Stock Market Outlook for October 4, 2024

The fundamentals behind the seasonal trade in Natural Gas continue to evolve favourably, warranting the ongoing accumulation of exposure to the commodity.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

iShares S&P/TSX Global Base Metals Index ETF (TSE:XBM.TO) Seasonal Chart

First Trust NASDAQ Global Auto Index Fund (NASD:CARZ) Seasonal Chart

iShares China Large-Cap ETF (NYSE:FXI) Seasonal Chart

iShares China Index ETF (TSE:XCH.TO) Seasonal Chart

Sprott Physical Uranium Trust (TSE:U/UN.TO) Seasonal Chart

Cathedral Energy Services Ltd. (TSE:CET.TO) Seasonal Chart

Freeport-McMoRan, Inc. (NYSE:FCX) Seasonal Chart

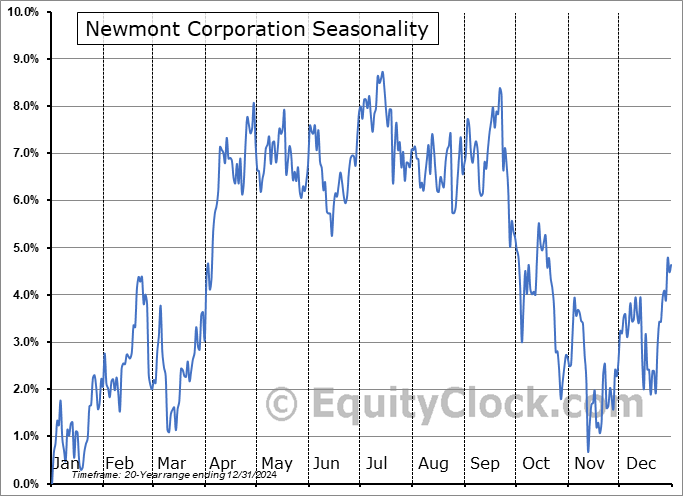

Newmont Corporation (NYSE:NEM) Seasonal Chart

First Quantum Minerals Ltd. (TSE:FM.TO) Seasonal Chart

Southern Copper Corp. (NYSE:SCCO) Seasonal Chart

Chorus Aviation, Inc. (TSE:CHR.TO) Seasonal Chart

ANSYS, Inc. (NASD:ANSS) Seasonal Chart

Danaher Corp. (NYSE:DHR) Seasonal Chart

Champion Iron Ltd. (TSE:CIA.TO) Seasonal Chart

Trinity Industries Inc. (NYSE:TRN) Seasonal Chart

ArcelorMittal SA (NYSE:MT) Seasonal Chart

The Markets

Stocks dipped slightly on Thursday as investors continue monitor the developments in the middle east and position ahead of the release of the monthly payroll report on Friday. The S&P 500 Index closed lower by nearly two-tenths of one percent, continuing to show signs of rolling over from the short-term rising trend that benefited performance over the past month. Waning upside momentum remains apparent as MACD crosses back below its signal line and RSI is moves back towards its middle line, both giving up on their positive slopes that had been apparent over the past few weeks. A lack of excitement in stocks is apparent with the benchmark above former resistance at 5650. Fortunately, the levels of support below remain plentiful, including the aforementioned horizontal hurdle, as well as major moving averages that are all positively sloped as we head towards the best six month of the year timeframe that gets underway at month-end. Seasonality still gives an edge to a cautious view of stocks in the near-term, particularly given the evidence of near-term upside exhaustion, but a retracement lower would be viewed as an ideal reset before the normal end-of-year rally commences.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly Jobless Claims and the health of the labor market

- A preview of what to expect of September’s Nonfarm Payroll report

- The bounce of the US Dollar Index from significant horizontal support

- The seasonal trade in Natural Gas and the fundamentals behind the trade

- US Factory Orders and what stands out in the report

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for October 4

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.87.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|