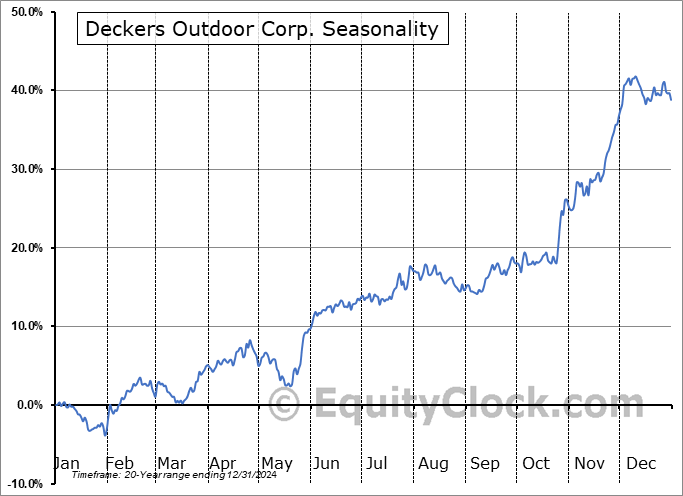

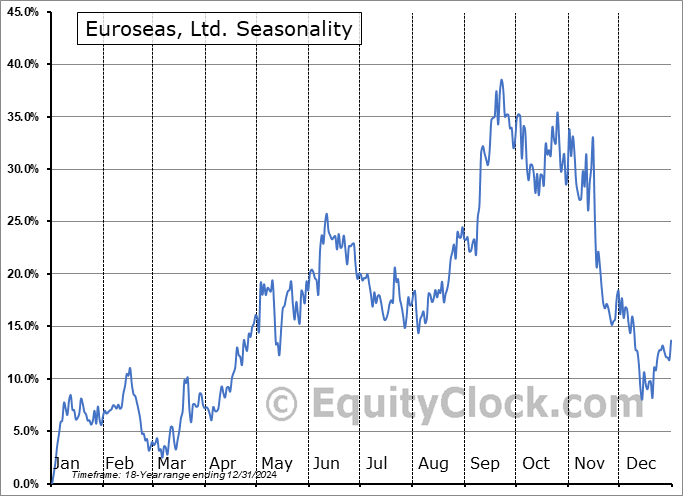

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|