Stock Market Outlook for April 25, 2025

The Technology Sector has broken above short-term declining trendline resistance, but the intermediate-term trajectory remains threatening.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

BNY Mellon Strategic Municipals, Inc. (NYSE:LEO) Seasonal Chart

Bel Fuse, Inc. (NASD:BELFA) Seasonal Chart

SPDR S&P 1500 Momentum Tilt ETF (AMEX:MMTM) Seasonal Chart

Thermo Fisher Scientific Inc. (NYSE:TMO) Seasonal Chart

Westport Fuel Systems Inc. (NASD:WPRT) Seasonal Chart

Genpact Ltd. (NYSE:G) Seasonal Chart

Opko Health Inc. (NASD:OPK) Seasonal Chart

Bio-Techne Corporation (NASD:TECH) Seasonal Chart

The Markets

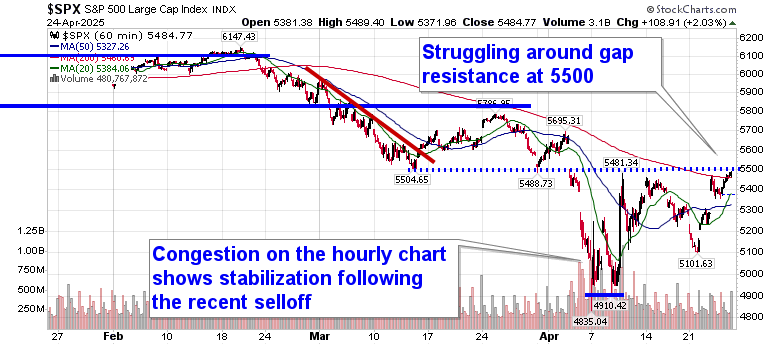

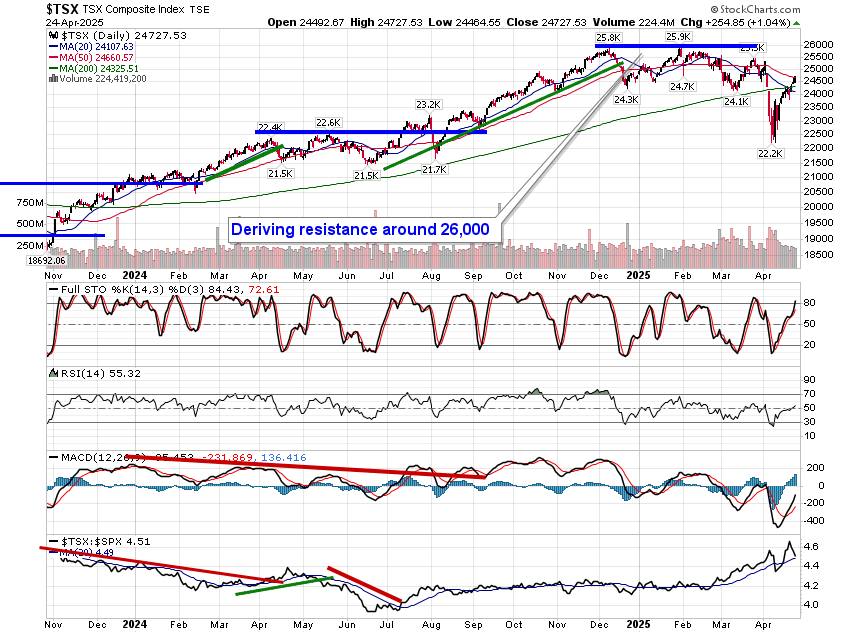

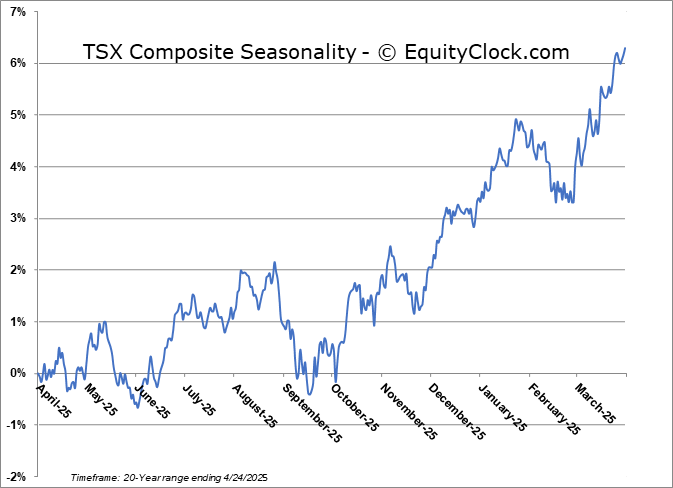

Stocks continued to climb their way out of the hole that they fell into following the US “Liberation Day” at the start of April as investors start to pickup beaten down names in the technology sector. The S&P 500 Index ended higher by 2.03%, breaking above the declining 20-day moving average (5373) and keeping pressure on overhead resistance at 5500. There remains an implied cap over this market in the range between 5500 and 5800 that would likely require a catalyst to break (eg. progress towards a trade deal with China); without one, look for the sellers to step in around this zone. As has been pointed out, the benchmark remains in a precarious state heading into the second quarter, holding levels below the 200-day moving average, a variable hurdle that is now rolling over and providing a characteristic of an intermediate to long-term bearish trend. Unfortunately, this technical degradation in the market has come during this period of seasonal strength that runs through the month of April, therefore we are biased to let this favourable timeframe show what it is capable of before taking action, particularly with how washed out stocks have recently become; the more likely time that the next evolution of the declining intermediate-to-long-term trend for stocks should occur is through the off-season that starts in May. We continue to leave our Super Simple Seasonal Portfolio as is, but we are cognizant of the need to do something ahead to mitigate the threat that the intermediate-term trend is portraying. We continue to monitor the potential impact of the rotation in the market on our list of candidates in the market to Accumulate and to Avoid, but we are finding things to buy amidst this market tumult.

Today, in our Market Outlook to subscribers, we discuss the following:

- The break of the declining short-term trend in the Technology sector

- US Durable Goods Orders and the investment implications within

- Copper

- Weekly jobless claims and the health of the labor market

- Investor sentiment

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for April 25

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Thursday, as gauged by the put-call ratio, ended bearish at 1.02.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|