Stock Market Outlook for December 31, 2025

US Technology leadership may be fading, but tech stocks in other areas around the globe may be emerging as outperformers into the start of 2026.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

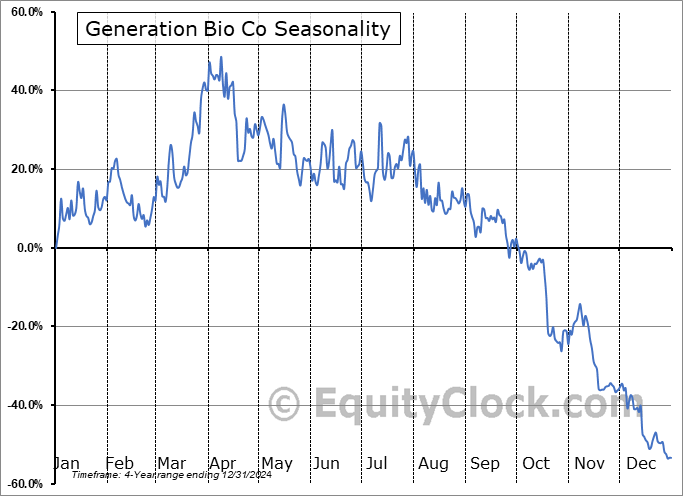

Generation Bio Co (NASD:GBIO) Seasonal Chart

Innovator IBD 50 Fund (AMEX:FFTY) Seasonal Chart

PCM Fund (NYSE:PCM) Seasonal Chart

Leonardo DRS, Inc. (NASD:DRS) Seasonal Chart

Alto Ingredients Inc (NASD:ALTO) Seasonal Chart

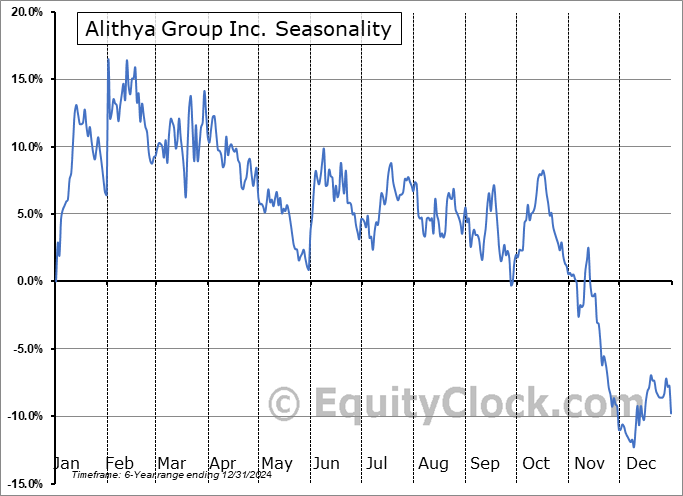

Alithya Group Inc. (TSE:ALYA.TO) Seasonal Chart

Franco-Nevada Corp. (TSE:FNV.TO) Seasonal Chart

Northrop Grumman Corp. (NYSE:NOC) Seasonal Chart

Disclaimer: Comments and opinions offered in this report are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered is believed to be accurate, but is not guaranteed.

