Stock Market Outlook for January 20, 2026

Tailoring portfolios towards the strength in the industrial economy. We’ll tell you what to focus on.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Williams Sonoma, Inc. (NYSE:WSM) Seasonal Chart

Allegheny Technologies (NYSE:ATI) Seasonal Chart

Communication Services Select Sector SPDR Fund (NYSE:XLC) Seasonal Chart

Viemed Healthcare Inc. (NASD:VMD) Seasonal Chart

National Storage Affiliates Trust (NYSE:NSA) Seasonal Chart

CNX Resources Corp. (NYSE:CNX) Seasonal Chart

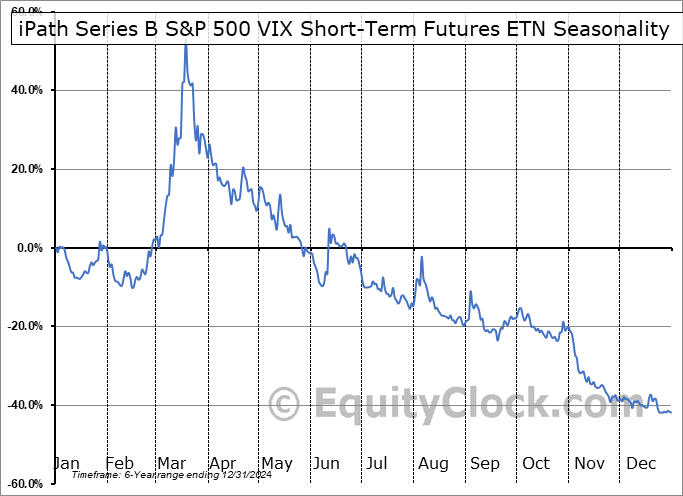

iPath Series B S&P 500 VIX Short-Term Futures ETN (AMEX:VXX) Seasonal Chart

Disclaimer: Comments and opinions offered in this report are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered is believed to be accurate, but is not guaranteed.

Note: Monday is Martin Luther King, Jr. Day in the US and markets will be closed in observance of this holiday. Our next report will be released on Tuesday.

Mission Accomplished…

As many of our subscribers know, January is a very busy month for us amidst the updating of our chart database to include the price performance from the calendar-year that has just past. We are pleased to announce that this process is now complete and all profiles have been updated. New downloads are available to yearly subscribers, detailing maximum and optimal holding periods, as well as monthly performance metrics, for all securities in Canada and the US with sufficient data associated with them. Yearly subscribers can look for the links to these new files in the Download tab.

