Stock Market Outlook for January 30, 2026

Crypto carnage providing a warning for the prospects of the Technology sector ahead amidst the pro-cyclical uptick to start the year.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Tyson Foods Inc Cl A (NYSE:TSN) Seasonal Chart

Myers Industries, Inc. (NYSE:MYE) Seasonal Chart

iShares S&P Global Industrials Index ETF (CAD-Hedged) (TSE:XGI.TO) Seasonal Chart

Expeditors Intl of Washington, Inc. (NYSE:EXPD) Seasonal Chart

IES Holdings, Inc. (NASD:IESC) Seasonal Chart

TETRA Technologies (NYSE:TTI) Seasonal Chart

EnerSys Inc. (NYSE:ENS) Seasonal Chart

Texas Instruments, Inc. (NASD:TXN) Seasonal Chart

Disclaimer: Comments and opinions offered in this report are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered is believed to be accurate, but is not guaranteed.

The Markets

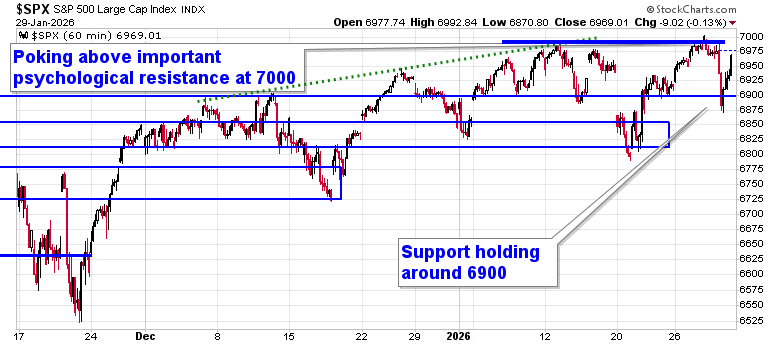

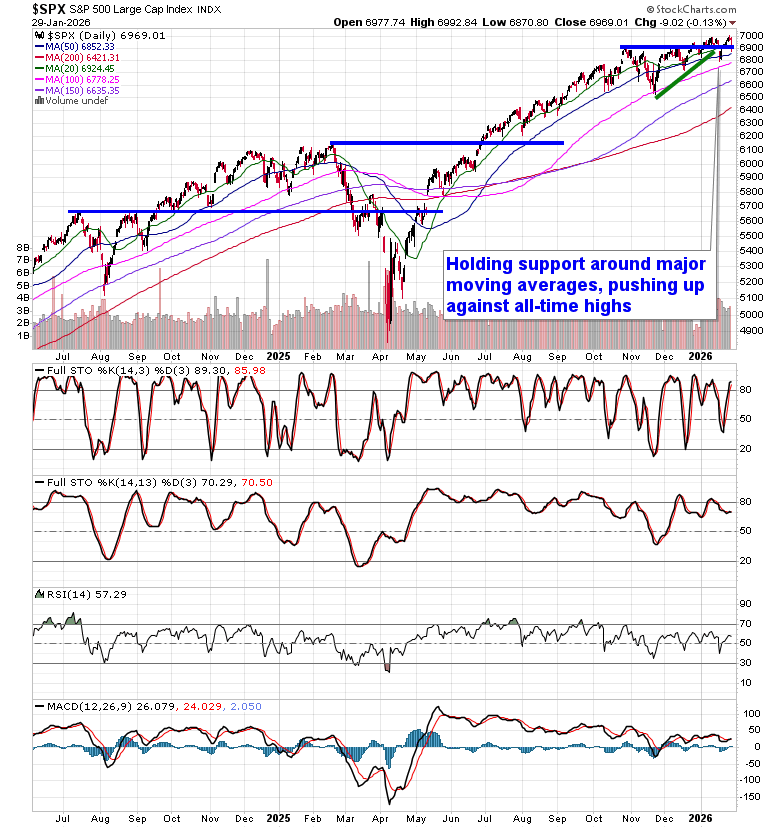

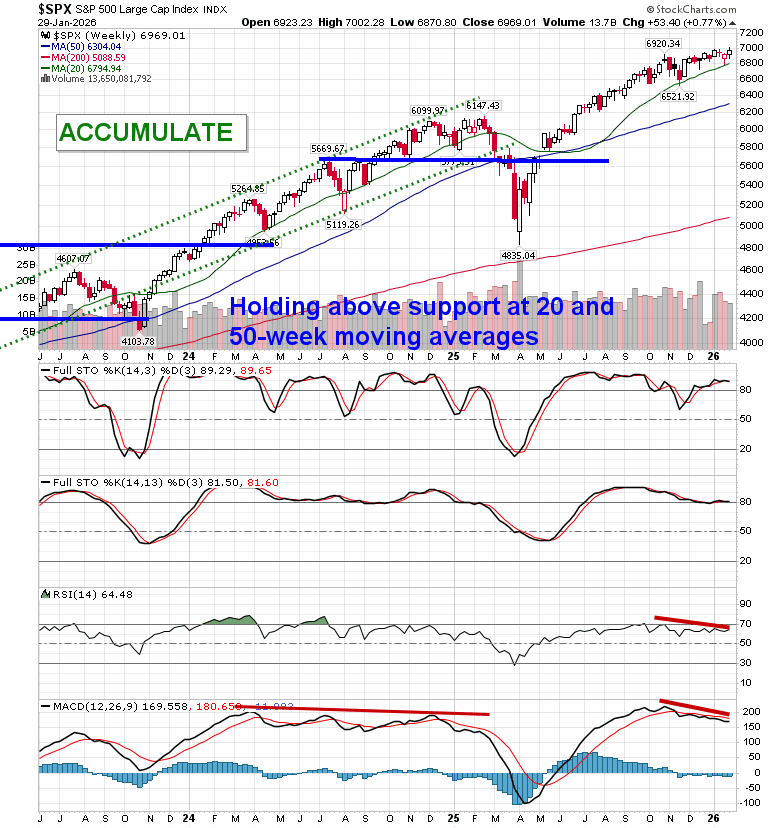

Stocks closed mildly lower on Thursday as a selloff in Technology following a poor reaction to earnings from Microsoft (MSFT) had investors scrutinizing exposure to the sector, particularly ahead of the close of the month. The S&P 500 Index closed down by just over a tenth of one percent, pulling back from the all-time intraday high achieved during the previous session around 7000; the market is highlighting the importance of this level of psychological resistance. Short-term support around 6900 remains intact, enticing buyers to step in at the lows of Thursday’s session. Previous October gap resistance turned support around 6830 has been