Stock Market Outlook for June 25, 2025

The key to this equity market for a successful summer rally period is oil, yields, and the dollar.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Cincinnati Financial Corp. (NASD:CINF) Seasonal Chart

Principal Financial Group (NASD:PFG) Seasonal Chart

Tilly’s Inc. (NYSE:TLYS) Seasonal Chart

Invesco S&P SmallCap Quality ETF (AMEX:XSHQ) Seasonal Chart

BSR Real Estate Investment Trust (TSE:HOM/UN.TO) Seasonal Chart

The Markets

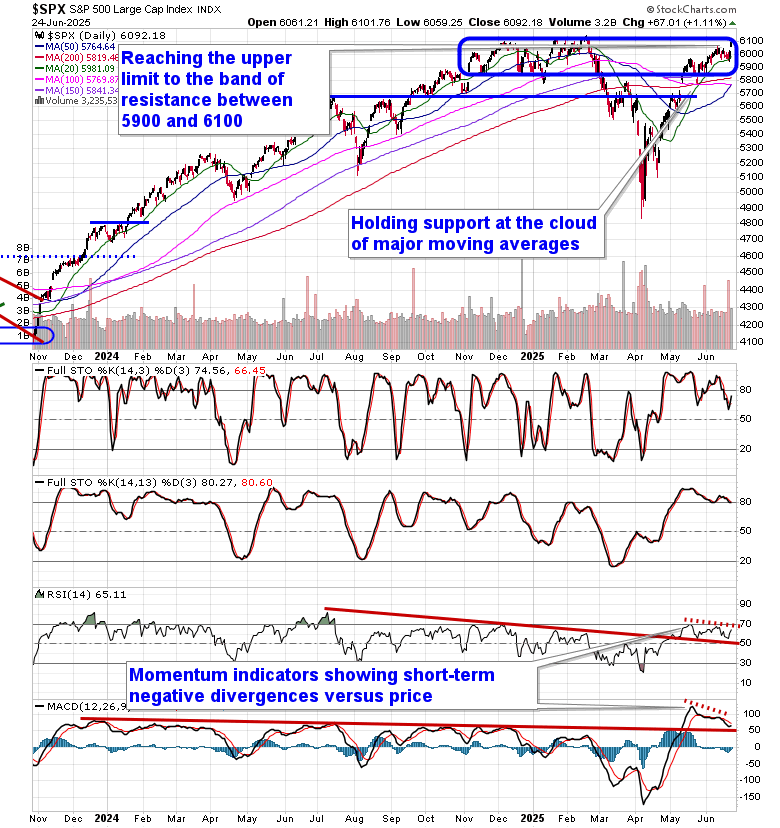

Further declines in interest rates and the price of oil pushed investors back into risk on Tuesday as concerns that were expressed by investors previously fade. The S&P 500 Index closed up by 1.11%, reaching the upper limit to the band of resistance between 5900 and 6100. An upside gap around 6025 has been recorded, instantly plotting a point of support to shoot positive bets against as we near the start of the summer rally period that tends to see investors buy into the equity market on the 27th of June, on average. Support at the 20-day moving average (5981) has been confirmed in the past couple of sessions, a variable hurdle that has been unviolated throughout the bull-market rally from the April lows. While it appears that we will not be granted the opportunity to buy back into the market at lower levels during this first of the two timeframes that tends to account for the bulk of the weakness during the offseason for stocks, our desire is to still be exposed to risk (stocks) for the positive timeframe that normally follows the end of quarter weakness. Tuesday’s jolt confirms that the short-term rising trend is intact and no technical damage was achieved following the recent digestion off of the April low, providing a setup to be enticed to. We will be seeking to bump up risk exposure in portfolios back to the state that it was prior to the start of the normally weak timeframe on June 14th. Our list of candidates in the market that are worthy to Accumulate or Avoid continues to be appropriately positioned, keeping investors tuned into those segments of the market that are working in such areas as Technology, Communication Services, Financials, and Utilities, essentially many of the groups that topped the leaderboard during Tuesday’s session.

Today, in our Market Outlook to subscribers, we discuss the following:

- Equity market breadth indicators

- The key to the summer rally period in stocks

- US Existing Home Sales

- Case-Shiller Home Price Index

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for June 25

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.89.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

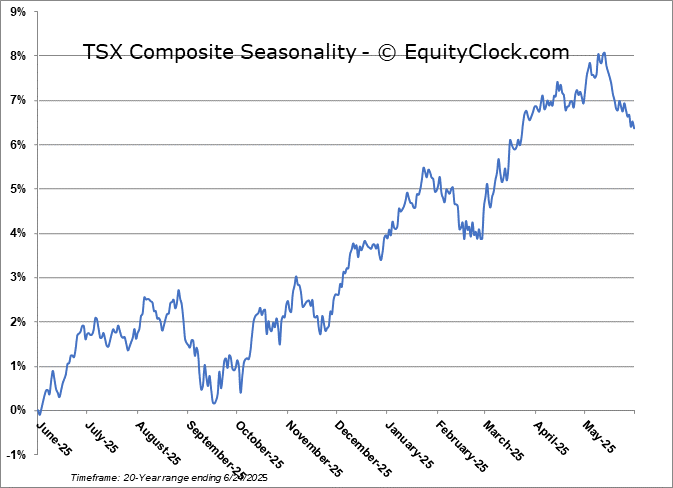

TSE Composite

| Sponsored By... |

|