The Markets

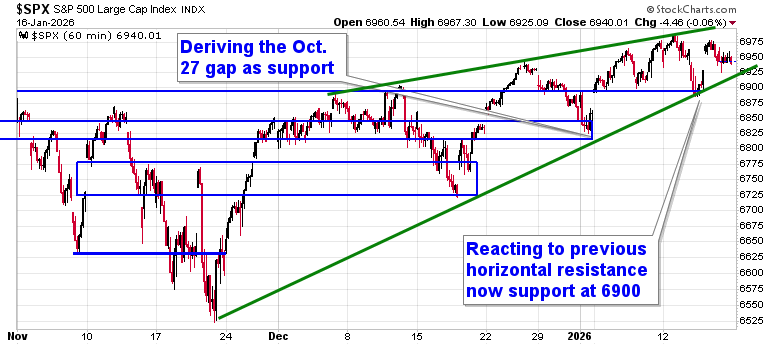

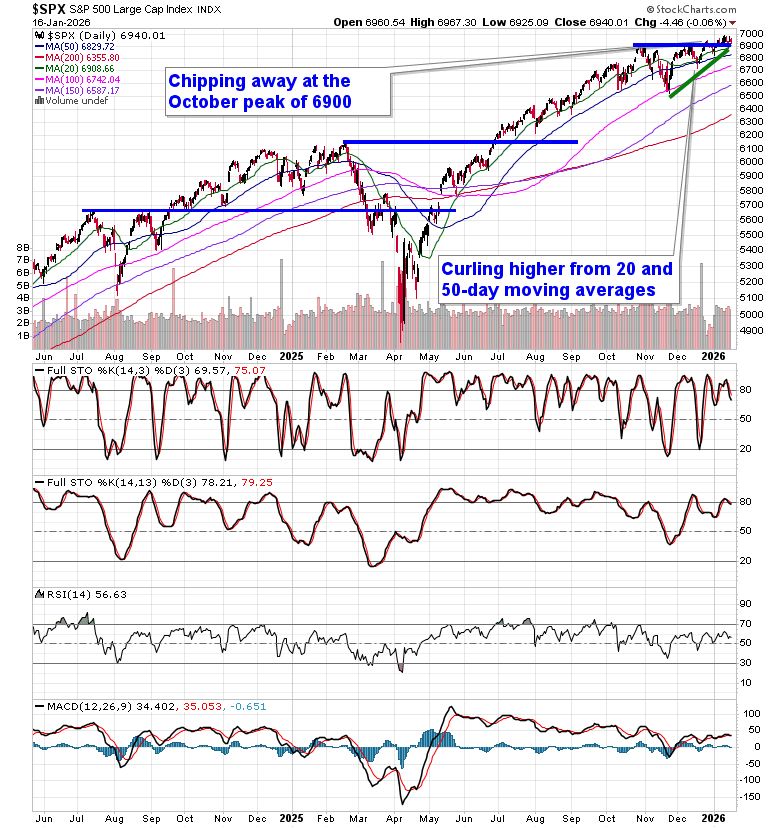

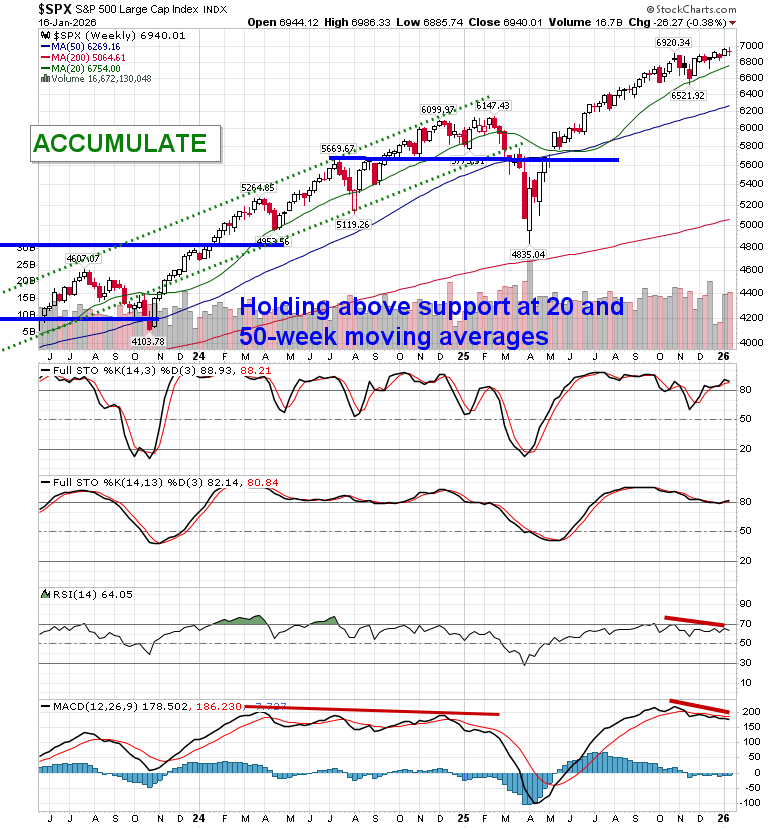

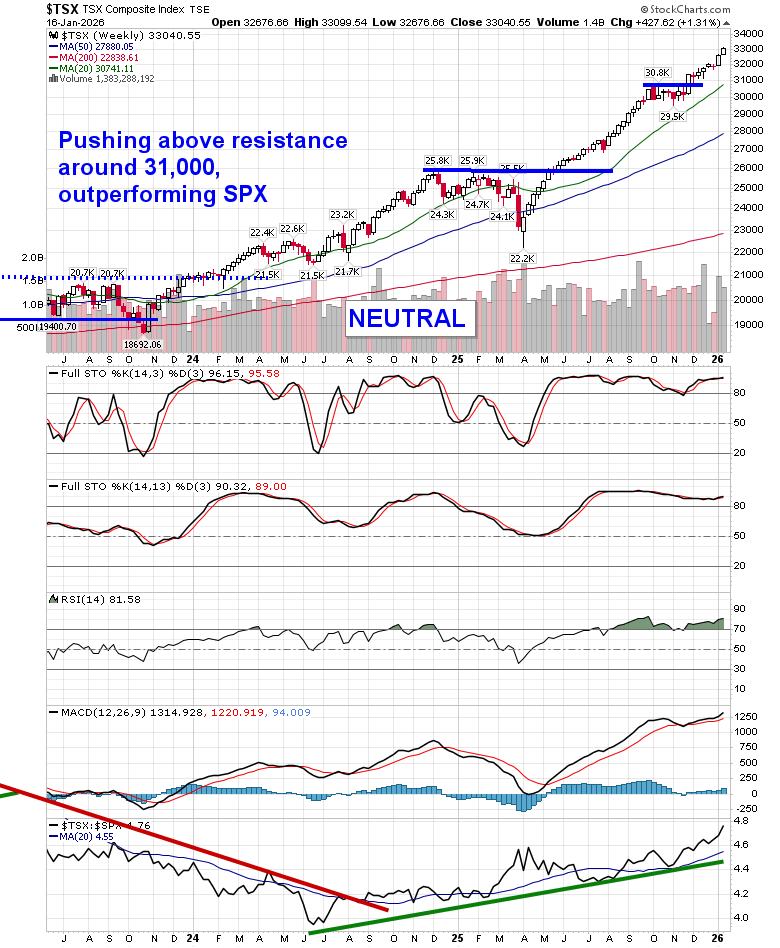

Stocks closed little changed on Friday as the market navigates through the middle of January, typically a lacklsutre period for equity market performance. The S&P 500 Index closed down by a mere six basis points (0.06%), still managing to hold above horizontal resistance presented by the prior 52-week closing highs around 6900. The upside gap charted during Thursday’s session is being filled. End of October gap resistance remains an important level of support around 6830 and, until it is broken, playing on the long-side of this market remains appropriate. The benchmark continues to trade within a narrowing range that, ultimately, points to a culmination around the 7000 level, a psychologically important level that is presently acting as a draw. In the Seasonal Advantage Portfolio that we oversee at Castlemoore, we remain fully invested in the equity market and we continue