Stock Market Outlook for February 27, 2025

The downbeat economic performance to start the year continues, this time with shipping volumes and new home sales.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

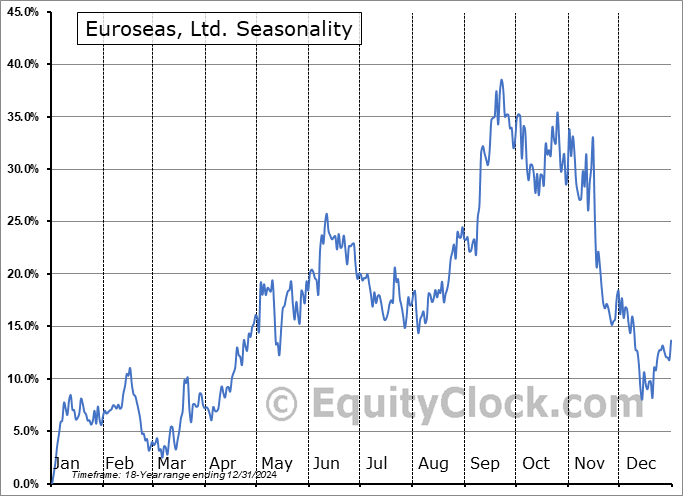

Euroseas, Ltd. (NASD:ESEA) Seasonal Chart

Shineco, Inc. (NASD:SISI) Seasonal Chart

Artemis Gold Inc. (TSXV:ARTG.V) Seasonal Chart

The Markets

The struggle in stocks continues to progress as per usual for the back half of February. The S&P 500 Index closed little changed during the Wednesday session, charting a rather incisive doji candlestick below former support and current resistance at the 50-day moving average (6004). A cap to the benchmark remains overhead around 6100, representing the highs from the past few months. Momentum indicators have negatively diverged from price since the middle of last year, highlighting the waning enthusiasm investors had been expressing towards tech-heavy (Mag-7) benchmarks, like this, amidst extreme valuations. Downside risks on a pullback over the near-term are to the July/August 2024 highs around 5700, a move that would amount to a 7% pullback from recent heights. This would be a healthy and ordinary correction within a bull market, by any measure. We continue to monitor the potential impact of the apparent rotation in the market on our list of candidates in the market to Accumulate and to Avoid and we have adopted more of a neutral stance as segments that were previously noted as Accumulate candidates fall off (eg. Technology) and as areas to Avoid are added.

Today, in our Market Outlook to subscribers, we discuss the following:

- The change in shipping volumes and expenditures in January

- The downfall of the Baltic Dry Index

- Struggling performance of transportation stocks

- US New Home Sales and the median price of new homes sold

- Homebuilding stocks

- Forestry stocks and the breakout of Lumber

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for February 27

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Wednesday, as gauged by the put-call ratio, ended close to neutral at 0.92.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|