Stock Market Outlook for September 22, 2025

On the lookout for potential currency headwind to stocks through the remaining days of September.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Emerson Electric Co. (NYSE:EMR) Seasonal Chart

DENTSPLY Intl Inc. (NASD:XRAY) Seasonal Chart

Hawaiian Electric Industries Inc. (NYSE:HE) Seasonal Chart

Transmation, Inc. (NASD:TRNS) Seasonal Chart

Planet Fitness, Inc. (NYSE:PLNT) Seasonal Chart

Red Rock Resorts, Inc. (NASD:RRR) Seasonal Chart

Schnitzer Steel Industries, Inc. (NASD:RDUS) Seasonal Chart

Under Armour, Inc. (NYSE:UA) Seasonal Chart

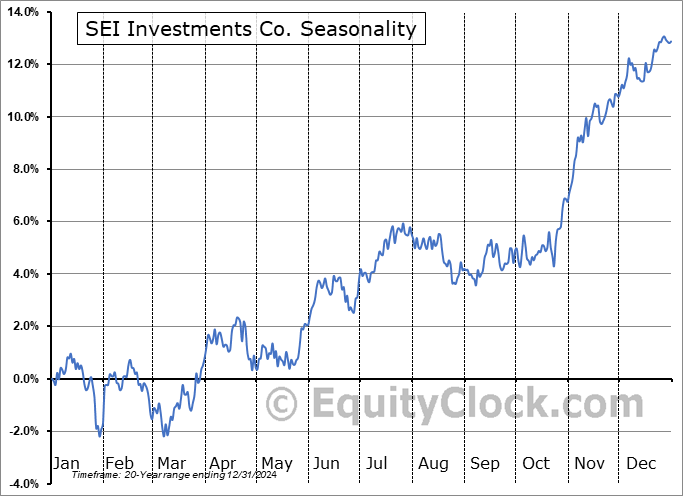

SEI Investments Co. (NASD:SEIC) Seasonal Chart

Noah Holdings Ltd. (NYSE:NOAH) Seasonal Chart

Eagle Bancorp, Inc. (NASD:EGBN) Seasonal Chart

East West Bancorp, Inc. (NASD:EWBC) Seasonal Chart

The Markets

The push into technology continues, sending the S&P 500 further into record high territory. The S&P 500 Index ended up by just less than half of one percent, continuing to hold above the 20-day moving average (~6524), the variable hurdle that has supported the short-term trend off of the April lows. The weakest, most volatile, period for the equity market is upon us, running through the last couple of weeks of the month (the first half of September is normally positive), leaving us with a cautious bias pertaining to broad equity exposure in the very near-term. The strategy remains to avoid being aggressive in risk (stocks) for now (over the next few weeks), but take advantage of any volatility shocks (should they materialize) to increase the risk profile of portfolios ahead of the best six months of the year for stocks that gets underway in October. We have picked our spots in the market to which we want to be exposed (including various technology subsectors) in our list of candidates in the market that are worthy to Accumulate or Avoid and the performance continues to be exceptional. Those themes that are enduring according to our three-pronged approach incorporating seasonal, technical, and fundamental analysis keeps us focused and we are not concerned, at all, if the broad market weakness that is normal of September fails to materialize.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the S&P 500 Index

- Small Cap stocks

- Banks

- Canada Retail Sales

- Canadian and US Dollars

- Commodity exposure for portfolios

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for September 22

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish

Sentiment on Friday, as gauged by the put-call ratio, ended bullish at 0.75.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|