Stock Market Outlook for December 5, 2025

Investor enthusiasm in stocks is growing, supportive of the year-end buying binge in equity markets.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

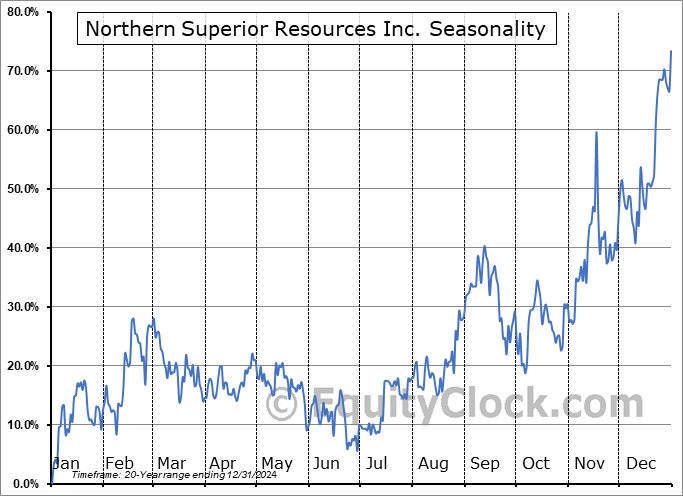

Northern Superior Resources Inc. (TSXV:SUP.V) Seasonal Chart

Galaxy Digital Holdings Ltd. (TSE:GLXY.TO) Seasonal Chart

Alarm.com Holdings, Inc. (NASD:ALRM) Seasonal Chart

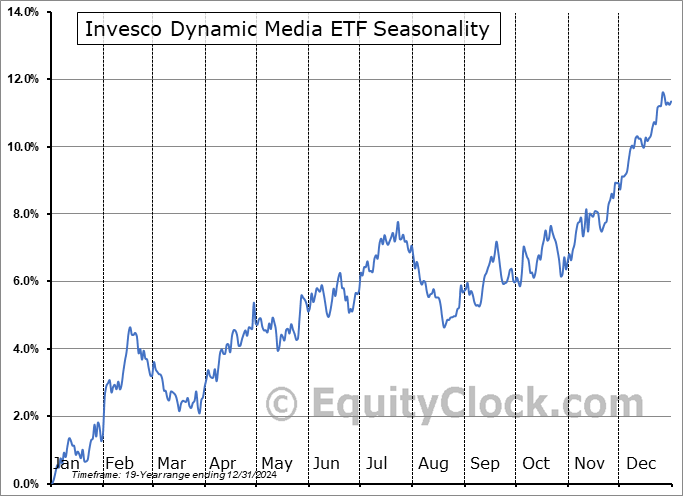

Invesco Dynamic Media ETF (NYSE:GGME) Seasonal Chart

Advantage Solutions Inc. (NASD:ADV) Seasonal Chart

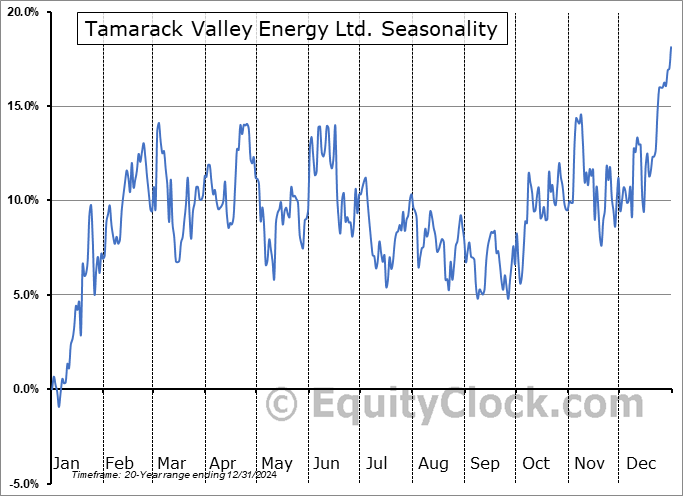

Tamarack Valley Energy Ltd. (TSE:TVE.TO) Seasonal Chart

Cogent Communications Holdings, Inc. (NASD:CCOI) Seasonal Chart

UMH Properties, Inc. (NYSE:UMH) Seasonal Chart

Purecycle Corp. (NASD:PCYO) Seasonal Chart

Novagold Resources, Inc. (TSE:NG.TO) Seasonal Chart

TAL Education Group (NYSE:TAL) Seasonal Chart

Arista Networks, Inc. (NYSE:ANET) Seasonal Chart

iShares S&P/TSX Capped Materials Index ETF (TSE:XMA.TO) Seasonal Chart

ARK Autonomous Technology & Robotics ETF (AMEX:ARKQ) Seasonal Chart

The Markets

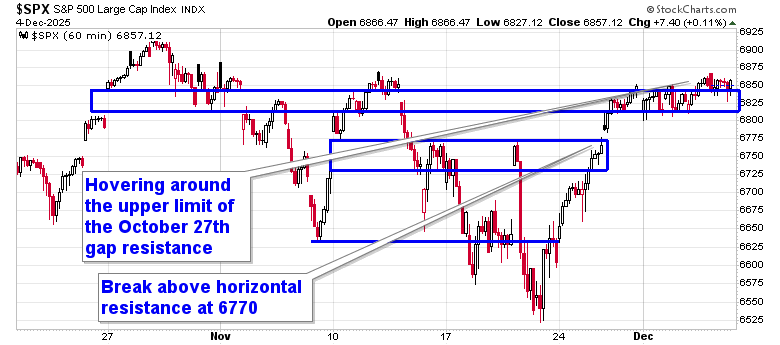

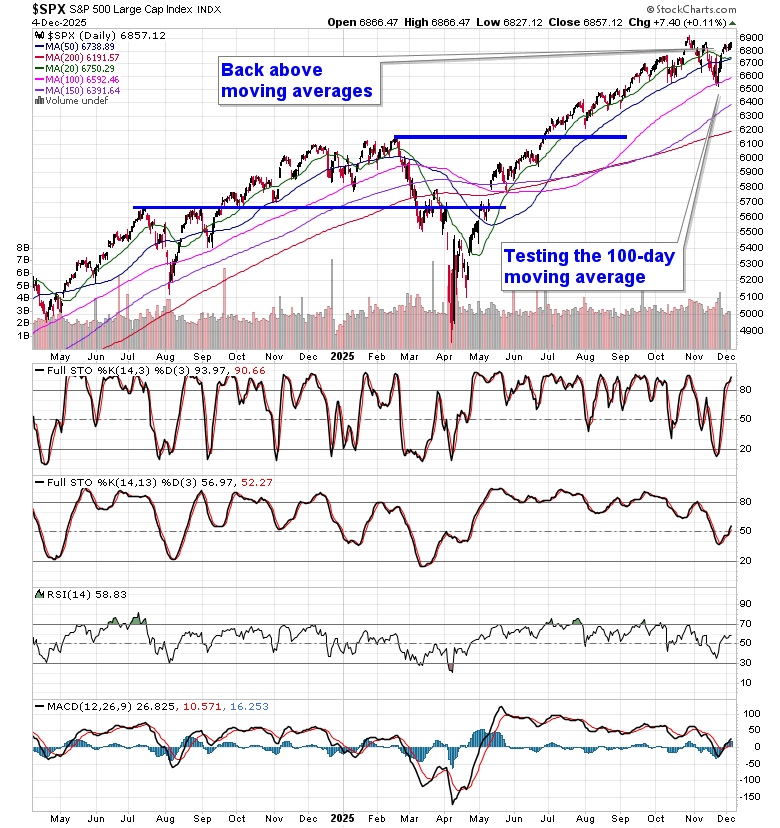

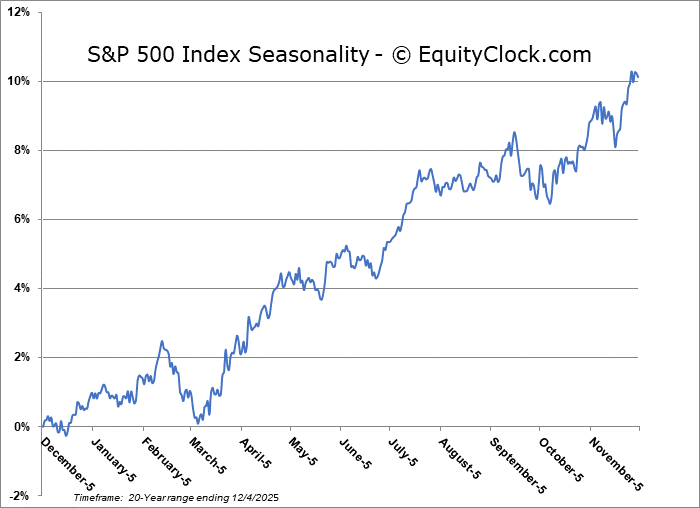

Stocks closed little changed on Thursday as the stall and digestion of the Thanksgiving week strength that the first half of December is known for starts to be revealed. The S&P 500 Index edged higher by a tenth of one percent, hovering around the upper bound of the gap that was originally opened on October 27th around 6830. Previous gap resistance at 6770 continues to be looked to as support. The market has been proving that it is no longer showing greater respect to levels of resistance than to levels of support, at least on an ultra-short-term timescale, but the hurdles overhead are major nuts to crack and require broader participation to definitively break. The major threshold on the upside to scrutinize is, quite obviously, the all-time high at 6920 that was charted at the end of October. The bears continue to contend with positive seasonality for this time of year with gains the norm for market benchmarks in December, but a softer period on the calendar through the first half of December following the strong end of November performance may be sufficient to fuel digestion of recent strength. As we have been emphasizing, the 20-week moving average (now around 6600) has been the desired risk-reward point to adding new risk exposure to portfolios and the large-cap benchmark tested this point two weeks ago. So far, everything is playing out well according to our playbook and our list of candidates in the market that are worthy to Accumulate or Avoid continues to provide ideas on how to position in this market that has become fairly volatile in recent weeks.

