Stock Market Outlook for August 20, 2024

End-of-summer seasonal positivity in a position to support stocks surrounding the last long weekend of summer.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Pros Holding Inc. (NYSE:PRO) Seasonal Chart

REGENXBIO Inc. (NASD:RGNX) Seasonal Chart

Cadence Bank (NYSE:CADE) Seasonal Chart

iShares MSCI Spain Capped ETF (NYSE:EWP) Seasonal Chart

China Fund, Inc. (NYSE:CHN) Seasonal Chart

LiveRamp Holdings, Inc. (NYSE:RAMP) Seasonal Chart

NetApp Inc. (NASD:NTAP) Seasonal Chart

Data I/O Corp. (NASD:DAIO) Seasonal Chart

ENI S.P.A. (NYSE:E) Seasonal Chart

Citi Trends, Inc. (NASD:CTRN) Seasonal Chart

Matrix Service Co. (NASD:MTRX) Seasonal Chart

Pinnacle Financial Partners, Inc. (NASD:PNFP) Seasonal Chart

Mettler Toledo Intl, Inc. (NYSE:MTD) Seasonal Chart

Air Canada (TSE:AC.TO) Seasonal Chart

The Markets

Stocks closed solidly higher to start the week as traders push back into the growth trade that was shaken to its core in the recent volatility spike in the market. The S&P 500 Index closed with a gain of just less than one percent, moving above a point of short-term resistance at the August 1st high of 5566. The all-time high at 5669 is now the hurdle to watch as we get into the end of summer and the next short-term seasonal uptick during the broader off-season for stocks with the Labor day holiday. Through the next month, until the 19th of September, the S&P 500 Index has averaged a gain of 1.6% over the past two decades with 14 of the past 20 periods ending higher. The positivity that surrounds the last long weekend of summer can make it difficult to hold the benchmark down, but this short-term reprieve in broader weakness that dominates the third quarter (beyond the summer rally timeframe) is still within the confines of the period of volatility for stocks. The degradation in economic fundamentals in recent months continues to pose the threat of higher than average volatility through this timeframe and the desire is to continue to lean on the side of caution in risk assets so long as the macro economic backdrop expresses uncertainty.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

- Currencies

- Cryptocurrencies

- Commodities

- Major Benchmarks

- Sub-sectors / Industries

- ETFs: Bonds | Commodities | Equity Markets | Industries | Sectors

Subscribe now.

Today, in our Market Outlook to subscribers, we discuss the following:

- Our weekly chart books update, along with our list of all segments of the market to either Accumulate or Avoid

- Other Notes

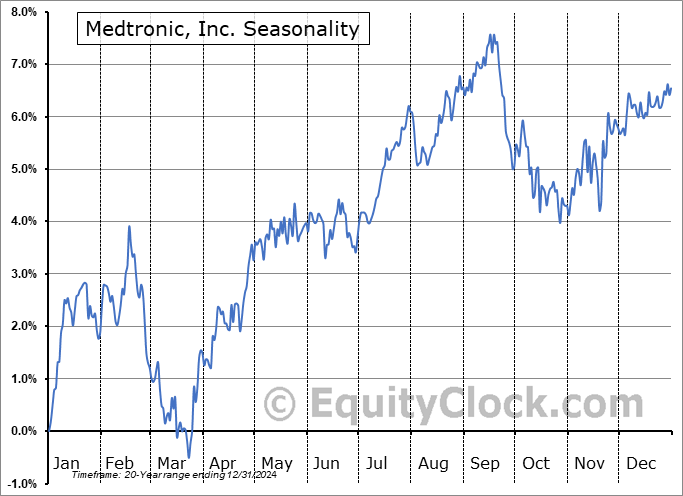

- The expansion of breadth in the Health Care sector

- Gold and Gold Miners

- Investor sentiment

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for August 20

*** Note: In our email to subscribers, we erroneously titled the report as “September” as opposed to “August” (we obviously have Fall on the mind with the cold weather we are experiencing in this part of the world). The title has been corrected to reflect the current date for the online report. ***

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Monday, as gauged by the put-call ratio, ended overly bullish at 0.75.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|