Stock Market Outlook for November 27, 2024

Market breadth is remaining bullish heading through the end of the year, conducive to the normal year-end melt-up in stocks.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Performance Food Group Co. (NYSE:PFGC) Seasonal Chart

Nano One Materials Corp. (TSE:NANO.TO) Seasonal Chart

Three Valley Copper Corp. (TSXV:TVC.V) Seasonal Chart

WisdomTree Emerging Markets Dividend Fund (AMEX:DVEM) Seasonal Chart

Baru Gold Corp. (TSXV:BARU.V) Seasonal Chart

Okta, Inc. (NASD:OKTA) Seasonal Chart

Rio Tinto PLC (NYSE:RIO) Seasonal Chart

VanEck Vectors Vietnam ETF (NYSE:VNM) Seasonal Chart

Global X Uranium ETF (NYSE:URA) Seasonal Chart

VanEck Vectors Steel ETF (NYSE:SLX) Seasonal Chart

iShares MSCI Brazil Capped ETF (NYSE:EWZ) Seasonal Chart

iShares MSCI EAFE Value ETF (NYSE:EFV) Seasonal Chart

Granada Gold Mine Inc. (TSXV:GGM.V) Seasonal Chart

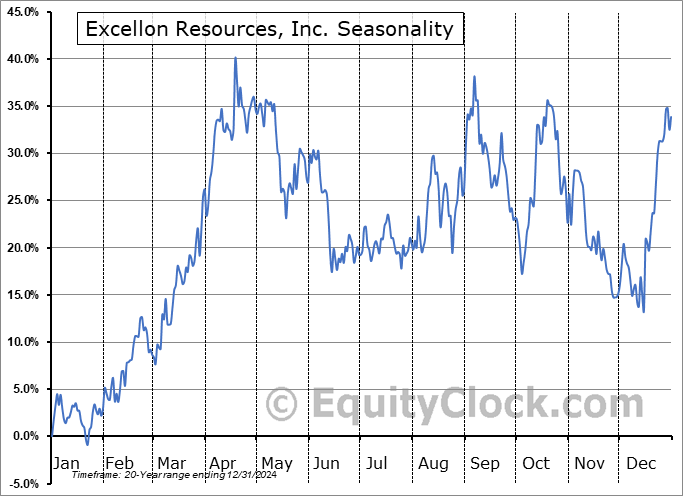

Excellon Resources, Inc. (TSE:EXN.TO) Seasonal Chart

Aberdeen International Inc (TSE:AAB.TO) Seasonal Chart

The Markets

Stocks continued to push higher on Tuesday, seeing the lift that normally surrounds the US Thanksgiving holiday week . The S&P 500 Index ended the session up by just less than six-tenths of one percent, continuing to move higher from support at the 20-day moving average (5904). Short-term declining trendline resistance that was formed by connecting the peaks since November 11th has been broken, leading to the fresh all-time intraday high that was charted during the session. On a intermediate-term scale, there remains greater evidence of support than resistance, presenting the desired backdrop for strength that is normally realized in the market at year-end. Major moving averages are all pointed higher and momentum indicators continue to gyrate above their middle lines, providing characteristics of a bullish trend. Our list of candidates in the market to Accumulate and to Avoid remains well positioned to benefit from the strength that is filtering into the market at this seasonally strong time of year, but we will scrutinize whether any changes are required as the price action evolves.

Today, in our Market Outlook to subscribers, we discuss the following:

- Breadth indicators showing characteristics of a bullish trend

- US New Home Sales

- Homebuilding stocks and our preferred housing play through the months ahead

- Forestry stocks and the capped price of lumber

- The change in US Home Prices

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for November 27

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.81.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|