keeping us engaged with equity exposure until definitively broken. We remain on the lookout for a potential shift of the market’s character ahead where levels of resistance hold greater weight than support, but, despite the threats, nothing has been revealed yet; should this become confirmed, looking to trim equity exposure will become prudent, bracing for the kind of volatility that is average around this time of year. In the Seasonal Advantage Portfolio that we oversee at CastleMoore, there have been no trades that have been considered to be required and we continue to benefit from our pro-cyclical and commodity oriented stance. We continue to tailor towards the themes in our chart books to either Accumulate or Avoid that have been capturing the strength and rotation that has filtered into the market from the November 20th lows.

Today, in our Market Outlook to subscribers, we discuss the following:

- Market Action & Technical Levels

- Technology Weakness: Software vs. Semiconductors

- Cryptocurrency: Risk Appetite Warning

- Trade Data & Tariff Impacts

- Labor Market: Stable, Not Deteriorating

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for January 30

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish

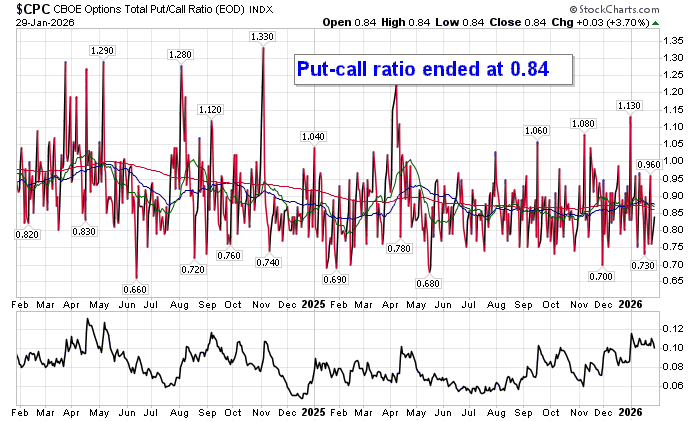

Investor sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.84.

Soon to be released…

We are busy placing the finishing touches on our Monthly Report for February, providing you with all of the insight and analysis that you need to navigate the month(s) ahead. Subscribers can look for this report in their inbox on Friday.

