Stock Market Outlook for October 10, 2024

Gasoline product supplied jumped to the highest level in years last week, but this is likely an aberration given the push of product that would have been required ahead of the impact of Hurricane Milton.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

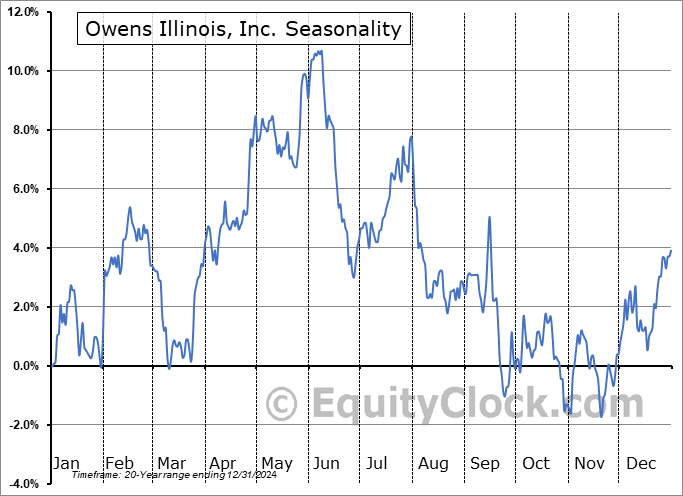

Owens Illinois, Inc. (NYSE:OI) Seasonal Chart

TE Connectivity Ltd. (NYSE:TEL) Seasonal Chart

Chemed Corp. (NYSE:CHE) Seasonal Chart

Sinclair Broadcast Group, Inc. (NASD:SBGI) Seasonal Chart

Berry Plastics Group Inc. (NYSE:BERY) Seasonal Chart

Global X Autonomous & Electric Vehicles ETF (NASD:DRIV) Seasonal Chart

KraneShares Electric Vehicles and Future Mobility Index ETF (AMEX:KARS) Seasonal Chart

The Markets

Stocks shook off the headwinds of rising rates and a stronger US Dollar to post gains on Wednesday as the push back into technology (semiconductors) continues. The S&P 500 Index closed higher by just over seven-tenths one percent, charting a record high and seemingly defying expectations for volatile performance heading into election day that is less than a month away. Support has been maintained at previous resistance of 5669, along with the 20-day moving average that is presently hovering around the same level, keeping the positive trajectory intact. Despite evidence of waning upside momentum within this tail-end to the period of seasonal volatility for stocks, we certainly cannot deny that this market is showing greater evidence of support than resistance, a characteristic of a bullish trend. We continue to like the groups that are on our list of Accumulate candidates and there are certainly segments of the market to Avoid (see our market commentary below). The ability of the market as a whole to overcome the period of seasonal weakness for stocks rather unscathed is certainly telling of the relentless demand, despite the fact that the risk-reward, broadly, is not very attractive. The start of the best six months of the year for stocks is now just three weeks away and there is a need from a seasonal perspective to ramp up risk exposure at some point.

Today, in our Market Outlook to subscribers, we discuss the following:

- Evidence of fading momentum in this market

- Weekly petroleum supply and demand and the surge in gasoline product supplied last week

- The technicals of energy sector industries

- Wholesale Trade and the impact on the seasonal trade in the Agriculture industry

- Agriculture commodities

- The ongoing decline of Wholesale Inventories

- The areas of Wholesale activity that are flourishing, enticing allocations for seasonal portfolios

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for October 10

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Wednesday, as gauged by the put-call ratio, ended slightly bullish at 0.93.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|