Today, in our Market Outlook to subscribers, we discuss the following:

- Jump in the Dark Index (DIX)

- Preparing for the seasonal trade in Energy stocks

- Energy market fundamentals

- Weekly Jobless Claims and the health of the labor market

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for December 5

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish

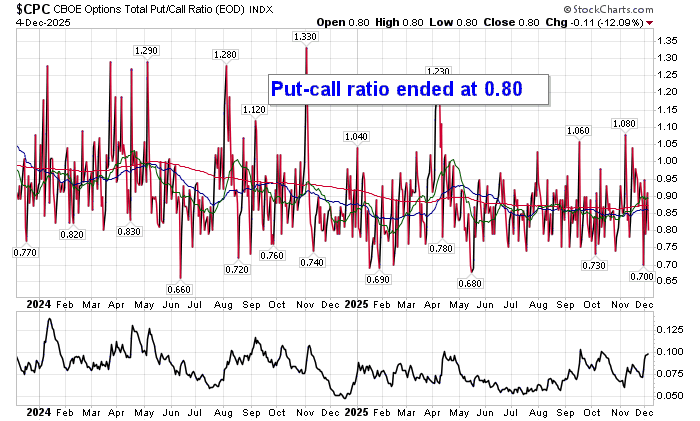

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.80.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

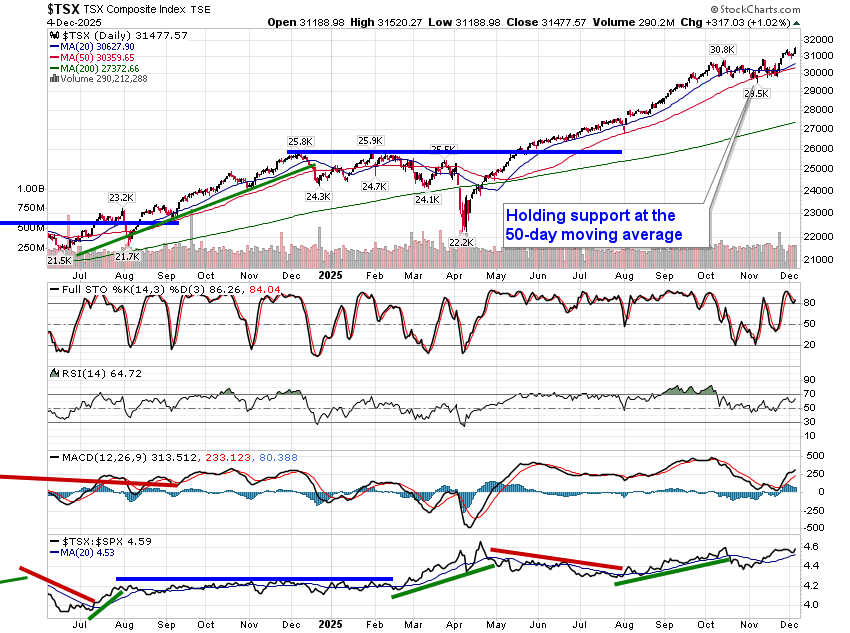

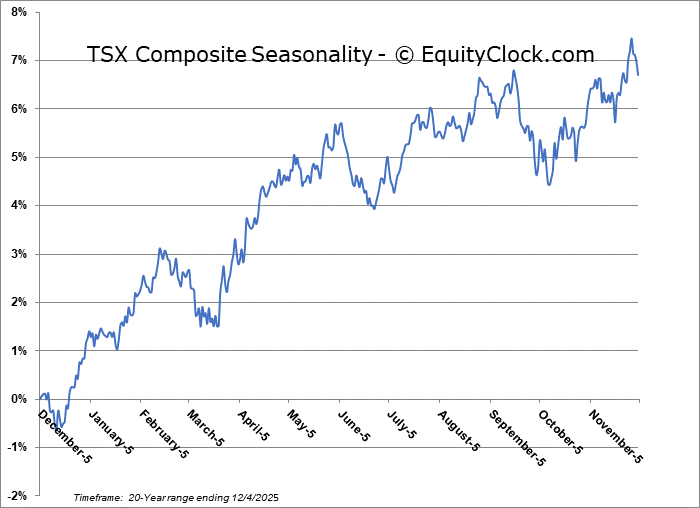

TSE Composite

| Sponsored By... |

|