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish

Seasonal charts of companies reporting earnings today:

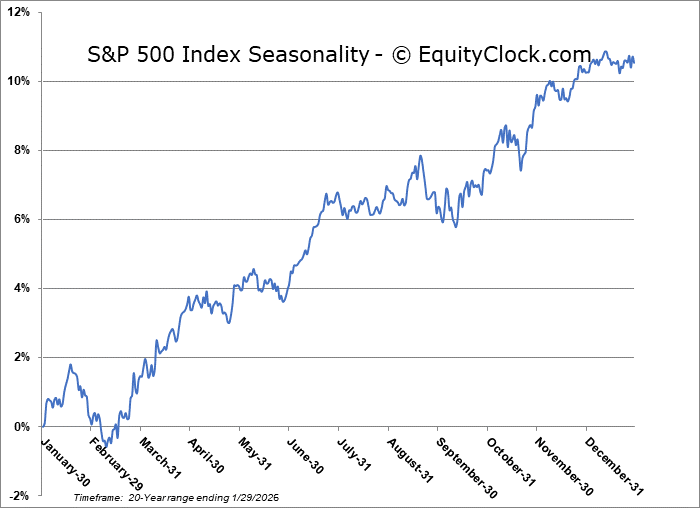

S&P 500 Index

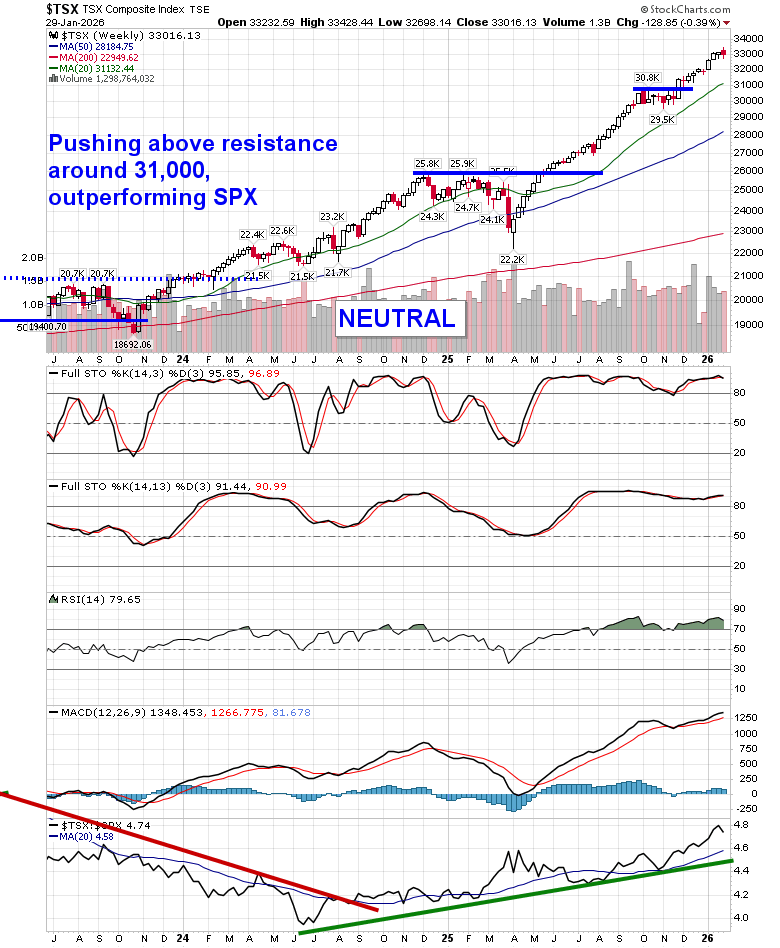

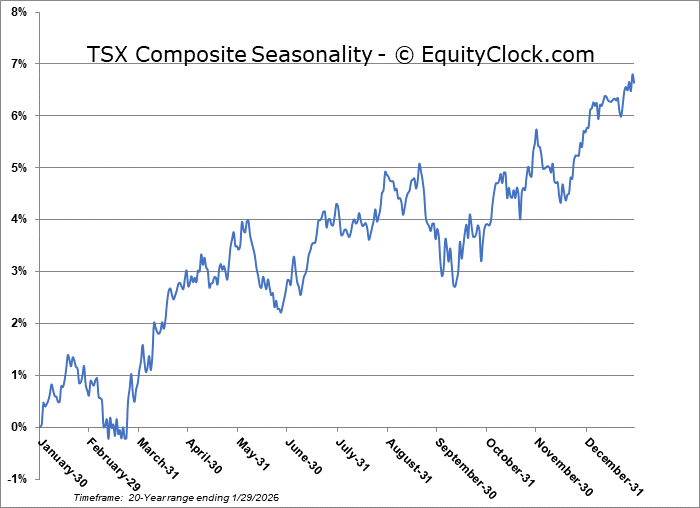

TSE Composite

| Sponsored By... |

|