Stock Market Outlook for February 6, 2025

Active investment managers and individual investors not all that enthusiastic about stocks.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

iShares Edge MSCI Minimum Volatility USA ETF (AMEX:USMV) Seasonal Chart

Invesco DWA Consumer Staples Momentum ETF (NASD:PSL) Seasonal Chart

Brown-Forman Corp. – Class B (NYSE:BF/B) Seasonal Chart

Escalade, Inc. (NASD:ESCA) Seasonal Chart

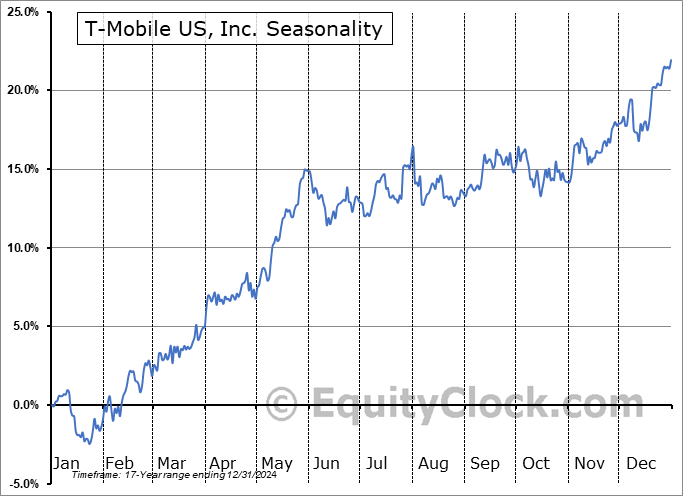

T-Mobile US, Inc. (NASD:TMUS) Seasonal Chart

Scorpio Tankers Inc. (NYSE:STNG) Seasonal Chart

Credicorp Ltd. (NYSE:BAP) Seasonal Chart

MYR Group, Inc. (NASD:MYRG) Seasonal Chart

Mine Safety Appliances Co. (NYSE:MSA) Seasonal Chart

Dollar Tree, Inc. (NASD:DLTR) Seasonal Chart

The Markets

Stocks closed marginally higher on Wednesday, supported by the pullback of the cost of borrowing following the announcement from the US Treasury Department that it won’t be steeping up its debt issuance “for at least the next several quarters.” The S&P 500 Index gained just less than four-tenths of one percent, holding support at the 20-day moving average (~5995). The benchmark remains below the upper limit of gap resistance that was opened during the Artificial Intelligence fuelled selloff recorded a week ago Monday between 6017 and 6088. The market remains in a tenuous state as broader momentum dwindles. Momentum indicators have negatively diverged from price since the middle of last year, highlighting the waning enthusiasm investors had been expressing towards tech-heavy benchmarks, like this, amidst extreme valuations. We continue to monitor the potential impact of the apparent rotation in the market on our list of candidates in the market to Accumulate and to Avoid and we have adopted more of a neutral appearance as segments that were previously noted as Accumulate candidates fall off (eg. Technology) and as areas to Avoid are added.

Today, in our Market Outlook to subscribers, we discuss the following:

- Waning investor enthusiasm towards stocks

- US Petroleum Status

- The technical setup for energy stocks at this seasonally strong time of year

- US Vehicle Sales and the weakest time of the year for auto stocks

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for February 6

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Wednesday, as gauged by the put-call ratio, ended bullish at 0.75.

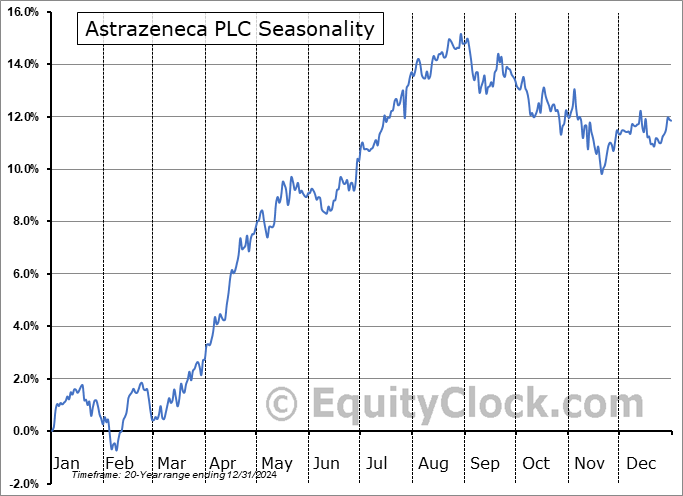

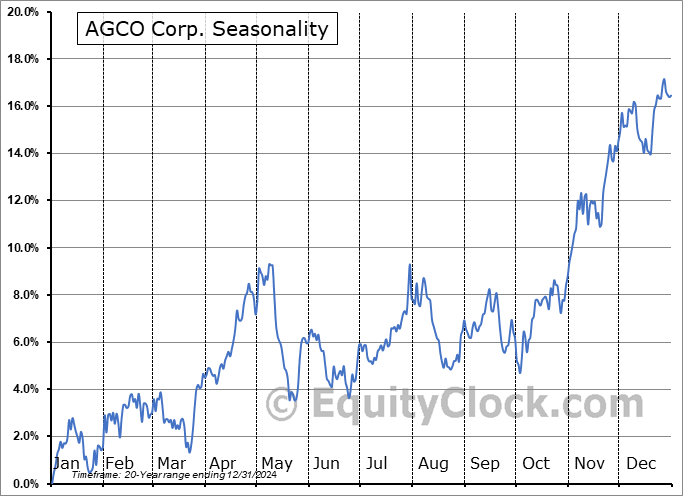

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|