Stock Market Outlook for February 20, 2024

Housing starts just showed the weakest January change since 2009, at the height of the Great Financial Crisis.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Sempra Energy (NYSE:SRE) Seasonal Chart

BMO Real Return Bond Index ETF (TSE:ZRR.TO) Seasonal Chart

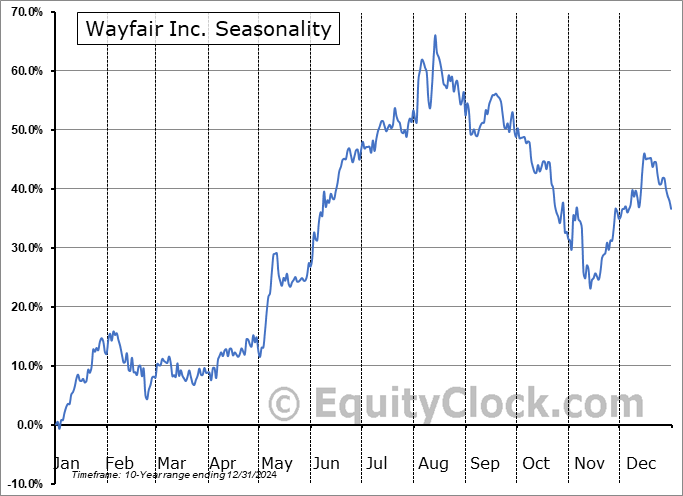

Wayfair Inc. (NYSE:W) Seasonal Chart

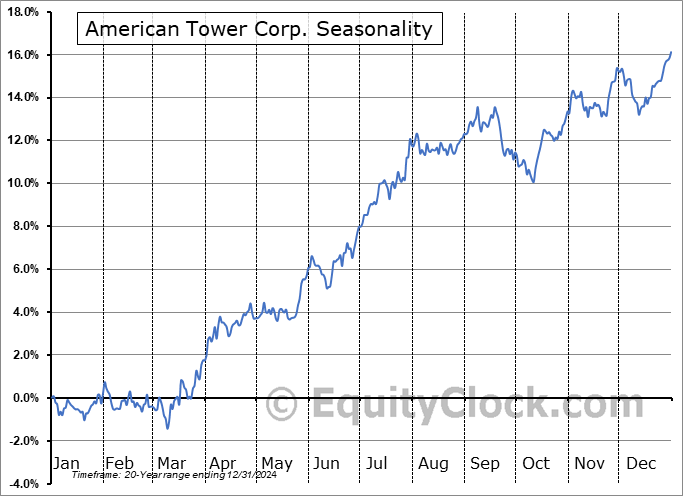

American Tower Corp. (NYSE:AMT) Seasonal Chart

Essex Property Trust, Inc. (NYSE:ESS) Seasonal Chart

FTI Consulting, Inc. (NYSE:FCN) Seasonal Chart

Waste Connections, Inc. (NYSE:WCN) Seasonal Chart

Invesco Preferred ETF (NYSE:PGX) Seasonal Chart

The Markets

Stocks closed lower on Friday after another report of inflation in the economy stoked fears that conditions may not be present for the Fed to start cutting rates according to the market’s expectations. The S&P 500 Index closed down by half of one percent, pulling back from the intraday all-time high level charted in the past week at 5048. Gradually, we are seeing evidence of an equity market that is losing upside traction as momentum indicators (MACD and RSI) negatively diverge from price, a sign that buying demand is not as robust as it once was now that the market has reached record heights. Short-term support remains firmly ingrained around the 20-day moving average at 4942, a hurdle that is likely to be put to the test amidst the period of seasonal weakness for the market through the back half of February. While the previous all-time high of 4800 is the logical retracement point to a near-term market pullback, levels all the way down to previous horizontal resistance at 4600 are fair game as part of a healthy digestion of the strength that has been achieved in recent months.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the large-cap benchmark

- The normalization of the path of initial jobless claims

- The weakest January change in Housing Starts since the Great Financial Crisis

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for February 20

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Friday, as gauged by the put-call ratio, ended close to Neutral at 0.93.

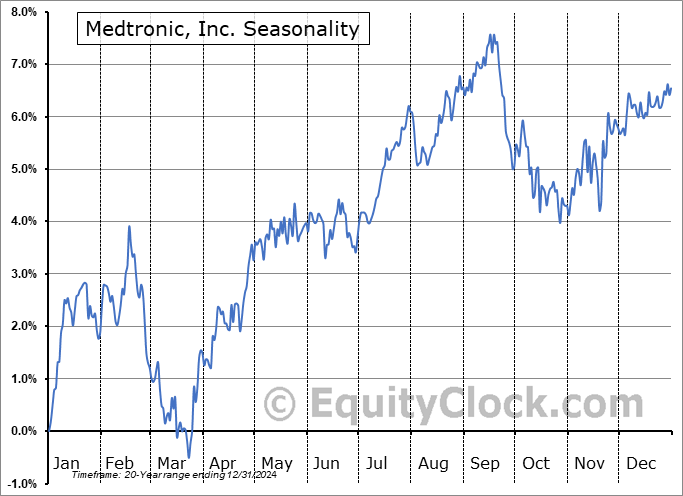

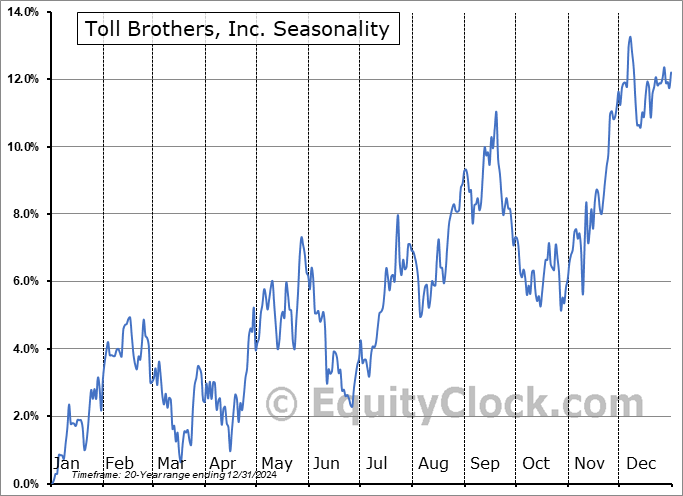

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|