Stock Market Outlook for August 14, 2024

Managed money is ramping up their short allocation in intermediate treasury bond futures back toward an all-time record.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

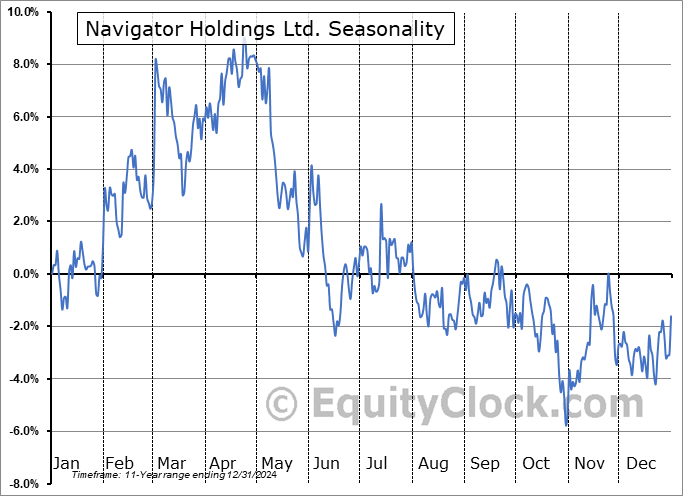

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Kennametal, Inc. (NYSE:KMT) Seasonal Chart

Texas Capital Bancshares, Inc. (NASD:TCBI) Seasonal Chart

Beazer Homes USA, Inc. (NYSE:BZH) Seasonal Chart

Espey Mfg. & Electronics Corp. (AMEX:ESP) Seasonal Chart

Hancock Whitney Corp. (NASD:HWC) Seasonal Chart

The Markets

Stocks rallied on Tuesday following the release of a softer than expected read of producer prices, thereby raising hopes that the Fed will finally have the cue to cut rates through the remaining months of this year. The S&P 500 Index closed higher by 1.68%, reaching back to short-term resistance at the 20-day moving average (5416). The benchmark has made significant progress to return to levels around the 50-day moving average (5451), reaction to which will be scrutinized closely given the indications it provides pertaining to the path of the intermediate-term (multi-month) trend. The downside gap that was charted on August 2nd between 5384 and 5413 has been closed/filled and a band of supply between 5400 and 5490 is now the test on the upside. Overall, the short-term trajectory remains negative, characterized by the trend of lower-highs and lower-lows off of the summer rally peak on July 16th and the resilience of the intermediate-term trend is being tested as levels of significant resistance are put to the test. The technicals are not yet portraying a sustained intermediate negative path, but the seasonals and fundamentals hint that this is an elevated risk through the months ahead. Caution in risk assets remains prudent.

Today, in our Market Outlook to subscribers, we discuss the following:

- Producer Price Index (PPI)

- The decline in inflation expectations and the seasonal trade in treasury bonds

- The extreme short allocation in treasury note futures

- Interest rate sensitive segments of the market and how we are benefiting

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for August 14

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Tuesday, as gauged by the put-call ratio, ended slightly bullish at 0.94.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|