Stock Market Outlook for November 13, 2025

The big re-balance trade away from Technology is underway…but likely not for a prolonged period of time.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

iShares S&P Mid-Cap 400 Value ETF (NYSE:IJJ) Seasonal Chart

Invesco S&P SmallCap 600 Revenue ETF (AMEX:RWJ) Seasonal Chart

Howard Hughes Holdings Inc. (NYSE:HHH) Seasonal Chart

Canadian Utilities Ltd. (TSE:CU.TO) Seasonal Chart

Allied Properties Real Estate Investment Trust (TSE:AP/UN.TO) Seasonal Chart

Labrador Iron Ore Royalty Corp. (TSE:LIF.TO) Seasonal Chart

Rogers Sugar Inc. (TSE:RSI.TO) Seasonal Chart

Total Energy Services Inc. (TSE:TOT.TO) Seasonal Chart

Mastec, Inc. (NYSE:MTZ) Seasonal Chart

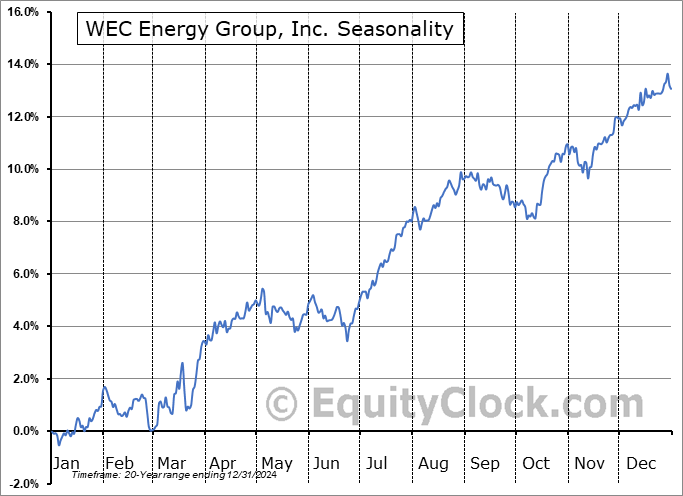

WEC Energy Group, Inc. (NYSE:WEC) Seasonal Chart

Fox Corporation (NASD:FOX) Seasonal Chart

The Markets

Stocks closed generally higher on Wednesday as traders held onto optimism that the record long government shutdown in the US will be resolved. The S&P 500 Index closed higher by 0.06%, elevating from support at the 50-day moving average (6694) that was tested on Friday at the lows of the day. The hourly chart shows an ongoing “twitchiness” that has sprinkled the chart with gaps. The benchmark jumped back above the October 24th gap on Monday and is now hovering just marginally above downside gap resistance that was charted on November 4th between 6809 and 6845 (Wednesday’s close was at 6850). Volatility is coming in and, gradually, the technical cues that kept us cautious of taking on new risk exposure for the best six months of the year are fading, but there is reason to not expect much of equity market performance through the next week and a half (or so). We continue to lean heavily on our list of candidates in the market that are worthy to Accumulate or Avoid, which continues to show far more ideas worthy to buy than to sell.

Today, in our Market Outlook to subscribers, we discuss the following:

- Rotation away from Technology

- Accumulate candidates that are benefiting from the rotation

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for November 13

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish

Sentiment on Wednesday, as gauged by the put-call ratio, ended bullish at 0.79.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|