to tailor towards the themes in our chart books to either Accumulate or Avoid that have been capturing the strength and rotation that has filtered into the market from the November 20th lows.

Today, in our Market Outlook to subscribers, we discuss the following:

- Market Trend & Technical Posture

- Risk Outlook & Election-Year Context

- Industrial Production Signals a Manufacturing Upswing

- Materials & Commodities Confirm the Manufacturing Thesis; beware of normal near-term digestion

- Technology: Losing Relative Appeal

- Our screen of Energy stocks that have frequently gained in both February and March

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for January 20

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish

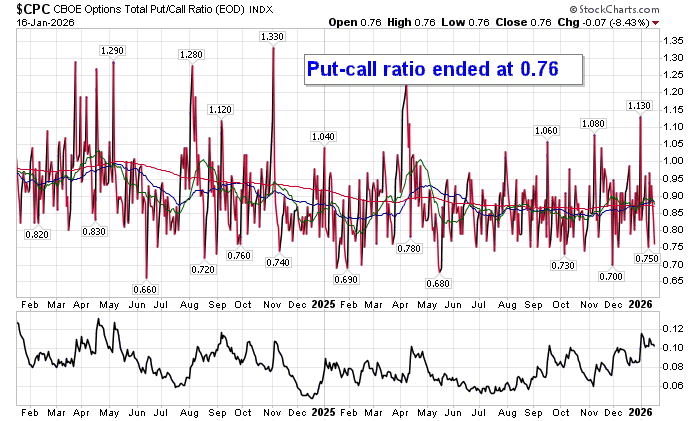

Sentiment on Friday, as gauged by the put-call ratio, ended bullish at 0.76.

Seasonal charts of companies reporting earnings today:

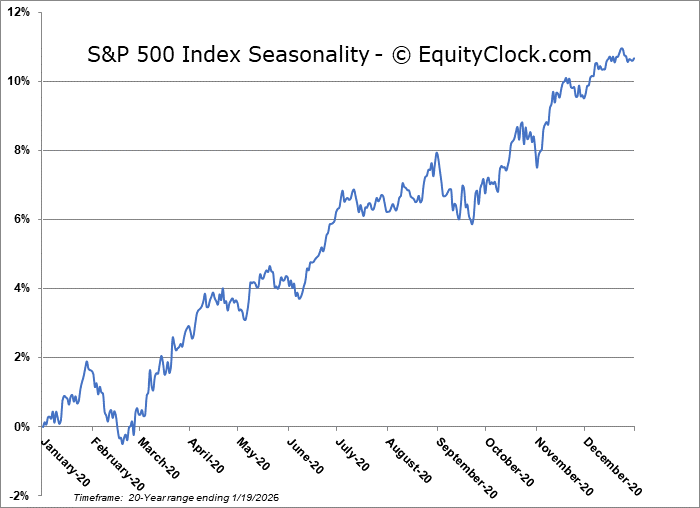

S&P 500 Index

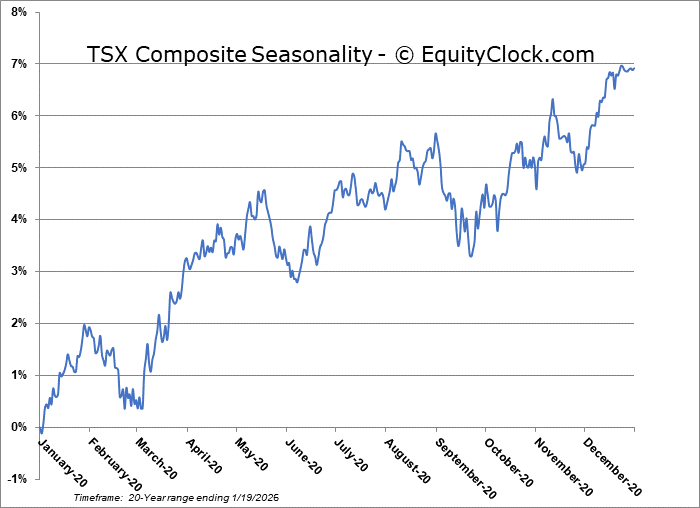

TSE Composite

| Sponsored By... |

|