Stock Market Outlook for July 16, 2024

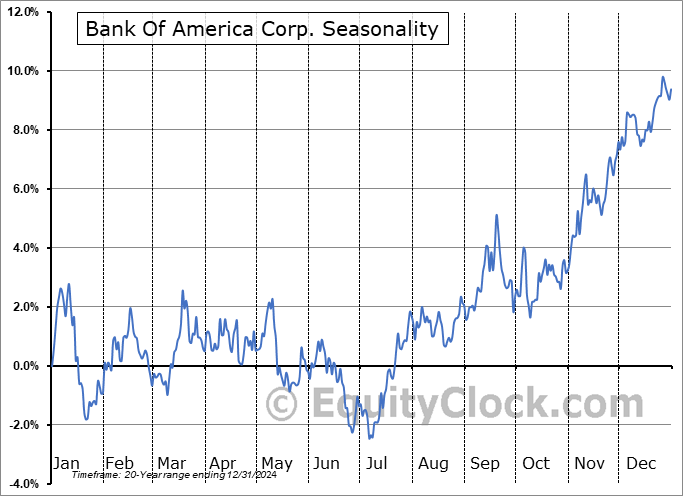

A major downturn in the equity market is unlikely so long as the banks remain supported.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

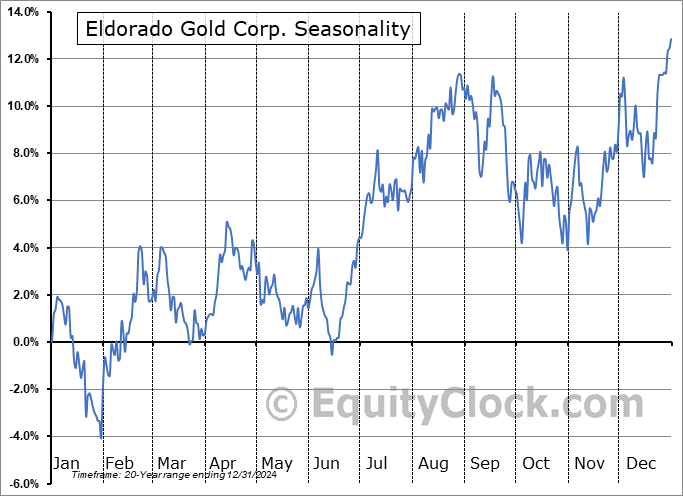

Eldorado Gold Corp. (TSE:ELD.TO) Seasonal Chart

Calfrac Well Services Ltd. (TSE:CFW.TO) Seasonal Chart

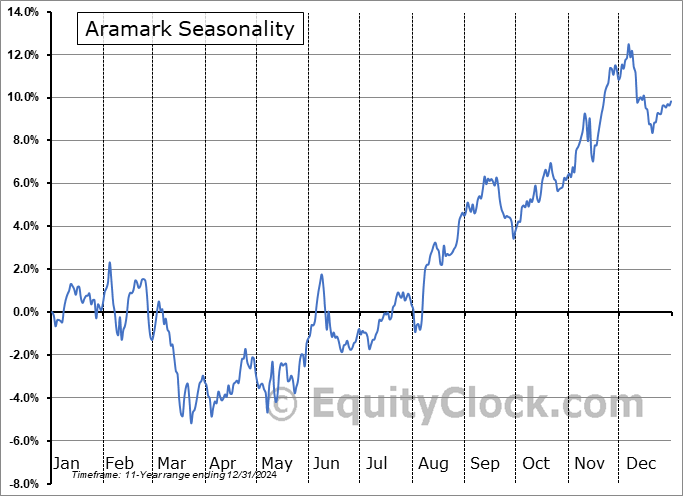

Aramark (NYSE:ARMK) Seasonal Chart

iShares Global Tech ETF (NYSE:IXN) Seasonal Chart

Bath & Body Works, Inc. (NYSE:BBWI) Seasonal Chart

Livent Corp. (NYSE:LTHM) Seasonal Chart

The Markets

Stocks clawed their way higher on Monday as the summer rally buoyancy that lifts stocks to start the third quarter remains alive and well. The S&P 500 Index closed with a gain of just less than three-tenths of one percent, achieving another fresh intraday record high as the rotation into many of this year’s laggards attempts to take hold. Support at the 20-day moving average (5518) continues to underpin this short-term move higher as the benchmark wades through an overbought state, according to the Relative Strength Index (RSI). Major moving averages continue to fan out positively, portraying everything that is desired to hold a bullish bias of stocks, particularly at this seasonally strong time of the year. The period of average volatility follows this strong mid-year period for stocks, therefore planning out stops on current holdings may be prudent to assure that risk mitigation efforts through August, September, and October are deployed effectively while looking for the opportunity to overweight bond market allocations.

Today, in our Market Outlook to subscribers, we discuss the following:

- Major benchmarks breaking above consolidation ranges, presenting further upside potential to a broader basket of stocks

- Banks breaking out

- Our weekly chart books update, along with our list of market segments to Accumulate or to Avoid

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for July 16

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

- Currencies

- Cryptocurrencies

- Commodities

- Major Benchmarks

- Sub-sectors / Industries

- ETFs: Bonds | Commodities | Equity Markets | Industries | Sectors

Subscribe now.

Sentiment on Monday, as gauged by the put-call ratio, ended bullish at 0.85.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|