The Markets

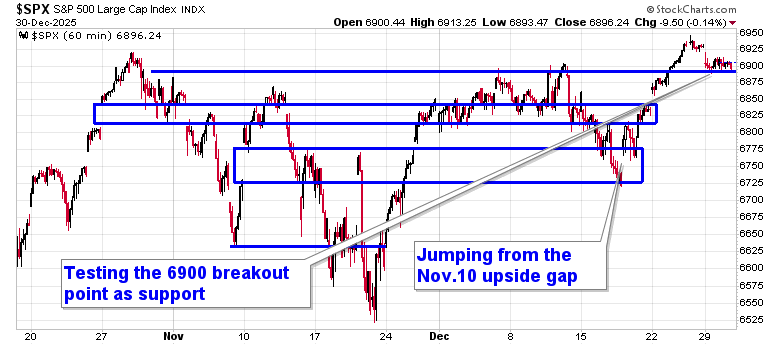

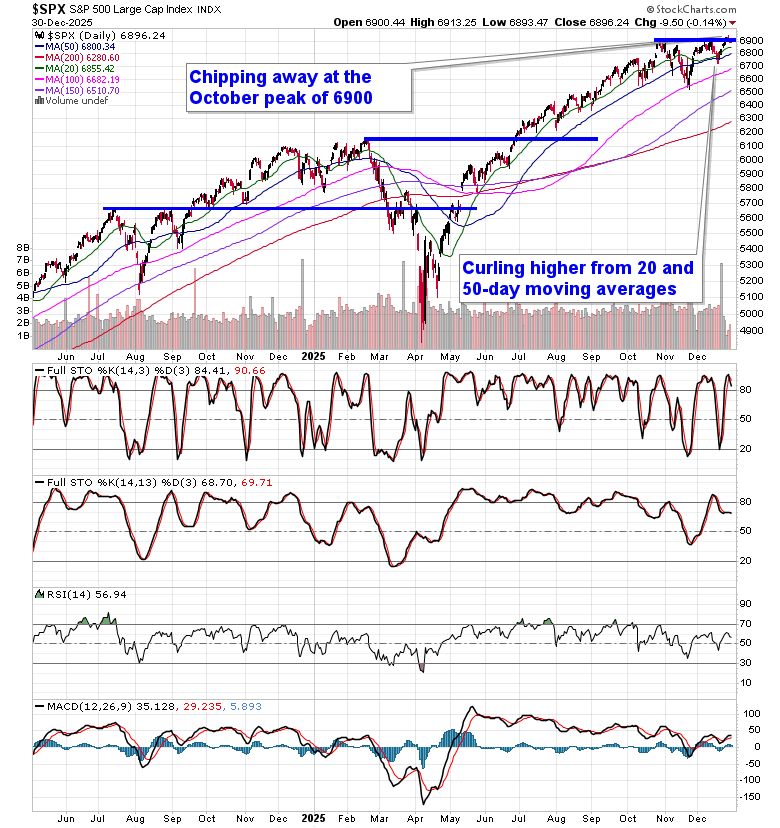

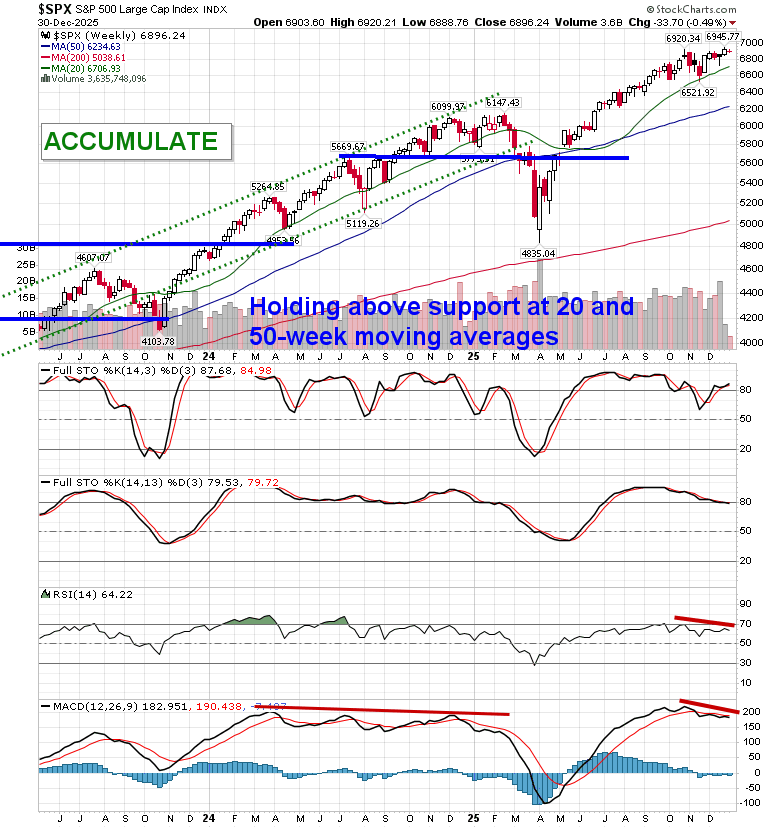

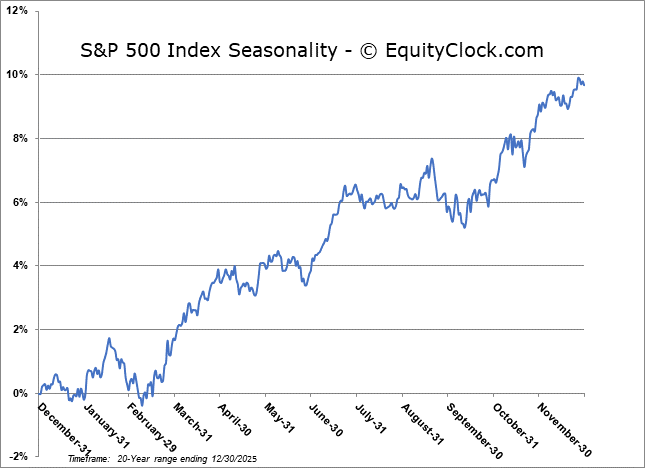

Stocks closed marginally lower in the second to last session of the year amidst portfolio repositioning before 2025 comes to a close. The S&P 500 Index declined by around a tenth one percent, continuing to pressure the recently broken level of horizontal resistance presented by the prior 52-week closing highs around 6900. The benchmark remains firmly elevated above prior zones of gap resistance around 6750 and 6830, presenting plenty of leeway before a more threatening technical setup would be presented. Underlying support at major moving averages and positive year-end tendencies suggest a move towards the psychologically important 7000 level that is now around 1.5% overhead; traders love to pin markets and stocks into these important levels during these significant seasonal timeframes. In the Seasonal Advantage Portfolio that we oversee at Castlemoore, we have been fully invested in the equity market since December 18th and the themes in our chart books to either Accumulate or Avoid have been capturing the strength that has leached into the market from the November 20th lows.

