Stock Market Outlook for July 24, 2024

Existing Home Sales show the weakest June change on record and prices are becoming vulnerable to pulling back, potentially impacting the wealth effect in the economy.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Invesco Variable Rate Investment Grade ETF (NASD:VRIG) Seasonal Chart

SPDR DoubleLine Short Duration Total Return Tactical ETF (AMEX:STOT) Seasonal Chart

Direxion Daily S&P 500 Bear 1X Shares ETF (AMEX:SPDN) Seasonal Chart

Vident Core US Bond Strategy ETF (AMEX:VBND) Seasonal Chart

BMO Floating Rate High Yield ETF (TSE:ZFH.TO) Seasonal Chart

Meridian Corp. (NASD:MRBK) Seasonal Chart

JPMorgan Ultra-Short Income ETF (AMEX:JPST) Seasonal Chart

iShares JPMorgan USD Emerging Markets Bond ETF (NASD:EMB) Seasonal Chart

ProShares UltraShort Dow30 (NYSE:DXD) Seasonal Chart

WisdomTree High Dividend Fund (NYSE:DHS) Seasonal Chart

iShares MSCI World Index ETF (TSE:XWD.TO) Seasonal Chart

iShares Government/Credit Bond ETF (NYSE:GBF) Seasonal Chart

Ivanhoe Mines Ltd. (TSE:IVN.TO) Seasonal Chart

J&J Snack Foods Corp. (NASD:JJSF) Seasonal Chart

SPDR Barclays Intermediate Term Treasury ETF (NYSE:SPTI) Seasonal Chart

Invesco Dividend Achievers ETF (NASD:PFM) Seasonal Chart

Cal-Maine Foods, Inc. (NASD:CALM) Seasonal Chart

The Markets

Stocks closed mildly lower on Tuesday as the period of volatility/weakness for stocks begins. The S&P 500 Index closed down by just less than two-tenths of one percent, ending right around the 20-day moving average (5550) that was broken into the end of last week. Momentum remains near-term negative following last week’s decline, but the Relative Strength Index (RSI) is attempting to hold levels around the 50-line in order to keep characteristics of a bullish trend intact. A short-term downside gap remains open between 5622 and 5658, a zone that will act as the cap to the summer rally that has now past its average peak. The time is here to prepare portfolio strategy for the period of volatility for stocks that runs through the next three months.

Today, in our Market Outlook to subscribers, we discuss the following:

- Small Caps and Banks reaching towards the upside targets that their recent breakouts have suggested

- US Existing Home Sales

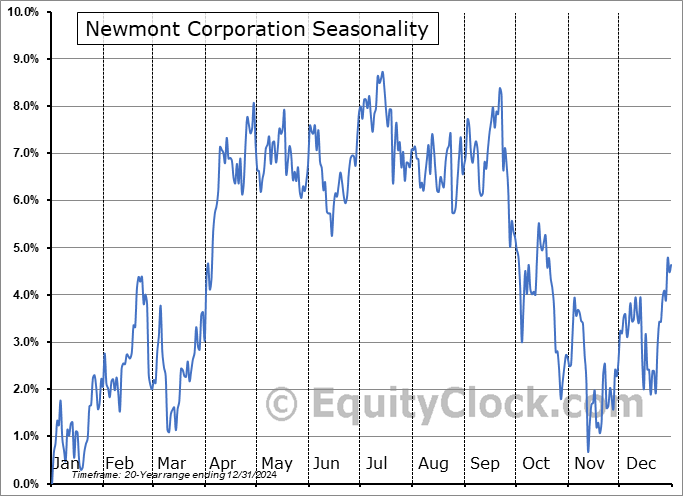

- The bifurcation that is playing out in the commodity market and the need to scrutinize the stocks of producers

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for July 24

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Tuesday, as gauged by the put-call ratio, ended close to neutral at 0.96.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|