Stock Market Outlook for August 29, 2023

The reversal of treasury bond prices last week creates a highly enticing risk-reward to look to accumulate positions, using intermediate-term levels of support below as the stop to any holdings.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

China Automotive Systems Inc. (NASD:CAAS) Seasonal Chart

Goodfood Market Corp. (TSE:FOOD.TO) Seasonal Chart

Houlihan Lokey, Inc. (NYSE:HLI) Seasonal Chart

The Markets

Stocks closed with a gain on Monday as the normal positivity that surrounds the Labor day long weekend materializes on cue. The S&P 500 Index ended higher by six-tenths of one percent, remaining below implied resistance at the 20 and 50-day moving averages, presently around 4450. Momentum indicators continue to rebound from their lows charted over the past couple of weeks, but they remain below their middle lines, which is characteristic of a bearish trend. While we have been seeking this reprieve in selling pressures as part of this normal period of volatility through August and September, we have to be prepared for the weakest time of the year for stocks coming up in September, often a period where standing back from risk has historically been beneficial.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

- Currencies

- Cryptocurrencies

- Commodities

- Major Benchmarks

- Sub-sectors / Industries

- ETFs: Bonds | Commodities | Equity Markets | Industries | Sectors

Subscribe now.

Today, in our Market Outlook to subscribers, we discuss the following:

- Our weekly chart books update: Find out what joins our list of Accumulate candidates this week

- Precious Metals

- Emerging Market stocks

- US Treasury Bonds

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for August 29

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Monday, as gauged by the put-call ratio, ended bearish at 1.08.

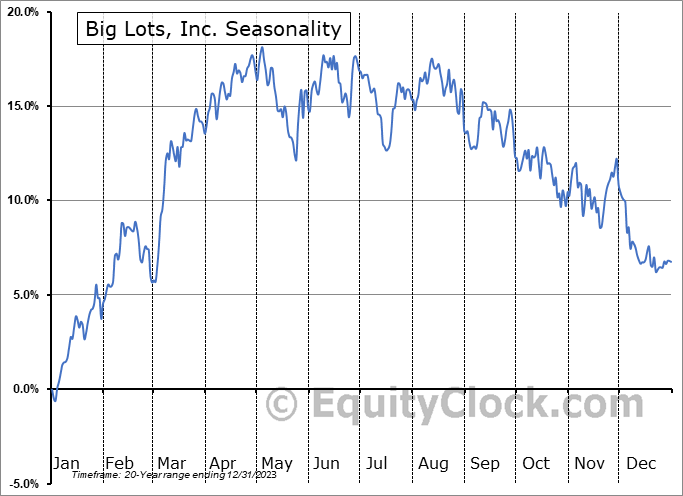

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|