Today, in our Market Outlook to subscribers, we discuss the following:

- The list of Health Care sector stocks that show enticing setups from seasonal and technical perspectives

- Chinese Technology stocks

- Loss of technology sector leadership in the US

- US Home Prices and the abnormal year-to-date decline in values that many regions are showing

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for December 31

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish

Soon to be released…

We are busy placing the final touches on our extensive monthly report for January, which is slated to be released on Wednesday. Subscribers can soon look for this report in their inbox.

Not signed up yet? Subscribe now to receive full access to all of the research, trades, forecasts, and insights that we publish

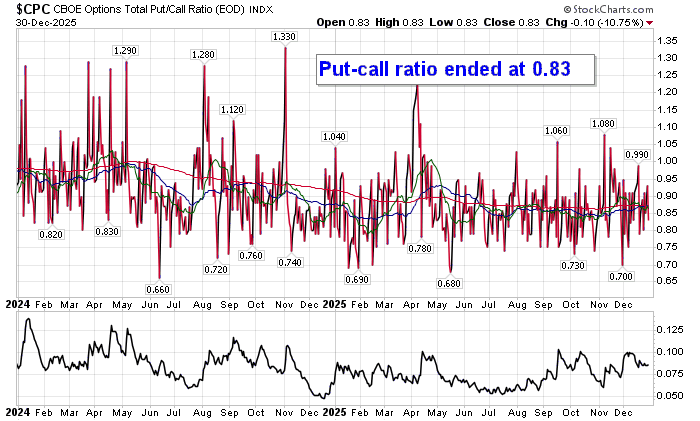

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.83.

Seasonal charts of companies reporting earnings today:

- No significant earnings scheduled for today

S&P 500 Index

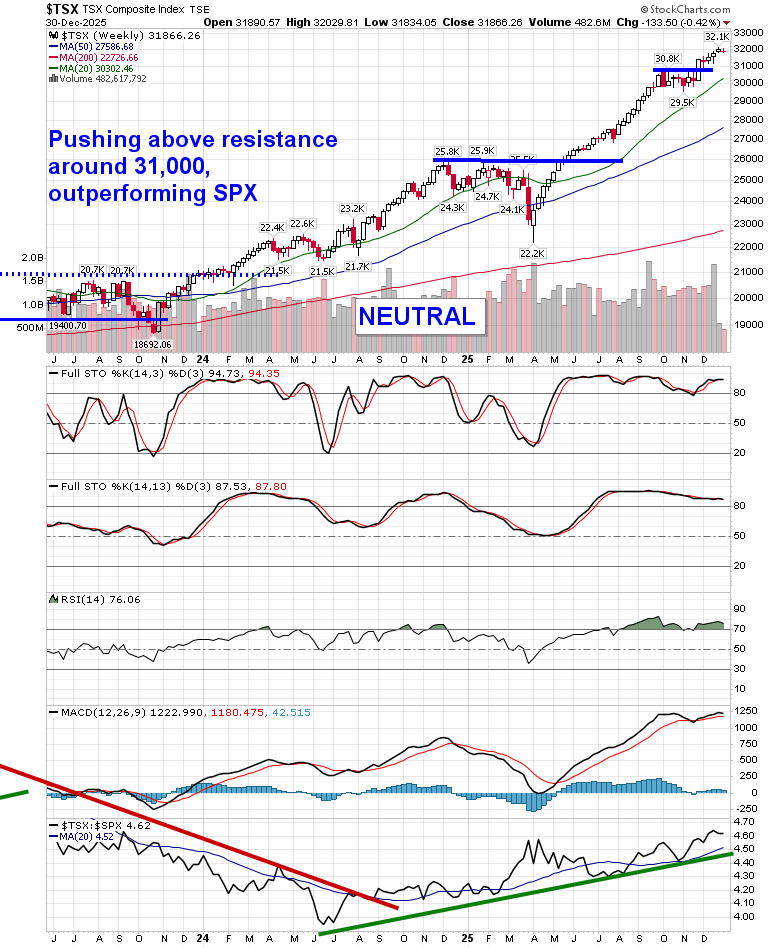

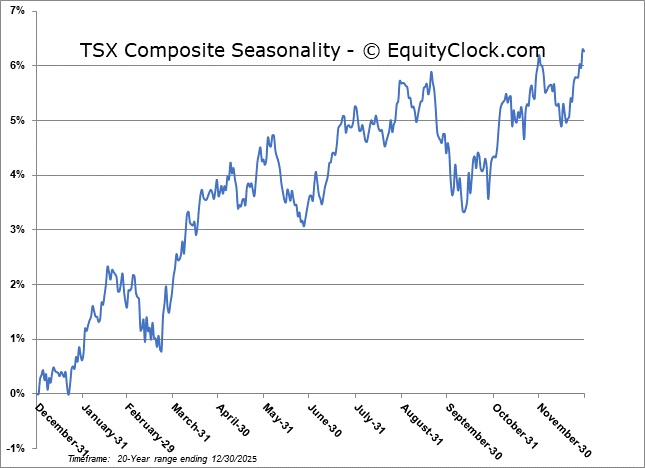

TSE Composite

| Sponsored By... |

|