Stock Market Outlook for December 9, 2024

The second largest surge in Canadian unemployment in the past four decades highlights a labour market that is struggling.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Invesco DB Agriculture Fund (NYSE:DBA) Seasonal Chart

TWC Enterprises Limited (TSE:TWC.TO) Seasonal Chart

Baxter Intl Inc. (NYSE:BAX) Seasonal Chart

Brookfield Renewable Energy Partners LP (TSE:BEP/UN.TO) Seasonal Chart

Quebecor, Inc. (TSE:QBR/B.TO) Seasonal Chart

Melcor Developments Ltd. (TSE:MRD.TO) Seasonal Chart

Estee Lauder Cos. (NYSE:EL) Seasonal Chart

Hess Corp. (NYSE:HES) Seasonal Chart

Toronto-Dominion Bank (TSE:TD.TO) Seasonal Chart

Plains All American Pipeline, LP (NASD:PAA) Seasonal Chart

Americas Silver Corp. (TSE:USA.TO) Seasonal Chart

iShares Global Energy ETF (NYSE:IXC) Seasonal Chart

Vanguard Total International Stock ETF (NASD:VXUS) Seasonal Chart

ShawCor Ltd. (TSE:MATR.TO) Seasonal Chart

Energy Select Sector SPDR Fund (NYSE:XLE) Seasonal Chart

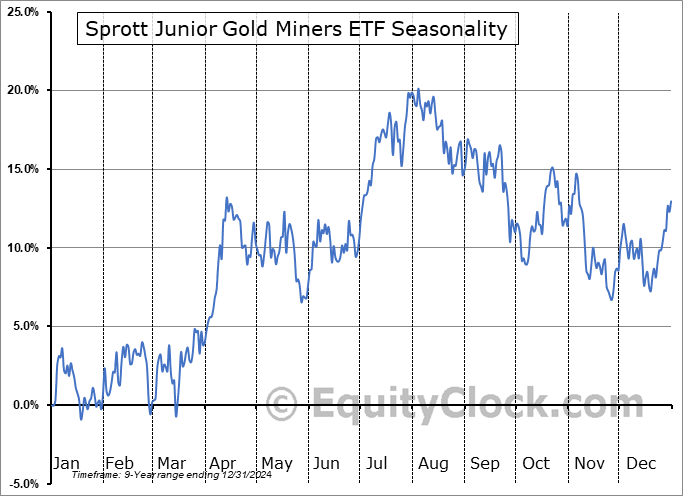

Sprott Junior Gold Miners ETF (AMEX:SGDJ) Seasonal Chart

abrdn Physical Platinum Shares ETF (NYSE:PPLT) Seasonal Chart

iShares Currency Hedged MSCI Emerging Markets ETF (AMEX:HEEM) Seasonal Chart

BMO S&P/TSX Capped Composite Index ETF (TSE:ZCN.TO) Seasonal Chart

Constellation Software Inc. (TSE:CSU.TO) Seasonal Chart

Premium Brands Holdings Corp. (TSE:PBH.TO) Seasonal Chart

iShares S&P/TSX Capped REIT Index ETF (TSE:XRE.TO) Seasonal Chart

Gold Fields Ltd. (NYSE:GFI) Seasonal Chart

Ensign Energy Services, Inc. (TSE:ESI.TO) Seasonal Chart

CAE, Inc. (TSE:CAE.TO) Seasonal Chart

The Markets

Stocks edged higher on Friday as a fairly middle-ground employment report in the US kept the prospect of a rate cut at the Fed’s next meeting intact. The S&P 500 Index gained a quarter of one percent, achieving yet another record closing high. Support continues at the 20-day moving average (5991). A sideways drift has developed in the past day following a break of short-term rising trendline support that stemmed from the November 19th double-bottom low at 5850, however, a trend of higher-highs and higher-lows remains; the 20-hour moving average is currently holding up the benchmark on an ultra-short-term scale. On a intermediate-term basis, there remains greater evidence of support than resistance, presenting the desired backdrop for strength that is normally realized in the market at year-end. Major moving averages are all pointed higher and momentum indicators continue to gyrate above their middle lines, providing characteristics of a bullish trend. Our list of candidates in the market to Accumulate and to Avoid remains well positioned to benefit from the strength that is filtering into the market at this seasonally strong time of year, but we will scrutinize whether any changes are required as the price action evolves.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the large-cap benchmark

- US Employment Situation and the investment implications within

- The eerily stagnant trend of wages in the past few months

- Canada Labour Force Survey and the investment implications within

- The second largest rise in Canadian unemployment in the past four decades

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for December 9

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Friday, as gauged by the put-call ratio, ended bullish at 0.85.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|