Stock Market Outlook for December 23, 2024

Businesses and investors may not be feeling very merry this holiday period, but there is still fuel in the tank for stocks to move higher.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Sow Good Inc. (NASD:SOWG) Seasonal Chart

Verrica Pharmaceuticals Inc. (NASD:VRCA) Seasonal Chart

Sunoco LP (NYSE:SUN) Seasonal Chart

Transcontinental Inc. (TSE:TCL/A.TO) Seasonal Chart

British American Tobacco PLC (NYSE:BTI) Seasonal Chart

Graphic Packaging Holding Co. (NYSE:GPK) Seasonal Chart

The Bank of Nova Scotia (NYSE:BNS) Seasonal Chart

North American Construction Group Ltd. (NYSE:NOA) Seasonal Chart

Pulse Seismic Inc. (TSE:PSD.TO) Seasonal Chart

Sprott Physical Gold Trust (NYSE:PHYS) Seasonal Chart

Mag Silver Corp. (TSE:MAG.TO) Seasonal Chart

VOC Energy Trust (NYSE:VOC) Seasonal Chart

Dream Office Real Estate Investment Trust (TSE:D/UN.TO) Seasonal Chart

Franco-Nevada Corp. (NYSE:FNV) Seasonal Chart

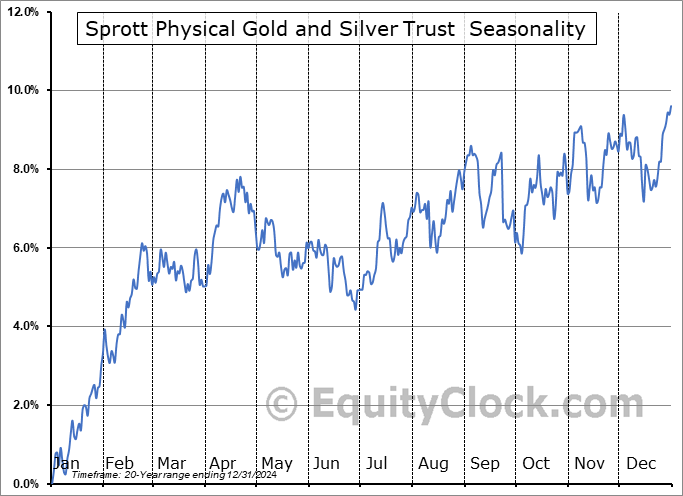

Sprott Physical Gold and Silver Trust (AMEX:CEF) Seasonal Chart

Endeavour Silver Corp. (TSE:EDR.TO) Seasonal Chart

Brookfield Infrastructure Partners L.P. (NYSE:BIP) Seasonal Chart

Silvercorp Metals, Inc. (AMEX:SVM) Seasonal Chart

Invesco DB Precious Metals Fund (NYSE:DBP) Seasonal Chart

SPDR Gold Shares (NYSE:GLD) Seasonal Chart

Sprott Inc. (NYSE:SII) Seasonal Chart

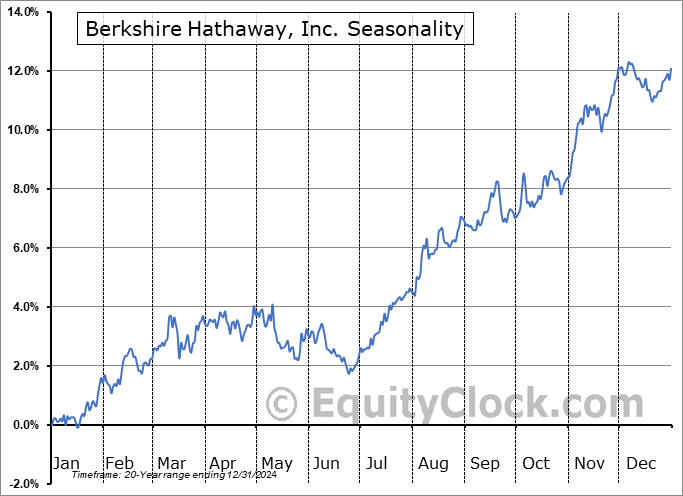

Berkshire Hathaway, Inc. (NYSE:BRK/B) Seasonal Chart

Lithium Americas Corp. (TSE:LAC.TO) Seasonal Chart

The Markets

Stocks snapped back from the weakness that has dominated the market in recent days as the Fed’s preferred inflation gauge (PCE Price Index) came in weaker than expected. The S&P 500 Index ended higher by just over one percent, closing right around resistance at the 50-day moving average (5927), a rather neutral level heading into an uncertain period. The benchmark has bounced from the previous level of support that was confirmed in November at the open gap charted following the US Election at 5850. While we will be looking for this point as the propping level for a rebound into the holiday period ahead, there is still much to be contemplated pertaining to the near-term trend given the sharply negative candlesticks charted during the last two hours of trade on Wednesday. On a intermediate-term basis, while the trend remains that of higher-highs and higher-lows, the first sign that the 50-day moving average has been unable to stem the tide of selling pressures certainly is sufficient to raise concern. Major moving averages continue to show rising parallel paths and momentum indicators continue to gyrate predominantly above their middle lines, providing characteristics of a bullish trend that warrants a positive positive bias, for now. Should we start to see major moving averages act as points of resistance, reason to conclude the shift of trend would be provided. Our list of candidates in the market to Accumulate and to Avoid remains appropriately positioned at this seasonally strong time of year, but our Avoid list has been growing in recent weeks given the fading of the election euphoria in the market.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the large-cap benchmark

- The start of the optimal holding period for Gold

- The underperforming trend of the Gold Miners

- Break of trend of bond yields and prices

- Manufacturer sentiment

- Investor sentiment

- The fuel in the tank for stocks and the stabilization of the path of Net Assets on the Fed’s balance sheet

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for December 23

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Friday, as gauge by the put-call ratio, ended close to neutral at 0.98.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|